In this article, Forrest Crist-Ruiz, assistant director of trading research and education at MarketGauge.com, considers what the iShares Transportation Average ETF can indicate about the direction of the market.

The US Federal Open Market Committee minutes, released on Wednesday, stated little to no change.

Rates will stay low until 2023 and the monthly $120bn bond buying programme will stay in place.

The US Federal Reserve has been hesitant to change any fiscal policy as it has been very attentive to the economic recovery.

However, this has worried some investors who believe hefty spending will increase inflation. Currently, the inflation rate is set to rise to around 2% by the end of 2021.

For Jerome Powell, chairman of the Federal Reserve (pictured), this number is acceptable because supporting the economy and maintaining a positive forecast for the unemployment rate is still the focus.

With that said, the overall market reaction was lacklustre, but upon a closer review we do see some signs of stress.

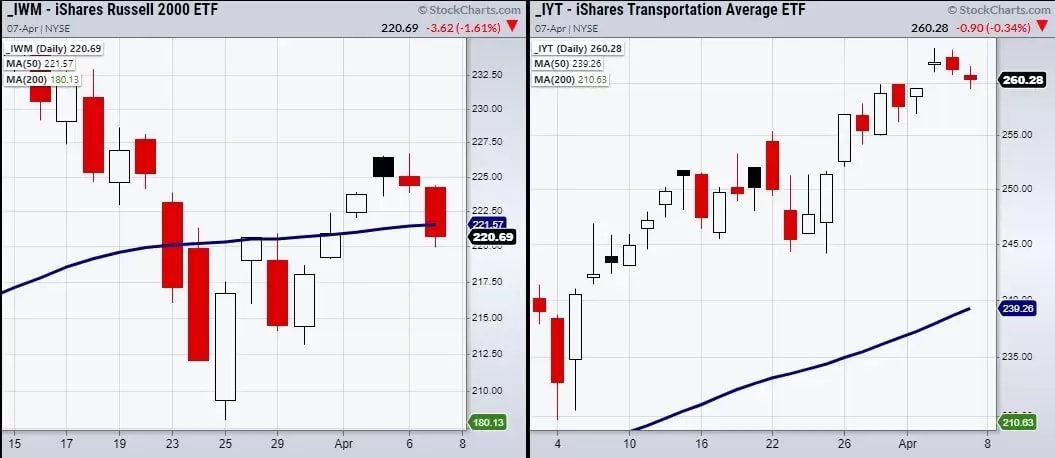

The small cap index Russell 2000 (represented by the iShares Russell 200 ETF [IWM]) closed under its 50-day moving average (DMA), which it recently cleared at $221.

The 50-DMA has been the best support for IWM to hold from a technical standpoint. Now, we will wait a second day for confirmation to see what IWM does.

The VanEck Vectors Semiconductor ETF [SMH] has also struggled to clear resistance at $158 along with the iShares Transportation Average [IYT] showing some drifting price action.

Because IYT helps to show the demand side of the economy, this holds great importance as we look for the market to continue upwards.

Today, investors could watch for IYT to show some more decisive price action and for IWM to either confirm a cautionary phase with a second close under its 50-DMA or rally back over that major moving average.

This article was originally published on MarketGauge. With over 100 years of combined market experience, MarketGauge's experts provide strategic information to help you achieve your investing goals.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy