BlackRock’s [BLK] share price gained over 40% in 2020 as global markets bounced back from the effects of the pandemic. Those gains have continued into 2021, with BlackRock’s share price up almost 7% as financial markets continue to defy the wider economic reality.

Against this backdrop, the investment manager is releasing fourth quarter results. Last quarter proved something of a bonanza, with big jumps in earnings and revenue driven by increased investment activity. Will that continue into the fourth quarter, or is BlackRock’s share price in for some volatility post-earnings?

When is BlackRock reporting Q4 earnings?

14 January

What happened last quarter?

In Q3, BlackRock delivered earnings per share of $9.22 for the third quarter, up 29% from the $7.15 per share in the same period last year. Revenue of $4.36bn was up 18% from the previous quarter’s $3.69bn. Assets under management came in at $7.32trn, beating the $6.96trn seen last year. Net inflows were $129bn, up from $100bn last quarter.

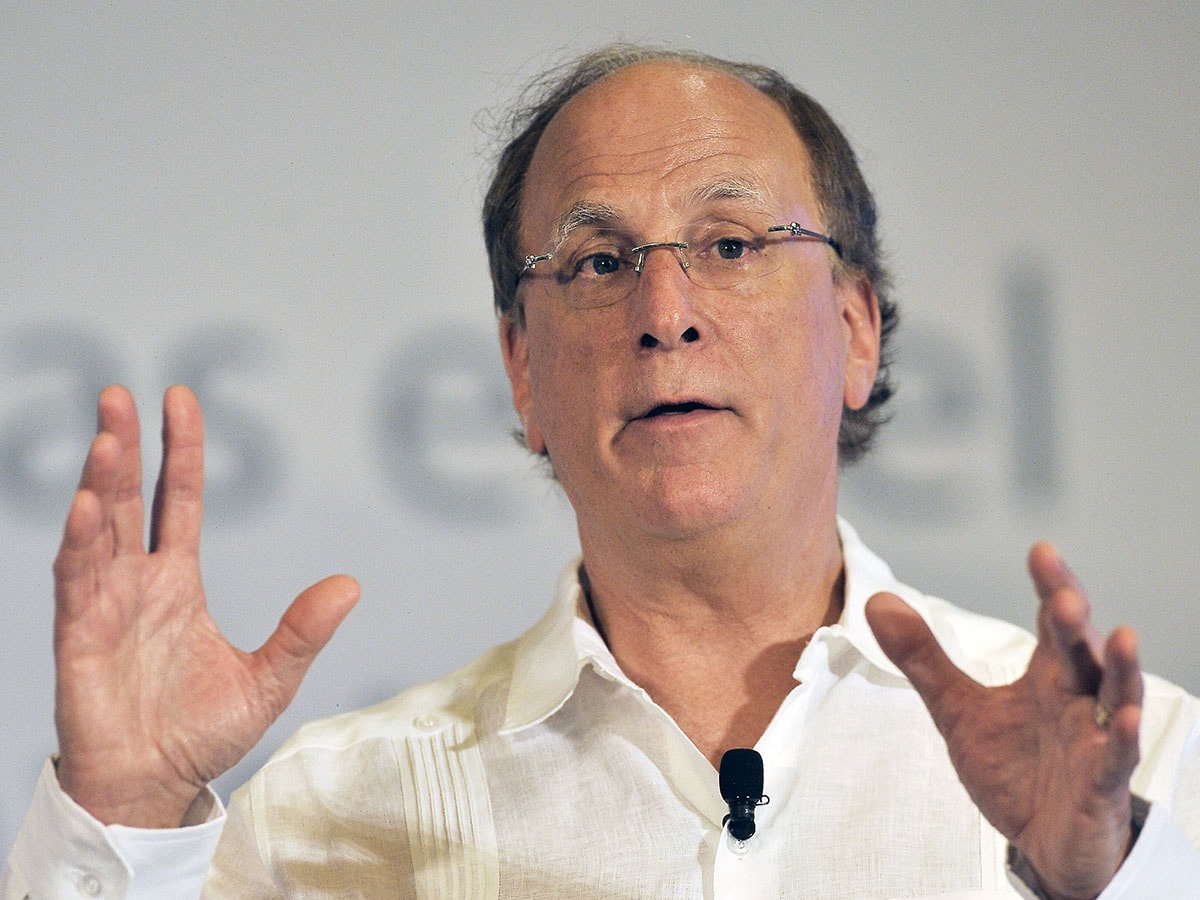

“Our results are a validation of our globally integrated asset management and technology business model, which allows us to consistently invest and evolve ahead of client needs. Each of our strategic investment areas, including iShares ETFs, alternatives and technology, continue to grow, while strong investment performance has driven positive active flows over the last year,” said Laurence D. Fink, chairman and CEO of BlackRock.

"Each of our strategic investment areas, including iShares ETFs, alternatives and technology, continue to grow, while strong investment performance has driven positive active flows over the last year" - Laurence Fink, BlackRock chairman and CEO

BlackRock focuses on ESG investments

BlackRock’s plans for environmental, sustainable and corporate governance (ESG) funds — and the revenue these products are bringing in — will be keenly watched in the upcoming results.

In the third quarter earnings, Fink touched on the growing importance of ESG investments, saying “as clients look to integrate ESG into their portfolios, BlackRock is uniquely positioned with industry-leading sustainability research, investment strategies and technology.”

A recent survey of 425 global investors conducted by BlackRock showed that investors plan to double ESG by 2025. According to Mark McCombe, chief client officer at BlackRock, this is part of a “tectonic shift” as a number of factors — including regulatory and political pressure — have made sustainability part of mainstream investing.

As OilPrice.com points out, sustainable assets already account for circa $17.1trn of the global market. However, investors and banks with over $120trn in AUM are already looking at making ESG investment part of their investment strategies.

$17.1trillion

Value of global sustainable assets

In the 12 months ending September 2020, the number of ESG indexes grew 40%, according to a survey by the Index Industry Association — the highest annual increase in any single major index class. BlackRock itself has tripled the number of iShares sustainable funds over the past two years.

According to BlackRock’s paper Reshaping Sustainable Investment, access to cheaper ESGs — like its own iShares sustainable ETFs — is one of the forces that will grow ETFs and index mutual funds by circa $1trn by 2030.

“Investors are transitioning money into sustainable investments and we believe they will increasingly do so in the most cost-effective way possible—through sustainable ETFs and index funds.” The paper said.

What is Wall Street expecting?

BlackRock is forecast to post earnings per share of $8.87 in the fourth quarter, up from the $8.34 seen in the same quarter last year. Revenue is pegged at $4.26bn, a 7.2% increase on last year’s $3.98bn haul. Analysts at Trefis aren’t as optimistic, expecting Blackrock’s revenue to be circa $3.72bn on earnings of $8.79 per share.

That said, Wall Street seems bullish on the assert manager as we head towards the earnings. This week, Morgan Stanley upped their price target on BlackRock from $750 to $890 on expectations of improving investment flows, including into higher fee categories, in the fourth quarter. This follows other analyst upgrades, including Jefferies who increased their price target to $868 from $816 and Deutsche Bank, who moved their target from $802 to $835.

Among the analysts tracking the stock on Yahoo Finance, BlackRock’s share price has an average $805.43 price target. Hitting this would represent a 3.3% upside on the current share price. Of the 15 offering recommendations, three rate it a strong buy and nine a buy.

| Market cap | $118.92bn |

| PE ratio (TTM) | 25.90 |

| EPS (TTM) | 30.11 |

| Quarterly revenue growth (YoY) | 18.30% |

BlackRock's share price vitals, Yahoo Finance, 14 January 2021

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy