Leah Price first encountered Better Home & Finance [BETR] while working at US government-sponsored enterprise Fannie Mae, and was immediately struck by the firm’s tech-forward approach. “These guys are so far ahead of everyone else,” she recalls thinking. “If they ever wanted to license out their software, these guys would kill it.”

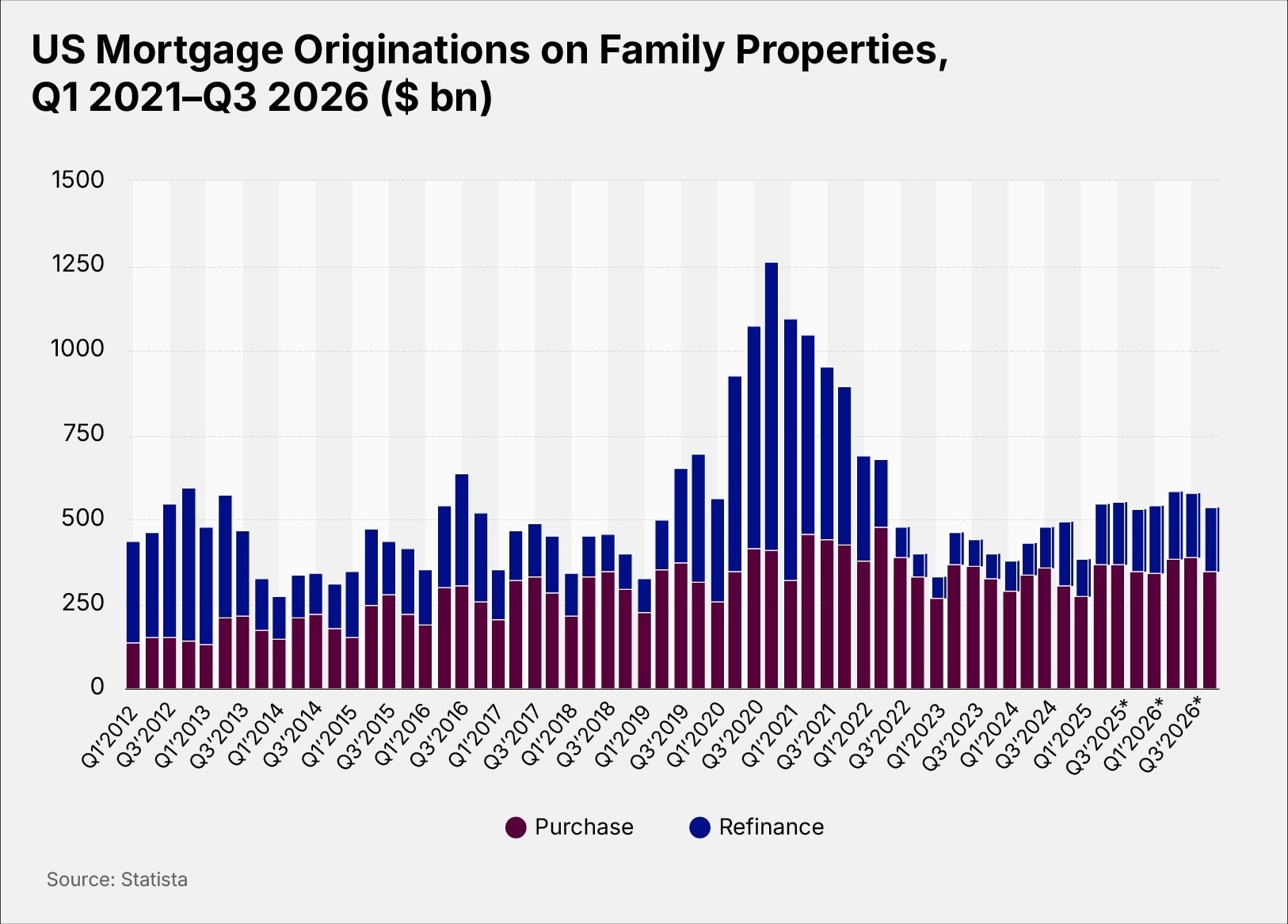

Several years later, Price now works as the Vice President of Better’s Tinman artificial intelligence (AI) platform, and has made it her goal to drive the company’s pivot from mortgage lender to technology service provider. When it comes to the impact of new technology, “the mortgage industry really hasn’t seen any of that benefit yet,” she explains, as the majority of the market uses software created in the 1990s. And, with $384bn-worth of mortgage originations in the US in Q1 2026, according to data from Statista, the company leading that technological charge has a lot of market to capture.

Price recently joined OPTO Sessions to demonstrate the effectiveness of Better’s AI tools, including a new AI mortgage advisor, and to discuss how AI could transform the lending landscape — plus how investors should go about testing the legitimacy of a company’s AI-led initiatives.

Fighting Inertia

In the mortgage industry, as with many parts of the larger services sector, the main obstacle to adoption of new technologies is not necessarily cost or a learning curve, Price says, but inertia. “The biggest hurdle, I will say, is not internal to Tinman or Better — it’s really the inertia of the industry … all of the people that are driving this industry, they’ve been using the same software for their entire careers.”

To make matters worse, all of the positive and negative hype around AI, combined with an uncertain regulatory environment, have made companies extra cautious about adopting potentially game-changing solutions.

To explain the challenge of deploying AI solutions, Price points to the Collingridge dilemma, a methodological quandary in which the deployment of any technology faces the basic obstacle that its effect cannot be easily predicted until it is extensively deployed. She explains it in terms of regulation: “If a regulator waits too long to regulate, all these crazy use cases can come out — you lose control. But if a regulator starts too soon, it can damper all growth.”

In the case of AI, Price points to the contrasting examples of the US and the EU. “The mortgage industry has been… paralyzed because the federal government hasn’t come out clearly stating exactly what the guardrails are going to be, whereas in Europe, there’s a lot of guardrails being put in place before the use cases are fully understood.”

Price sees the ideal approach as striking a balance between investigating use cases and limiting risk. “As a former regulator, I really think of this give and take. How do you try a little bit to explore, just come to the point where you realize what some of the risks are, and then you mitigate those risks?”

Surprisingly, perhaps, home loans companies in the US such as Better have an advantage when it comes to deploying new technology. While the industry has been slow to adopt innovations, following the 2008 economic crisis, it has sufficient guardrails in place to allow for the swift and safe adoption of AI solutions. “The mortgage industry is very heavily regulated by the states and the federal government … There’s very robust risk management frameworks from the regulators and also internalized” within companies, Price says.

Additionally, once a single industry leader has demonstrated the efficacy of Better’s solutions, many other firms are likely to jump on the bandwagon, Price argues. “Proving it out with the highest performer is the way that we convince the rest of the industry that look, this is achievable,” she says. “The envy of your segment is using it. You can too.”

The Agentic Advantage

One advantage of adopting an AI-driven framework is reducing the number of tools loan officers have to work with. “Typically, a mortgage lender of our size would use eight different pieces of software,” Price explains. “That doesn’t really work anymore, and the weakness there is starting to become very clear in the world of gen AI.”

Better’s Tinman thus serves as a unified platform with a number of different functions, including point of sale, a loan origination system, a compliance engine, a decision engine and a pricing engine.

Ultimately, Price says, “the borrower benefits in this world now because they have more access to different front doors that they might not have access [to] with fragmented platforms.”

Despite Better’s clear digital focus, the company is leveraging its AI systems to enhance, not replace, the human touch. “Even, as one of the most tech-forward mortgage originators, all of our loans are touched by human beings,” Price explains.

And this AI-human collaboration has improved the lending process in unexpected ways, Price attests. “Before a human underwriter is allowed to decline a file, we require that they also put it through our [AI] underwriting process to see if the AI tool can figure out how the borrower could possibly qualify for a given loan to find them a product that might meet their needs.”

That way, Better is checking all of the boxes to make sure borrowers get the most comprehensive service possible. “This really multiplies the ability and capabilities and strengthens the skill of all of the people that are working on the file.”

AI Washing

Given the hype surrounding AI, it can be hard to understand which companies are actually leveraging the technology’s advantages, and which are just putting on a show, Price admits. “Basically any company can go out there and make claims, ‘oh, we have all this AI, it’s really driving our efficiency and it’s really cool’, and show off some chat bot that they’ve slapped on top. And there they are, they’re an AI company. They should trade at a higher multiple, and they can get a lot of attention.”

This makes it hard for investors to determine which companies’ growth stories are actually going to be driven by AI. Rather than relying on investor resources, such as earnings calls, Price recommends that investors “do the homework”.

In the case of Better, it’s easy for an individual investor to test the efficacy of its AI solutions, Price says. “Go to our website. Dial the phone number, call [our AI chatbot] Betsy yourself. See if she’ll take your application … See how far you can push it yourself.”

In the end, encouraging this kind of engagement will drive the quality of service in the space. “We want to start challenging our competitors to also do live demos, to really show what you have and how that’s going to benefit borrowers and the industry.”

“If I can get my competitors out there feeling like it’s a little bit uncomfortable, that’s when I know I’ve done my job,” Price says.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy