In this article, Forrest Crist-Ruiz, assistant director of trading research and education at MarketGauge.com, explains how, under certain conditions, investors may find safety in commodities.

Recently, there has been a surge of articles pertaining to rising inflation as the US federal government plans to add more debt with upcoming spending from the infrastructure bill and another stimulus package.

Inflation has become an increasingly touchy topic.

On Wednesday, Janet Yellen, US secretary of the Treasury, backtracked her recent comments about how it might be necessary to increase interest rates to keep the market from overheating.

However, fear of inflation could still be why investors are hesitant to add more money to the current market.

If so, it can also be seen in the major indices’ reluctance to clear or hold over recent highs.

Additionally, two of the major indices are having trouble at their current price levels. The iShares Russell 2000 ETF [IWM] is back underneath its 50-day moving average (DMA) at $223.28 and the Nasdaq 100 (represented by the Invesco QQQ Fund [QQQ]) is floating not far above its 50-DMA at $308.99.

However, if the markets’ weakness stems from fear of rising inflation, Mish Schneider, director of trading research and education at MarketGauge.com, has successfully stayed ahead of the curve with her repeated trade picks in commodities going back to the beginning of the pandemic.

More government spending paired with an increasing deficit made room for commodities to flourish, like corn (represented by the Teucrium Corn Fund [CORN]), sugar (represented by the Teucrium Sugar Fund [CANE]), gold (represented by the SPDR Gold Trust [GLD]), and Invesco DB Agriculture Fund [DBA].

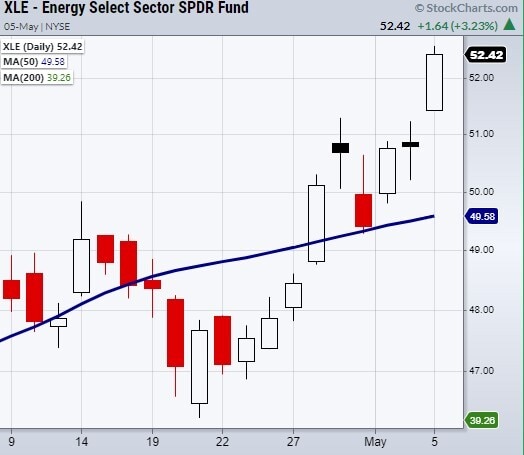

With that said, commodities that were thought to decrease in value under the new US administration are making a push upwards. One sector is the energy sector (represented by the Energy Select Sector SPDR Fund [XLE]).

It has recently crossed back over its 50-DMA and now is making a run for highs at $54.37.

If securities continue to have trouble heading into the second half of the year and the inflation rate increases, the commodities space offers a safer play in this choppy market.

This article was originally published on MarketGauge. With over 100 years of combined market experience, MarketGauge's experts provide strategic information to help you achieve your investing goals.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy