Wolfspeed [WOLF] is a semiconductor chipmaker that filed for bankruptcy in July 2025. Photronics [PLAB] manufactures high-precision stencils, known as photomasks, used to create circuit patterns on computer chips. ACM Research [ACMR] develops wet-cleaning and processing tools that improve chipmakers’ product yield.

Each company operates at a different stage of the semiconductor production process, which is divided into upstream, midstream and downstream phases.

Wolfspeed is considered an upstream play, producing semiconductor wafers that serve as the base for integrated circuits. Chip designing is considered an upstream process and is dominated by the likes of Nvidia [NVIDIA] and Advanced Micro Devices [AMD].

Mid-stream processes involve manufacturing and fabrication. Both Photronics and ACM Research produce equipment used in this phase. Lastly, downstream processes include packaging and testing.

In this article, we look at small-cap players — companies with a market cap of less than $2bn at the time of writing — in the US semiconductor industry. We will talk about the sector, analyze each stock’s price performance and reflect upon the bull and bear cases for ACMR, PLAB and WOLF.

Sector Talk: Trump vs CHIPS

After experiencing a cyclical market downturn in 2023, the global semiconductor industry bounced back in 2024 to deliver a 19% growth in industry sales to $627bn. Analysts at Deloitte said the semiconductor industry is expected to grow further to a new all-time high in 2025 and is on track to hit a key milestone of $1trn in chip sales by 2030.

The CHIPS and Science Act, signed into law in 2022 by former US President Joe Biden, has played a key role in driving private investment into domestic semiconductor manufacturing. Since its passage in August 2022, over 90 new manufacturing projects in the US have been announced, with investments totaling nearly $450bn across 28 states, the Semiconductor Industry Association reported.

However, the return of President Donald Trump to office has seen the US government curb the disbursement of CHIPS Act funds. The Trump administration is favoring tariffs over subsidies to incentivize domestic chip production.

Bloomberg reported that Secretary of Commerce Howard Lutnick has signaled an intention to withhold promised CHIPS Act grants to pressure semiconductor firms to expand their US operations.

This policy shift has impacted chipmaker Wolfspeed, which filed for Chapter 11 bankruptcy in late June. In October 2024, Wolfspeed had been awarded up to $750m in direct funding under the CHIPS Act.

However, the company was not awarded the grant before Biden’s exit and was negotiating with the Trump administration for the release of funds.

Market Performance

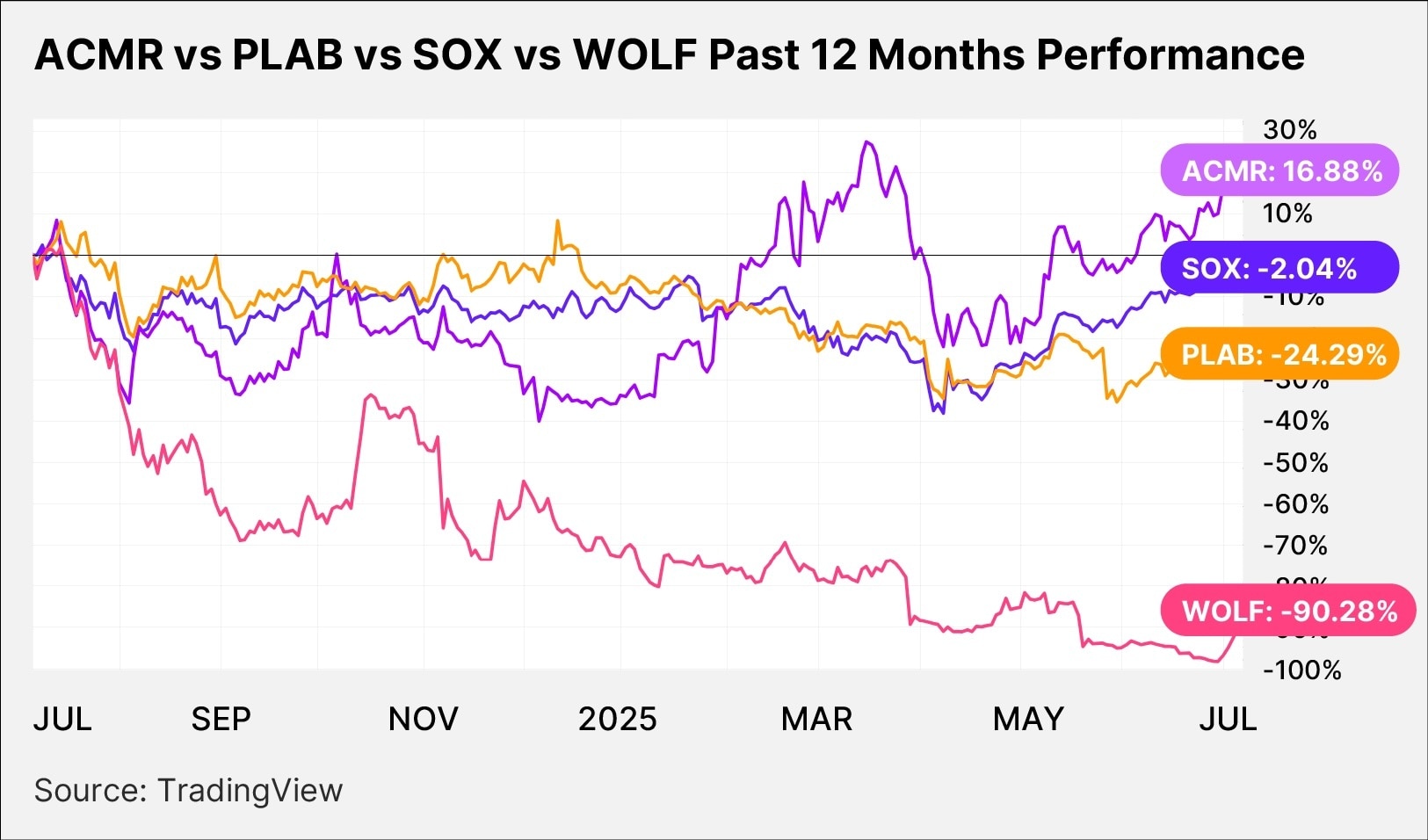

Wolfspeed, formerly known as Cree, was an LED manufacturer before pivoting to create silicon carbide technology in 2021. Uncertainties over the company’s future have sent the WOLF share price tumbling by 65.32% year-to-date, as of July 7.

However, on July 1, WOLF stock surged 97.5%, amid a substantial increase in trade volume, following the initiation of bankruptcy proceedings.

Elsewhere, shares of Photronics have seen their prices dip 18.12% year-to-date, as of the July 7 close.

Poor earnings and concerns related to top management changes are key reasons behind the fall in the PLAB share price in 2025.

Wet wafer cleaning equipment maker ACM Research bucked the trend and saw its share price jump 85.3% year-to-date, buoyed by a quarterly earnings beat and a positive revenue outlook.

In comparison, the PHLX Semiconductor Sector Index [SOX], a market capitalization-weighted index that tracks the performance of the 30 largest US-listed semiconductor companies, is up 11.27% year-to-date.

Here is how the fundamentals of the three stocks currently compare to each other.

| ACMR | PLAB | WOLF |

Market Cap | $1.79bn | $1.16bn | $359.50m |

P/E Ratio | 17.82 | 9.99 | N/A |

Estimated Sales Growth (Current Fiscal Year) | 17.19% | -3.77% | -6.66% |

Estimated Sales Growth (Next Fiscal Year) | 16.60% | 5.77% | 14.90% |

Source: Yahoo Finance

WOLF, PLAB and ACMR: The Investment Case

The Bull Case for Wolfspeed: A Comeback

The worst may be over for Wolfspeed. Investors are hoping that the start of the bankruptcy proceedings will mark a new dawn for the company. So far, the updates provided by the company have been positive.

Wolfspeed’s bankruptcy plan has received the backing of over 97% of senior secured noteholders and over 67% of convertible debtholders.

The company said that, upon emergence from the process, it expects to reduce its overall debt by about 70%, and its annual total cash interest payments by about 60%.

Despite the restructuring, Wolfspeed will continue to serve clients and pay vendors, backed by $1.3bn in cash on hand. The company expects to emerge from the process by Q3 2025.

The Bear Case for Wolfspeed: Risky Trade

Trading in the stock of a bankrupt company is risky. Chapter 11 bankruptcy proceedings prioritize creditors over shareholders.

Current Wolfspeed shareholders will see their equity cancelled. They will receive 3% or 5% of the new common equity, distributed on a pro-rata basis, that will be issued upon completion of the bankruptcy proceedings.

Additionally, existing shareholders will see their holdings diluted on new equity issuances and creditor conversions.

The Bull Case for Photronics: Positioned for Growth

Photronics is well-positioned to benefit from the growing artificial intelligence-driven semiconductor demand thanks to the company’s ability to produce “high-end” photomasks that are 28 nanometers or smaller.

It counts leading semiconductor manufacturers such as Taiwan’s United Microelectronics Corp [UMC], and South Korean heavyweight Samsung Electronics [SSNLF] and China’s Semiconductor Manufacturing International Corp [0981:HK] among its clients.

Importantly, Photronics noted in its annual report that it earns a small share of revenue from US federal contracts, limiting its exposure to CHIPS Act uncertainty.

The Bear Case for Photronics: Weak Financials

On May 28, Photronics’ share price fell over 15% after the company failed to meet quarterly revenue and earnings expectations.

The company reported a 3% year-over-year decrease in revenue to $211m in Q2 2025. Quarterly non-GAAP net income attributable slumped 15.33% year-over-year to $24.3m.

Furthermore, Photronics forecast Q3 revenue will be between $200m and $208m, lower than the $211m reported in Q3 2024.

Adding to investor concerns, CEO Frank Lee, who has been with the company for nearly two decades, is set to retire soon.

The Bull Case for ACM Research: Strong Earnings Momentum

In 2024, the company reported a 40.2% year-over-year increase in revenue to $782.1m and a 34% year-over-year rise in net income attributable to $103.6m.

In Q1 2025, ACM Research beat market expectations for the sixth consecutive quarter as the company reported a 13.2% year-over-year increase in revenue, supported by strong demand for its wafer cleaning solutions.

ACM Research forecast 2025 revenue will rise to a range of $850m–950m compared to $782.1m reported in 2024. The company upgraded its gross margin target range to 42–48%, from 40–45%.

The Bear Case for ACM Research: China exposure

ACM Research is highly exposed to geopolitical tensions between the US and China. The company derived about 99% of its revenue from China in 2024.

In December 2024, the company’s unit, ACM Research Shanghai [688082:SS], was added to the so-called Entity List by the US Bureau of Industry and Security. Companies worldwide are now prohibited from exporting hardware, software or technologies to ACM Research Shanghai.

ACM Research held an 81.5% stake in ACM Research Shanghai at the end of 2024. ACM Research Shanghai was listed on the Shanghai STAR Market, which has been touted as China’s equivalent to the tech-focused Nasdaq Exchange in the US.

Conclusion

WOLF, PLAB and ACMR present contrasting investment cases. Wolfspeed is a high-risk, high-volatility play that is attracting both shorts and longs. Photronics faces near-term headwinds despite its long-term positioning. ACM Research shows strong growth but remains vulnerable to US-China tensions.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy