With demand for electric vehicles continuing to rise, companies such as Albemarle, Ganfeng and AMTE Power which produce lithium and technology for batteries are trying to capture this growth. Albemarle has seen the strongest growth this year, while Ganfeng trades slightly down as the Chinese economy slows and western countries try to reduce reliance on Chinese lithium.

- Demand for lithium and battery technology is growing as electric vehicles become more mainstream

- Albemarle leads ahead of Ganfeng and AMTE Power after strong Q3 results

- Concerns over Chinese dominance in the lithium sector puts US and UK producers into focus

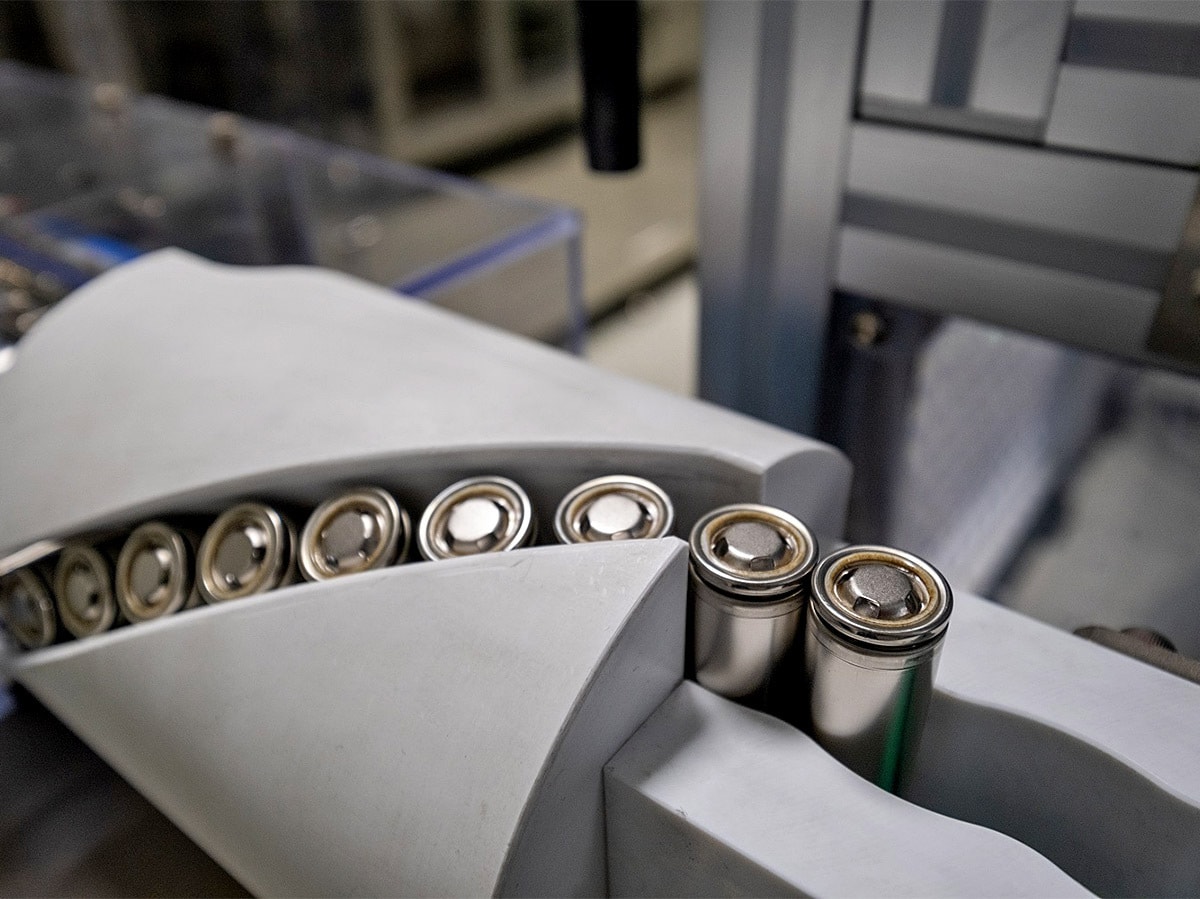

Rising electric vehicle demand has spun the spotlight on lithium and battery cell producers Albemarle [ALB], Gangfeng [002460] and AMTE Power [AMTE]. The battery technology market current value is estimated to be $95.7bn with projections that it could rise to $136.6bn by 2027, according to research carried out by MarketsandMarkets.

As electric vehicles become more mainstream, the requirement for new batteries grows while rising demand for other consumer electronics has also helped to prop up the battery technology industry. Albemarle shares have been able to successfully capture the growth in the industry this year, and have risen 35% since the start of the year.

Chinese-based Ganfeng Lithium has seen weaker performance as the Chinese economy continues to face challenges. Its shares are down 16.9% since the beginning of the year. London-based AMTE Power has seen the weakest performance of the three and has struggled to capture the positive momentum in the battery technology space and has seen shares crumble 52% this year.

Albemarle capitalises on strong lithium demand

Earlier this month, Albemarle released a strong set of results which has pushed its share price even higher. The group reported net sales of $2.1bn for the third quarter, up 152% year-on-year. Alongside this, net income rose 614% to $897.2m while adjusted EBITDA sat at $1.2bn.

Albemarle’s CEO Kent Masters noted that the strong performance was led by “strong demand for lithium-ion batteries”. With the company being “one of the world’s largest producers of lithium”, Masters believes that Albemarle is “well positioned to enable the global energy transition” and capture the growing demand for lithium.

Ganfeng has also seen strong revenue growth in the last year after sales jumped 30% year on year in H1 to RMB14.3bn ($2.03bn), while the company’s gross profit margin reached an all-time high of 60%. This has also been supported by strong lithium prices over the last few months. However, concerns over the strength of the Chinese economy in recent months have weighed down shares.

AMTE Power shares have dramatically underperformed the pack this year. While the group was able to grow its turnover year-on-year by 31%, most of this growth was from grant income rather than operational revenue. Revenue declined by 48% to £162m which reflected a focus on battery development rather than completing new contracts.

Western countries target shift away from Chinese lithium dependence

There have been recent fears over the dominance that China has within the lithium industry, with western countries making plans to lower reliance on the Chinese-sourced metal. While this could harm future revenues for Chinese-based Ganfeng, it creates new opportunities for lithium and battery manufacturers in the UK and US.

Currently, China controls 58% of the global lithium chemical processing market. In an effort to even up the global distribution of lithium manufacturing, the US has provided billions of dollars in grants to battery metal companies in recent months. In November, it was announced that Green Lithium had found a UK base for its new £600m lithium refinery. Altilium Metals will also build a battery recycling plant within the UK as the country steps up its lithium and battery ambitions.

Fund in focus: Global X Lithium & Battery Tech ETF

The Global X Lithium & Battery Tech ETF [LIT] has declined 13.9% since the beginning of the year. The fund holds a considerable position in Albemarle with the company making up nearly 12% of total assets. This has helped to offset weaker performance from other companies the fund holds. Ganfeng is also held within the fund but only makes up approximately 3.9% of the total holdings.

The Amplify Lithium & Battery Technology ETF [BATT] has seen weaker performance after declining 22.6% since the beginning of the year. Albemarle still makes up one of the fund’s top 10 holdings with a 2.5% weighting. The fund has a heavier weight on companies such as BHP [BHP] at 7.33% and has a heavier weighting in lithium mining stocks.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy