BYD Auto became the world’s largest producer of electric vehicles during Q4 2023, but the company is facing headwinds in the form of a price war brought about by unfavourable economic conditions in China. There are signs that Cathie Wood’s ARK Invest, the largest institutional holder of BYD shares, might be losing faith in the stock.

BYD [1211:HK] is a Chinese multinational company best known for manufacturing electric vehicles (EVs) through its subsidiary BYD Auto.

It is a significant player in the EV industry because of its dominant position in China, the world’s largest EV market. In 2023 BYD was behind approximately 35% of new energy vehicle (NEV) sales in the country, according to data from the China Passenger Car Association (CPCA).

BYD overtook its US rival Tesla [TSLA] in Q4 of 2023 to become the world’s largest seller of EVs, with 18% of the global market. Tesla wasn’t far behind, holding 16% of the global market.

Despite this, BYD’s share price has declined slightly through the past year. There are signs that ‘super investor’ interest in BYD stock may have waned, with two significant investors having made sales during that time.

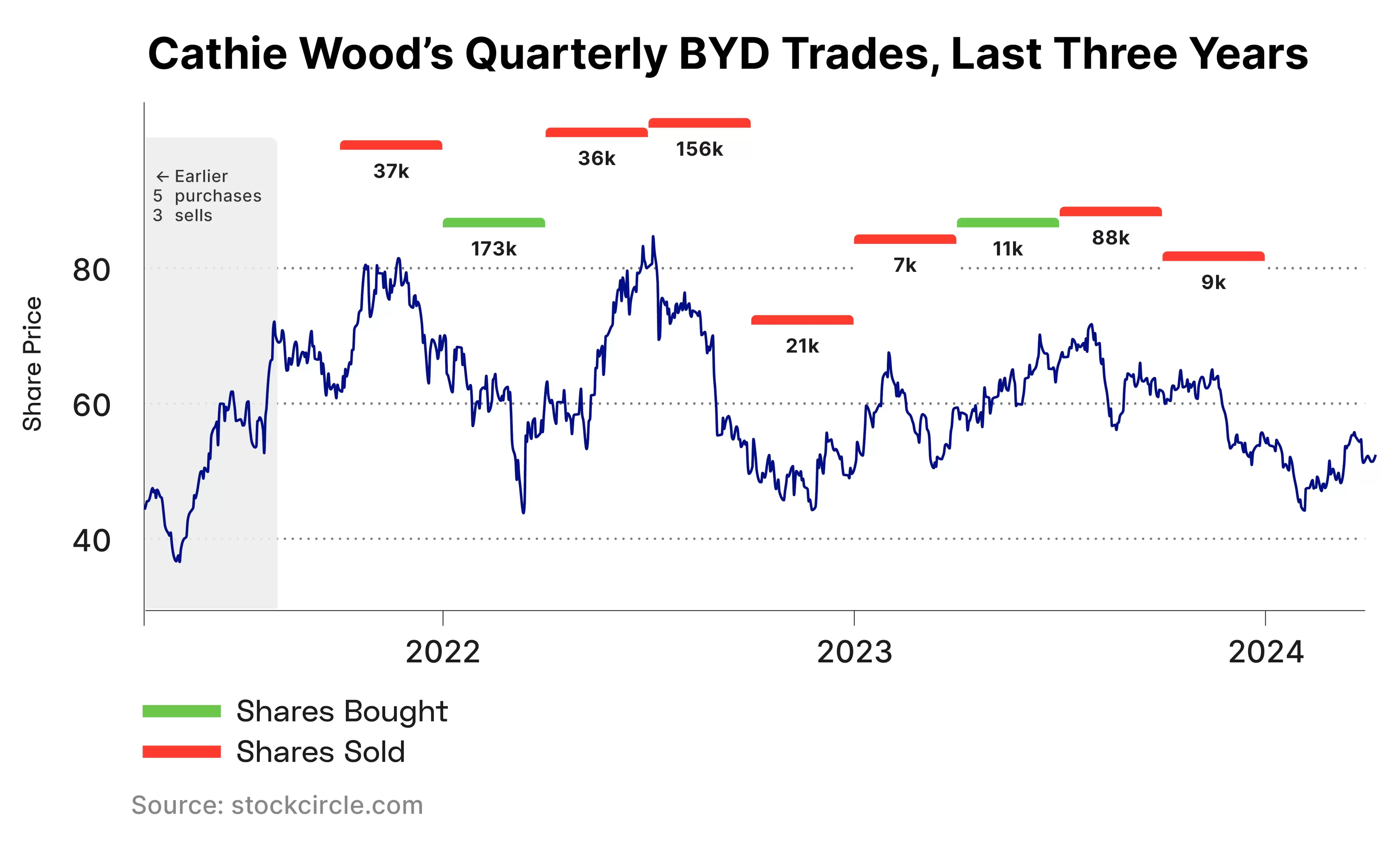

Cathie Wood, Founder, CEO and CIO of ARK Invest, is the largest institutional holder of BYD shares. The innovation-focused investor sold nearly 9,000 BYD shares during Q4 2023, following 88,000 sold during the previous quarter, according to data from Stockcircle.

Over the past three years, Wood has made net sales of approximately 170,000 BYD shares.

Ken Fisher, Founder, Executive Chairman and Co-Chief Investment Officer of Fisher Investments, also sold BYD shares for three consecutive quarters prior to Q4 2023, according to data from Stockcircle.

EV Market Decelerates

During Q4, BYD’s revenue increased 15.1% to ¥180.04bn ($24.9bn), Reuters reported on 26 March. Across the full year, BYD’s revenue — of which 80.27% is from its automobiles segment — increased 42.04% from the previous year.

Profits rose 18.6% year-over-year during Q4, but this represents BYD’s slowest profit growth since Q1 2022. Full-year profit increased 80.7% to ¥30.04bn ($4.2bn).

However, BYD slipped back behind Tesla on EV sales during the first quarter of 2024. Its delivery numbers fell 42% quarter-to-quarter, according to the Financial Times.

According to BYD’s 2023 annual report, the market for EVs in China increased by 12% year-over-year, while Chinese EV exports grew 57.9% in terms of units.

Cheaper Than Oil

Despite this, BYD’s revenue was squeezed by the escalating EV price war in China. BYD has cut prices across its range of EVs, under the slogan “Electricity is cheaper than oil”.

In its 2023 report, the company noted: “In 2023, the international geopolitical tensions intensified, the high inflationary environment prevailed, the growth of most major economies slowed down, and the complexity, severity and uncertainty of global economic development increased.”

This backdrop led to “insufficient overall demand, weak consumption and investment expectations” in the Chinese economy.

It was this which forced BYD and its competitors to lower their prices, in a price war that Reuters described as “brutal”. The news agency calculated that the price of 13 models accounting for 93% of BYD’s total Chinese sales had their prices cut by an average of 17% last year.

Tesla has cut more than $7,000 from the price of some models, though Business Insider reports that the company is likely to withdraw from its strategy of competing on price in order to protect its margins.

Both companies face increasing competition in China. Ride-hailing firm Didi [DIDIY] and GAC Aion, China’s third-largest EV maker, announced a joint venture to mass-produce self-driving taxis on 8 April, with the first model due for release next year.

Meanwhile, smartphone maker Xiaomi [XIACY] launched its first ever EV in March. The SU7 electric sedan is priced at ¥215,900 ($29,850), making it one of the cheapest EVs available. Demand at this price point is strong enough that Xiaomi has warned prospective buyers that they could face waiting times of four to seven months.

Another Way to Invest in BYD

In the 12 months to 9 April, BYD’s share price fell 7.8%. Year-to-date, the stock has fallen 3.3%.

On 29 January, Bernstein analyst Eunice Lee reiterated a ‘buy’ rating on the company’s Hong Kong-listed shares [1211:HK], with a HK$334 price target. This implies 65.35% upside from the 8 April close of HK$202.

However, given the intensity of the competition between individual EV makers, investors may want to diversify into the various EV companies in the space. An effective means of achieving this diversification is via a thematic ETF.

No ETF holds more BYD shares than the ARK Autonomous Tech & Robotics ETF [ARKQ]. This fund, which captures Wood’s bullish conviction about the electric and autonomous vehicle space, features Tesla as its top holding and has a 0.95% weighting in BYD as of 10 April.

However, there are early signs that, amid the decline in BYD’s share price so far this year, Wood is losing her conviction in the stock.

Ark held 176,610 BYD shares as of its last 13-F filing. As of 10 April, however, ARKQ holds 155,798 shares, implying that Wood has sold 20,812 shares since the end of Q4.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy