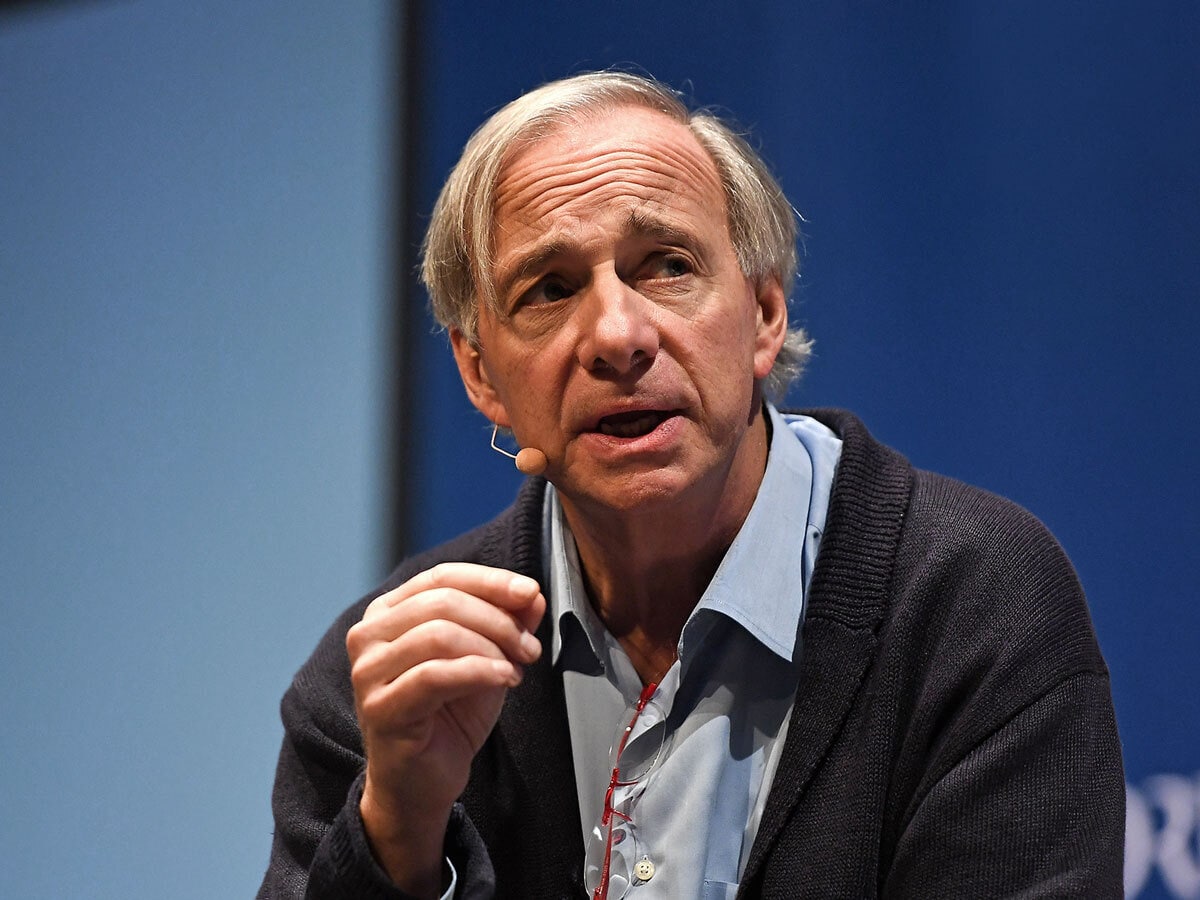

Are We Headed for a Recession?

“I think that right now we are at a decision-making point and very close to a recession,” said Ray Dalio, Founder of Bridgewater Associates, in an interview with NBC. “And I’m worried about something worse than a recession, if this isn’t handled well.” Referring to the domestic and geopolitical turmoil associated with US President Donald Trump’s tariffs, Dalio warned that the fallout could be worse than both 1971 and 2008, Seeking Alpha reported.

The Future of AI

Writing in TechRadar, Nebius [NBIS] Co-founder Roman Chernin outlined what he thinks 2025 could hold for artificial intelligence (AI). For starters, businesses will increasingly customize their AI models with proprietary data, as adoption increases. Elsewhere, AI bots will become more self-directed and autonomous, capable of handling multi-step processes. Innovators will also work to broaden access, for example, through on-demand GPU rentals.

Apple’s China Pivot Was Already Underway

Apple [AAPL] assembled $22bn worth of iPhones in India in the year to March, Bloomberg reported, up nearly 60% on the prior year. The tech giant now produces 20% of its iPhones in the country as it accelerates its shift from China; key suppliers include Foxconn [FXCOF] and Tata [TATAMOTORS:NS]. Shipments of iPhones from India to the US spiked after the tariffs were announced.

Can Hims Reverse its Drop?

Hims & Hers [HIMS] has plummeted since the FDA declared the semaglutide shortage was over on February 21. Nevertheless, CEO Andrew Dudum is optimistic, telling Sherwood he wants the company to become the Netflix [NFLX] of healthcare: “By owning that customer relationship, by understanding deeply what customers are yearning for … we are in a really unique position to both partner and eventually bring to market world-class treatments.” Read OPTO’s long-form analysis of this sometimes controversial stock.

Could Meta Be Forced to Sell Instagram?

In Washington yesterday the Meta [META] antitrust trial kicked off. The Federal Trade Commission (FTC) accuses it of monopolizing social media by acquiring Instagram and WhatsApp to kill off competition. The agency argues CEO Mark Zuckerberg bought rivals to neutralize threats, citing internal emails. If the FTC wins, Meta may be forced to divest both platforms, the BBC outlined.

China ETFs Save the Day

Chinese equity ETFs saw record inflows of nearly $24bn last week as state-backed funds moved to prop up markets hit by Trump’s tariff offensive. The buying spree surpassed the previous $23bn high in October, Bloomberg detailed, with much of the cash flowing into ETFs favored by China’s “national team”, although some of the most-bought ETFs, among them the Fullgoal CSI Hong Kong Connect Internet ETF [159792:SZ], have not previously been linked to state buyers.

Can These 4 Value Stocks Weather Trump’s Tariff Turmoil?

Trump’s tariffs and a deepening trade war, particularly with China, have spooked investors and sparked concerns about stock valuations. According to J.P. Morgan Managing Director Scott Blasdell, however, the tariffs present an opportunity for value investors. OPTO looks into the investment case for four value stocks that could do well amid tariff turmoil: Home Depot [HD], The Campbell’s Company [CPB], PepsiCo [PEP] and Johnson & Johnson [JNJ].

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy