Long term trading inevitably involves losses and no trader can have 100% winning trades all the time. In this guide, we discuss why risk management is important to your trading strategy and offer pointers to keep in mind when planning your CFD trading strategy.

Striking the right balance

To succeed as a trader, the size of your potential losses needs to make sense compared to the original profit potential on each new position. Without a disciplined attitude to risk and reward, it is easy to fall into the trap of holding losing positions for too long. Hoping things will turn around before eventually closing out for a large loss makes little sense if your original objective was to make a small profit over a few hours.

Long-term trading profit can be described as a winning combination of:

The number of profitable trades, compared with the number of losing trades and,

The average value of profits on each trade compared with the average value of losses.

It is important to combine these ratios and the relationship between risk and reward. For example, many successful traders actually have more losing than winning trades, but they make money because the average size of each loss is much smaller than their average profit. Others have a moderately average profit value compared to losses but a relatively high percentage of winning positions.

Why risk management is important

Experienced traders know that even strategies that have been successful over the long term can leave you vulnerable to risks in the short- to medium term, including:

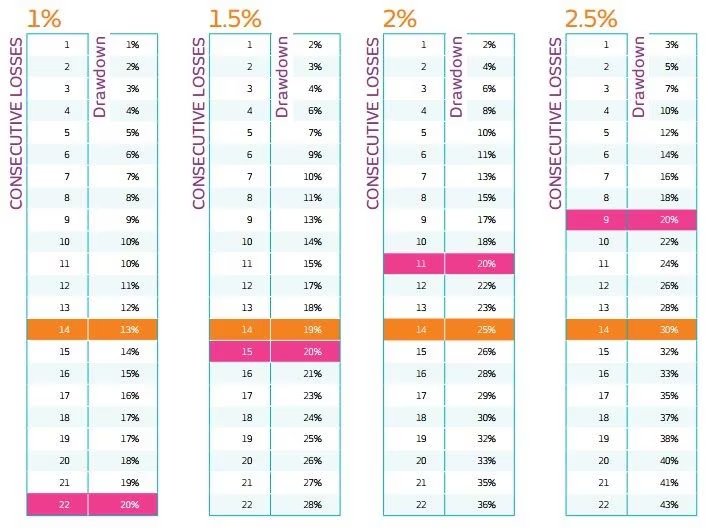

Significant runs of consecutive losses

Occasional large losses where prices gap through stop loss levels, for example due to a major news event

Changes in market circumstances which mean that you can never be certain that just because a strategy has worked in the past it will continue to work in the future.

Without appropriate risk management, events like this can lead to:

Loss of all your trading capital

Losses that are too large given your overall financial position

Having to close positions in your account at the wrong time because you don't have enough liquid funds available to cover margin

The need for an extended period of profitable and prudent trading just to recover your losses and restore your trading capital to its original level.

Loss taken | Gain necessary |

|---|---|

10% | 11% |

15% | 17% |

25% | 33% |

30% | 42% |

50% | 100% |

75% | 300% |

90% | 900% |

There is still, of course, the possibility that the above scenarios can arise even after you have used the appropriate risk management strategies. Losing more than 30% of your account can lead to a major task just to recover what you have lost. After large losses, some traders resort to taking even greater risks, and this can lead to ever-deepening difficulties.

To get the benefit of a winning strategy over the long term you need to be in a position to keep trading. With poor risk management, the inevitable large market move or short-term string of losses may bring your trading to a halt. You can't avoid risk as a trader, but you need to preserve capital to make money.

A risk-managed approach to trading recognises that you are taking risk but need to limit that risk in the short term to maximise longer term opportunities. Lack of risk management is one of the most common reasons for failure.

Margined trading is a double-edged sword

Margined trading is a double-edged sword, in that it magnifies potential losses as well as potential profits. This makes it even more important to limit your exposure to large adverse market moves or larger-than-usual strings of losses.

Risk management rules can sometimes reduce profits over the short to medium term. The temptation to abandon prudent risk management is often greatest after a period of success and even a single large trade in these circumstances can easily lose all your recent hard-won profits and more. It is all too common to have a lot of successful trades with smaller positions, followed by the inevitable losses that come along just when you have decided to take on bigger positions.

A consistent, controlled approach to trading is more likely to be successful in the long run. Gradually compounding your account by leaving your profits in the account and prudently increasing your positions in line with your increased capital is a more likely path to success than overtrading in the short term.

Good risk management can also improve the quality of your trading decisions, by helping with your psychological approach to the market. Getting into a cycle of overconfidence followed by excessive caution is a common problem for traders. Trading without risk management makes this more likely.

Risk management involves limiting your positions so that if a big market move or large string of consecutive losses does happen, your overall loss will be something you can reasonably afford. It also aims to leave enough of your trading funds intact for you to recover the losses through profitable trading within a reasonable timeframe.

Risk-management rules

The knowledge that your trading is backed by a good set of risk-management rules can be a big help in avoiding the cycle of euphoria and fear that often leads to poor decision-making. Good risk management frees you to look at the markets objectively and go with the flow of the market, confident in the knowledge that you have taken reasonable steps to limit the risk of large losses.

Limit your trading capital

The first thing to decide is how much capital you will devote to trading.

Many people are investors as well as traders. For example, you may hold long-term assets such as shares or property. Trading normally refers to buying and selling in seeking to profit from relatively short-term price changes. Investing, on the other hand, involves holding assets to earn income and capital gain often over a relatively long term. It can be a good idea to plan, fund and operate your investment and trading separately, as each activity involves different approaches to strategy and risk management.

Some of the factors you may wish to consider include your:

Overall financial situation and needs

Trading objectives

Tolerance for risk

Previous experience as an investor or trader

Wealth preservation should be a key consideration. It is best to limit your trading capital to an amount that you could prudently afford to lose if things go wrong. As previously discussed, this approach can have the added benefit of allowing you to trade without feeling too much pressure and improve your decision-making.

Conduct your own stress test

One useful technique in deciding on how much capital and risk to allocate to trading is to conduct your own stress test. Calculate the likely worst-case loss if there was a very big market move or a large string of losses at a time when you have your maximum position open.

Decide whether you could afford this and if you could deal with it emotionally. Limit your trading position to something you can handle in these circumstances. You should also make sure you have the liquid funds available to support your planned trading activities. Even if you are comfortable with the overall risk you take, it is best to make sure you have enough funds in your account, or available on short notice, to support your trading activities at all times.

Finally, if you're new to trading, it can be prudent to start in a relatively small way and plan to increase your trading activities once you have developed some experience and a track record of success.

Always use a stop-loss order

Successful trading involves balancing risk and reward. Good traders always work out where they will cut the loss on a trade before they enter it.

Our trading platform is designed to assist you with a risk/reward approach to trading. You can place a stop-loss order or guaranteed stop-loss order when you open a new position. Stop-loss orders are used to exit positions after the price moves against your position.

A sell stop order is used if your opening trade was to buy and you are long the market. A sell stop order can only be set at a level that is below the current market price. If the market falls to the stop price you nominate, the order becomes a market order to sell at the next available price.

Stop orders are often called stop-loss orders, but they can also be used to take profits. For example, a common strategy is to move your sell stop-loss higher as the market moves higher. This can be easily managed by applying the trailing stop loss function. A buy stop-loss is used if your opening trade was to sell and you are short the market. A buy stop order can only be placed above the current market price. If the market rises to the stop price you have nominated, the order becomes a market order to buy at the next available price.

Slippage

It is important to know that stops may be filled at a worse price than the level set in the order. Any difference between the execution price and stop level is known as slippage. The risk of slippage means that a stop-loss order cannot guarantee that your loss will be limited to a certain amount. We also offer guaranteed stop-loss orders (GSLOs), which are an effective way of safe-guarding your trades against slippage or gapping during periods of high volatility. A GSLO guarantees to close your trade at the price you specified, for a premium. We refund this charge in the event that your GSLO is not triggered on your trade. Find out more about our range of order types and execution.

What causes slippage?

One common reason for slippage is when the price gaps in response to a major news event. For example, you may set a stop loss at $10.00 on XYZ company CFDs when they are trading at $10.50. If XYZ company announces a profit downgrade and the price falls to $9.50 before trading again, your stop-loss order will be triggered because the price had fallen below $10.00. It then becomes a market order and is sold at the next available price. If the first price at which your volume can be executed is $9.48, your sell order would be executed at that price. In this case you would suffer slippage of 52 cents per CFD.

Slippage is particularly common in shares because markets close overnight. It is not at all uncommon for shares to open quite a bit higher or lower than the previous day's price, which makes it easy for slippage to occur on stop-loss orders. Slippage can also occur where there is not enough volume to fill your stop order at the nominated price.

Even though stop-loss orders can sometimes be subject to slippage, they are a vital risk-management tool. It is good risk-management practice to have a stop-loss order in place for every position you open. It is best to place the stop-loss order at the same time as you enter the trade.