What is forex (FX) trading?

FX trading, also known as foreign exchange trading or forex trading is the exchange of different currencies on a decentralized global market. It’s the largest and most liquid financial market in the world.

Foreign exchange rates between different currency pairs show the rates at which one currency will be exchanged for another. It plays a vital role in foreign trade and business as products or services bought in a foreign country must be paid for using that country's currency.

What is forex trading and how does it work?

Foreign exchange trading is also known as FX trading or forex trading provides the opportunity to speculate on price fluctuations within the FX market. FX is an industry term that is abbreviated from forex and is commonly used instead of forex. However, forex is also an abbreviation of foreign exchange.

The goal of FX trading is to forecast if one currency’s value will strengthen or weaken relative to another currency. A forex trader will encounter several trading opportunities each day, due to daily news releases. They take advantage of this by becoming extremely receptive to market news releases and then trade based upon the suspected market sentiment.

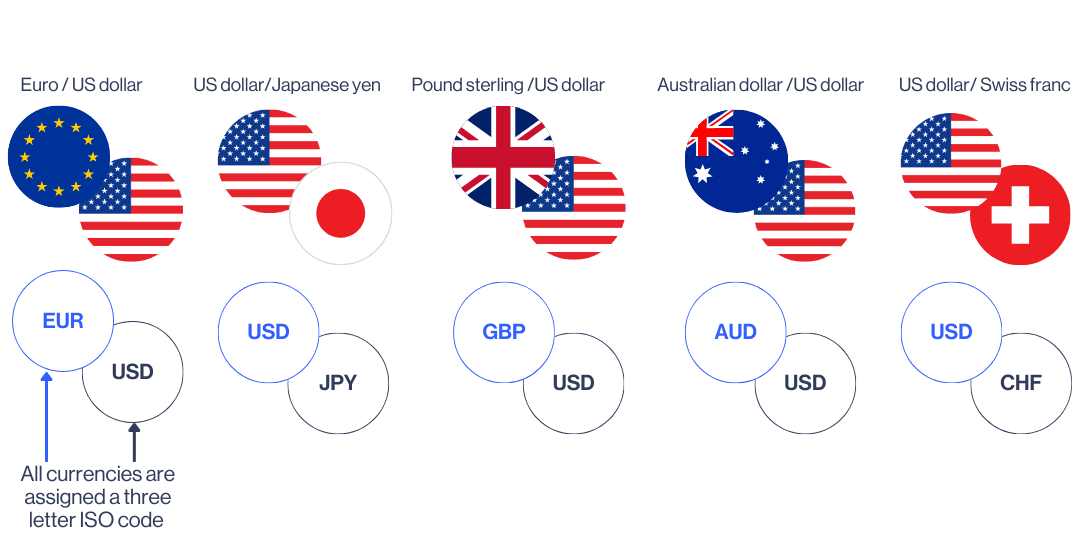

What are forex currency pairs

Forex is always traded in currency pairs – for example, GBP/USD (Pound sterling v US dollar). Forex trading works by speculating against the difference in valuation of two currencies.

For example, If you were to trade the GBP/USD, and thought the price of the US dollar were to drop lower than GBP, you could short sell the currency pair to profit from the difference in value.

Looking at the GBP/USD currency pair, the first currency (GBP) is called the 'base currency' and the second currency (USD) is known as the 'counter currency'. Alternatively, if you think GBP will fall against USD (or that USD will rise against GBP), you could go long.

What are the different types of currency pairs

There are 3 different types of forex pairs:

Major pairs: Includes the most traded currencies globally and always involve the US dollar (USD) as either the base or quote currency. These pairs tend to have high liquidity

💡 Examples:

CAD/USD (Canadian Dollar / US Dollar)

EUR/USD (Euro / US Dollar)

USD/JPY (US Dollar / Japanese Yen)

Minor pairs- Do not include the US dollar but involve all the other major economies. These tend to trade at moderate liquidity

💡 Examples:

EUR/GBP (euro / British pound)

AUD/NZD (Australian dollar / New Zealand dollar)

GBP/JPY (British pound / Japanese yen)

Exotic Currency Pairs- consist of one major currency and one from an emerging market. These pairs have higher spreads and lower liquidity, making them more volatile.

💡 Examples:

GBP/ZAR (British pound / South African rand)

USD/TRY (US dollar / Turkish lira)

EUR/SEK (euro / Swedish krona)

What is a pip?

A pip (percentage in point) is the smallest price movement a forex pair can make. Most currency pairs are quoted to four decimal places, and a pip is typically the fourth decimal place (0.0001). Traders use pips to measure price movements and calculate potential profits or losses in a trade.

If GBP/USD moves from 1.2500 to 1.2505, that’s a 5-pip movement.

For pairs that involve the Japanese yen (JPY), a pip is the second decimal place (0.01) instead of the fourth.

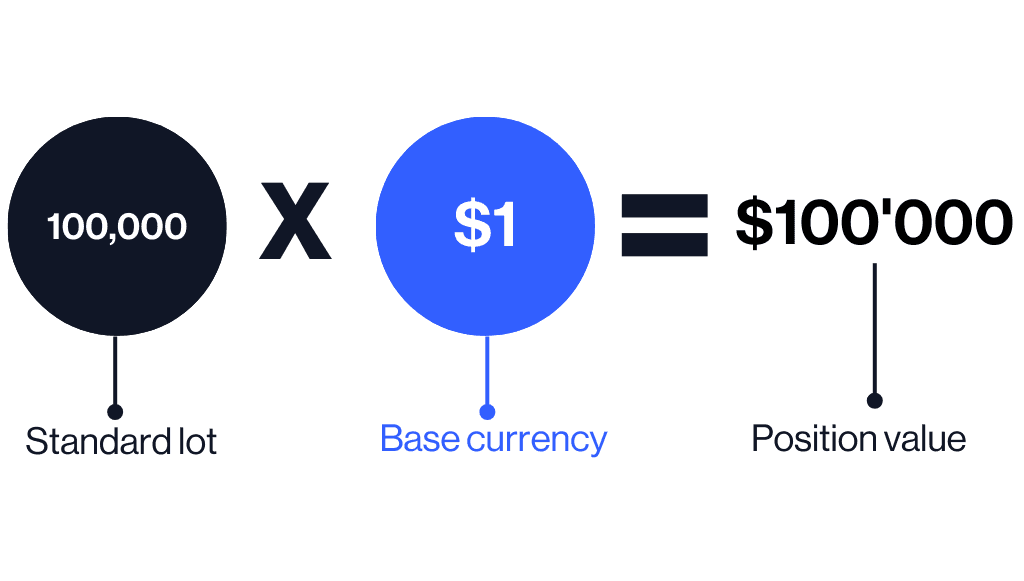

What is a lot?

A lot in forex trading refers to the size of a trade. Since forex is traded in large volumes, lots standardize how much of a currency you buy or sell in one trade.

There are 3 different types of lots sizes:

Effect of lots on Forex trades:

If you trade 1 standard lot, a 5-pip move would mean $50 gained or lost.

If you trade 1 mini lot, a 5-pip move equals $5 profit or loss.

If you trade 1 micro lot, a 5-pip move equals $0.5 profit or loss.

🚨 Lot size directly affects trade risk – larger lot sizes mean bigger potential profits, but also larger potential losses.

How to trade the FX market:

There are many ways to trade on the forex market, all of which follow the previously mentioned principle of simultaneously buying and selling currencies. If you believe an FX ‘base currency’ will rise relative to the price of the ‘counter currency’, you may wish to ‘go long’ (buy) that currency pair. If you believe the opposite will happen and the market will fall, you may wish to ‘go short’ (sell) the currency pair.

The forex market was historically traded via a forex broker. However, with the rise of online trading companies, you can take a position on forex price movements with a CFD trading account.

CFD trading accounts provide a form of derivative FX trading where you do not own the underlying asset, but rather speculate on its price movements. Derivative trading can provide opportunities to trade forex with leverage. As this can be a risky process, forex traders often choose to carry out forex hedging strategies, in order to offset any currency risk and subsequent losses.

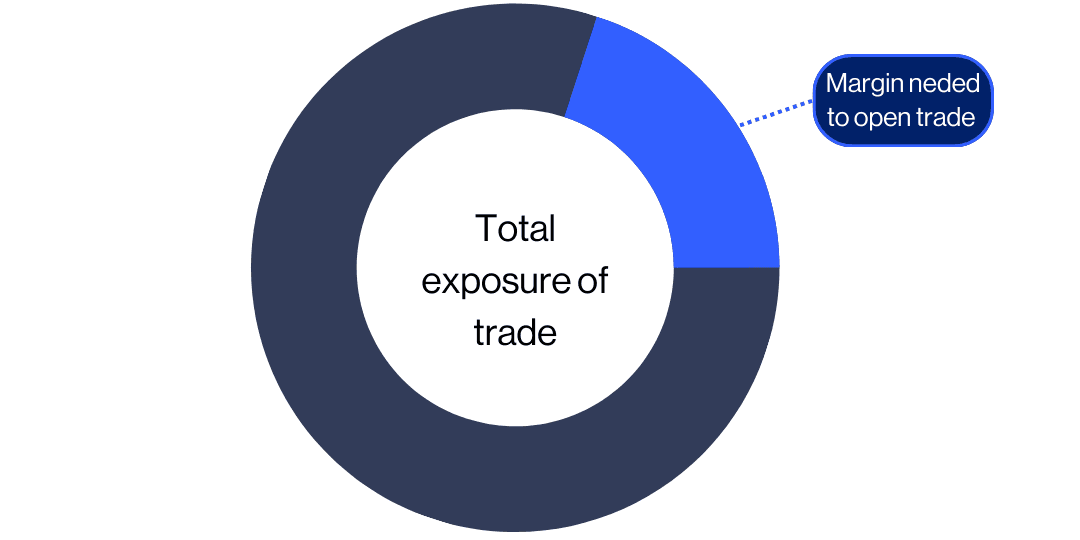

What is leverage in forex trading?

When trading, forex leverage allows traders to control a larger exposure with less of their own funds. The difference between the total trade value and the trader’s margin requirement is usually ‘borrowed’ from the forex broker. Traders can usually get more leverage on forex than other financial instruments, meaning they can control a larger sum of money with a smaller deposit.

The availability of leverage is one of the reasons that many people are interested in trading FX via a CFD trading account. CMC Markets’ accounts offer competitive margin rates on forex instruments starting at just 3.3%, or 30:1 leverage. This is higher leverage than the 20% margin rate (5:1 leverage) available for shares instruments.

What is spread in forex?

The spread in forex trading is the difference between the buy and sell price of an FX currency pair. When you trade forex pairs, you are presented with a ‘buy’ price that is often above the market price and a ‘sell’ price that is often below the market price. The difference between these two prices is referred to as the ‘bid-ask’, or ‘buy-sell’ spread.

Forex trading has some of the lowest spreads available of all financial instruments we offer, starting at just 0.7 points, or 3 points for crude oil.

Forex trade example:

You’ve looked at the news this morning and seen some news that suggest that the pound will strengthen, so you decide to go long (buy) GBP/USD at 1.2500 with a position size of 10,000 units(1 mini lot).

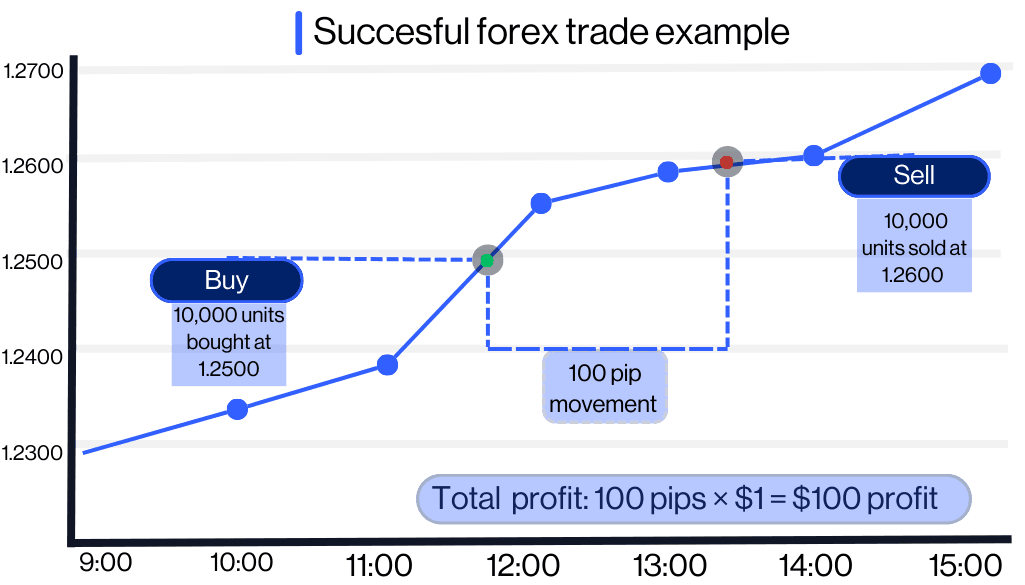

Successful forex trade example

Let’s assume GBP/USD rises to 1.2600 which is a 100-pip increase (1.2600 - 1.2500 = 100 pips). From when you opened your position. You close your trade at 1.2600, locking in a profit of $100.

Pip value for 1 mini lot (10,000 units)= £1 per pip

Total Profit: 100 pips × $1 = $100 profit

Your $2,000 margin deposit remains intact, and you gain $100, leaving you with a new balance of $2,100.

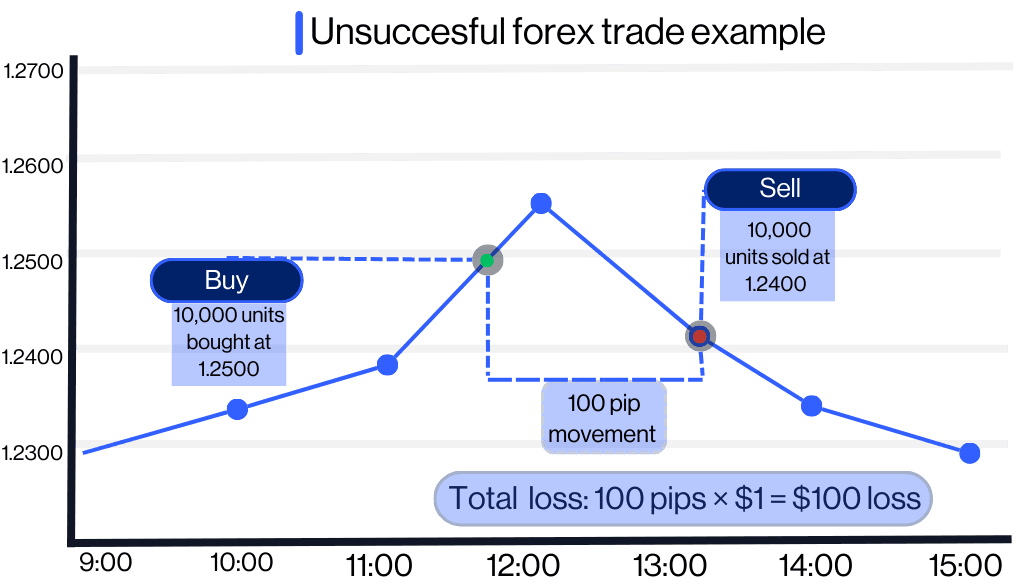

Unsuccessful forex trade example

Now assume GBP/USD falls to 1.2400 (a 100-pip decrease 1.2500 - 1.2400 = 100 pips). You close your trade at 1.2400, taking a loss of $100.

Pip Value for 1 Mini Lot (10,000 units): $1 per pip

Total Loss: 100 pips × $1 = $100 loss

£100 will be taken from your $2,000 deposit you’re balance will drop to $1,900

🚨 Leverage amplifies both profits and losses while a 100-pip move resulted in $100 gain/loss, a larger position size (e.g., a standard lot) would have made this £1,000 instead.

Who trades the foreign exchange market?

The foreign exchange is one of the most widely traded markets in the world, with a total daily average turnover reported to exceed $5 trillion a day. The forex market is not based in a central location or exchange, and is open 24 hours a day from Sunday night through to Friday night. Read more about forex market hours here. A wide range of currencies are constantly being exchanged as individuals, companies and organizations conduct global business and attempt to take advantage of rate fluctuations.

The foreign exchange market is used primarily by central banks, retail banks, corporations and retail traders. Understanding how each of these players interact with the FX market can help to determine market trends as part of your fundamental analysis.

Central banks are responsible for managing their nation’s currency, money supply and interest rates. When action is taken by central banks, it is usually to stabilize the nation’s currency.

Retail banks trade large volumes of currency on the interbank market. Banks exchange currencies between each other on behalf of large organizations, and also on behalf of their accounts.

Corporations that have dealt with companies overseas have to take part in the foreign exchange market to transfer funds for imports, exports or services.

Retail traders account for a much lower volume of forex transactions in comparison to banks and organizations. Using both technical analysis and fundamental analysis, retail traders aim to profit from forex market fluctuations.

What influences the foreign exchange markets?

To trade the forex market with little awareness of the factors that influence the FX market can result in substantial losses. Many of the macroeconomic forces at play can have huge effects on the valuation of a currency.

When looking at forex markets, it's important to remember that a stronger currency makes a country's exports more expensive for other countries, while making imports cheaper. A weaker currency makes exports cheaper and imports more expensive, so foreign exchange rates play a significant part in determining the trading relationship between two countries.

Political instability and economic performance

Political instability and poor economic performance can also influence the value of a currency, such as when there are presidential elections and national recessions. Politically stable countries with robust economic performance will usually be more appealing to foreign investors, so these countries draw investment away from countries characterized by more economic or political risk.

Interest rates

Interest rates, inflation rates and foreign currency rates are all interconnected, and as some rise others can fall. Central banks control the interest rate as a measure to control inflation. If a central bank wants to decrease inflation, it can increase interest rates in a bid to stop spending and lending. This generally increases the value of money in an economy, as there is less, or ‘more expensive’, money available in the economy.

On the other hand, when there is more money with less value in an economy, businesses and consumers increase spending and lending through loans and other types of credit. Sellers will then increase prices, causing inflation and a lower-valued currency. These fluctuations in currency value are one of the reasons forex traders may look to trade on interest rate announcements from central banks, like the US Federal Reserve or the Bank of Canada. This can be done through cross currency swaps, which can help to hedge currency risk on both interest rates and exchange rates.

Inflation rates

Often paired with interest rates, inflation rates can have a major influence on a nation’s foreign exchange rates. Rising inflation rates often have a negative effect on a currency’s value. Conversely, low inflation rates usually cause an appreciation in the value of a currency. When inflation is high, the price of goods and services increases, which can cause the currency to depreciate, as there is less spending.

Terms of trade

The terms of trade for a country represent the ratio of export prices relative to import prices. If a country’s export prices rise and its import prices fall, the terms of trade have favourably improved. This increases the nation’s revenue and is followed by an increase in demand for the country’s currency. This increase in demand can cause a rise in the currency’s value.

Debts

A nation’s debt can be a large influencer in the variations of its currency price. Countries with large debts in relation to their gross domestic product (GDP) will be less attractive to foreign investors. Without foreign investments, countries can struggle to build their foreign capital, leading to higher rates of inflation and thus, currency depreciation.

What are the benefits of forex trading?

The ability to trade on forex margin (using leverage).

High levels of liquidity mean that forex spreads stay tight and trading costs stay low.

Prices react quickly to breaking news and economic announcements (this can be a disadvantage too).

Trade 24 hours a day from Sunday to Friday.

The ability to go long and short.

Wide range of markets (trade CFDs on more than 330 forex pairs with CMC Markets).

Market trends can be more predictable.

What are the potential risks of forex trading?

You can lose all of your capital - leveraged forex trading means that both profits and losses are based on the full value of the position.

Risk of account close out - market volatility and rapid changes in price can cause the balance of your account to change quickly, and if you do not have sufficient funds in your account to cover these situations, there is a risk that your positions will be automatically closed by the platform.

Currency pair correlations can increase the interest rates outside of major forex pairs.

Market volatility and gapping - financial markets may fluctuate rapidly and gapping is a risk that arises as a result of market volatility, and one of the effects of this may mean that stop-loss orders are executed at unfavourable prices.

Risk of carry trade.

Central bank decisions can have an effect on interest rate levels.

Bottom line

Forex trading is a fast-paced, exciting option and some traders will focus solely on trading this asset class. They may even choose to specialize in just a few select currency pairs, investing a lot of time in understanding the numerous economic and political factors that move those currencies.

要开始在我们平台上进行外汇交易,您可以在我们的CMC平台或MT4平台上开设标准账户或FX Active账户,交易超过330个货币对,包括所有主要货币对、次要货币对及冷门货币对。您也可以先在模拟账户上练习外汇交易策略,然后再通过真实账户用真实资金进行交易。

有许多在线资源可以帮助您学习外汇交易。您可以从我们的学习外汇部分了解更多基础知识,涵盖了多个主题,包括保证金和杠杆、点数、外汇市场交易时间和外汇交易策略。

为了帮助您熟悉我们的平台和外汇交易,您可以开设外汇模拟账户来练习使用$10,000虚拟资金。The seven major currency pairs make up around 75% of all forex trades worldwide. These include USD/CAD, GBP/EUR, AUD/USD and EUR/USD. Read our full guide on what is forex trading and how does it work?

You can’t trade forex without using leverage on our platform. If you’re concerned about the risks of leverage, there are a number of risk-management tools, such as stop-losses and take-profit orders, that could be used when placing a trade. Learn about the execution and order types available on our platform.

并不存在“最好的外汇策略”,因为适合一个交易者的策略可能不适合另一个人。这取决于多种因素,以及您自身的风险承受能力。外汇交易策略种类繁多,包括日内交易、中期波段交易和超短线剥头皮交易等。

16 strongest currencies

Explore the 16 most powerful currencies in the forex market and the factors that drive their performance. Understand how GDP, trade volume, and monetary policies shape their movements and global influence.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.