There’s no let-up for traders – at least not yet. The last full working week before Christmas is likely to be the busiest of the month, packed with potentially market-moving central bank rate meetings and the release of US government shutdown-delayed economic data. We’ll also get the latest quarterly results from Micron Technology, whose stock is an important part of the artificial intelligence (AI) trade.

- Market News

- Weekly outlook

- The Week Ahead: US Data, Central Bank Decisions, Micron Earnings

The Week Ahead: US Data, Central Bank Decisions, Micron Earnings

- 1.US jobs, inflation

- 2.Central bank interest rate decisions

- 3.Micron Technology Q1 earnings

- 4.Market Calendar

US jobs, inflation

Tuesday 16 December (November jobs report)

Thursday 18 December (November CPI report)

Economists expect the jobs report, out on Tuesday, to show that the US economy added 35,000 non-farm payrolls in November, down from 119,000 in September. November’s delayed employment report will also include October's non-farm payrolls print (estimated to be around 55,000 jobs), but other October data points such as the unemployment reading will not be published as the longest government shutdown on record prevented the collection of household data on which the jobless rate is based. November’s jobless rate is expected to be unchanged from that of September at 4.4%.

On Thursday, the November inflation report is expected to show that consumer prices increased 3% year-on-year, the same pace of price growth as in September. The Bureau of Labor Statistics cancelled the October consumer price index (CPI) print, again because the shutdown prevented data collection. It remains unclear how the data gap might affect month-on-month and year-on-year comparisons in the future.

The market will be paying close attention to November’s jobs and CPI reports, both of which are likely to shape the Federal Reserve’s thinking ahead of its next rate-setting meeting on 27-28 January. The Fed has cut interest rates by 75 basis points since September, including the latest quarter-point cut on 10 December. If official figures show that inflation or job creation was stronger than expected in November, traders and investors may infer that the Fed made an error in cutting rates. In that scenario, gold could benefit.

This month, gold prices have stabilised above $4,200 a troy ounce. The yellow metal has also formed a bullish pattern, known as a flag, on the technical chart. A continuation of that pattern, supported by a rally above $4,300 early on Friday 12 December, may suggest that gold could reach $4,460 in the near term.

Gold CFDs, July 2025 - present

Sources: TradingView, Michael Kramer

Central bank interest rate decisions

Thursday 18 December (European Central Bank, Bank of England)

Friday 19 December (Bank of Japan)

The upcoming trio of central bank rate meetings could produce three different decisions. On Thursday, the European Central Bank is expected to leave interest rates unchanged, while the Bank of England is expected to cut rates by a quarter of a percentage point to stimulate some much-needed economic growth. Then on Friday, the Bank of Japan is widely expected to raise rates in a bid to contain inflation.

To a large extent markets have already priced theses decision in. More interesting, perhaps, is the recent speculation that the ECB could raise its 2026 growth forecast, implying that the central bank’s next move could be rate hike, possibly in late 2026. Market participants will therefore be scrutinising ECB policymakers’ comments for signals that the rate-cutting cycle is over and that rate hikes may be back on the agenda. This matters because such a policy shift could lead to a materially stronger euro in the not-too-distant future.

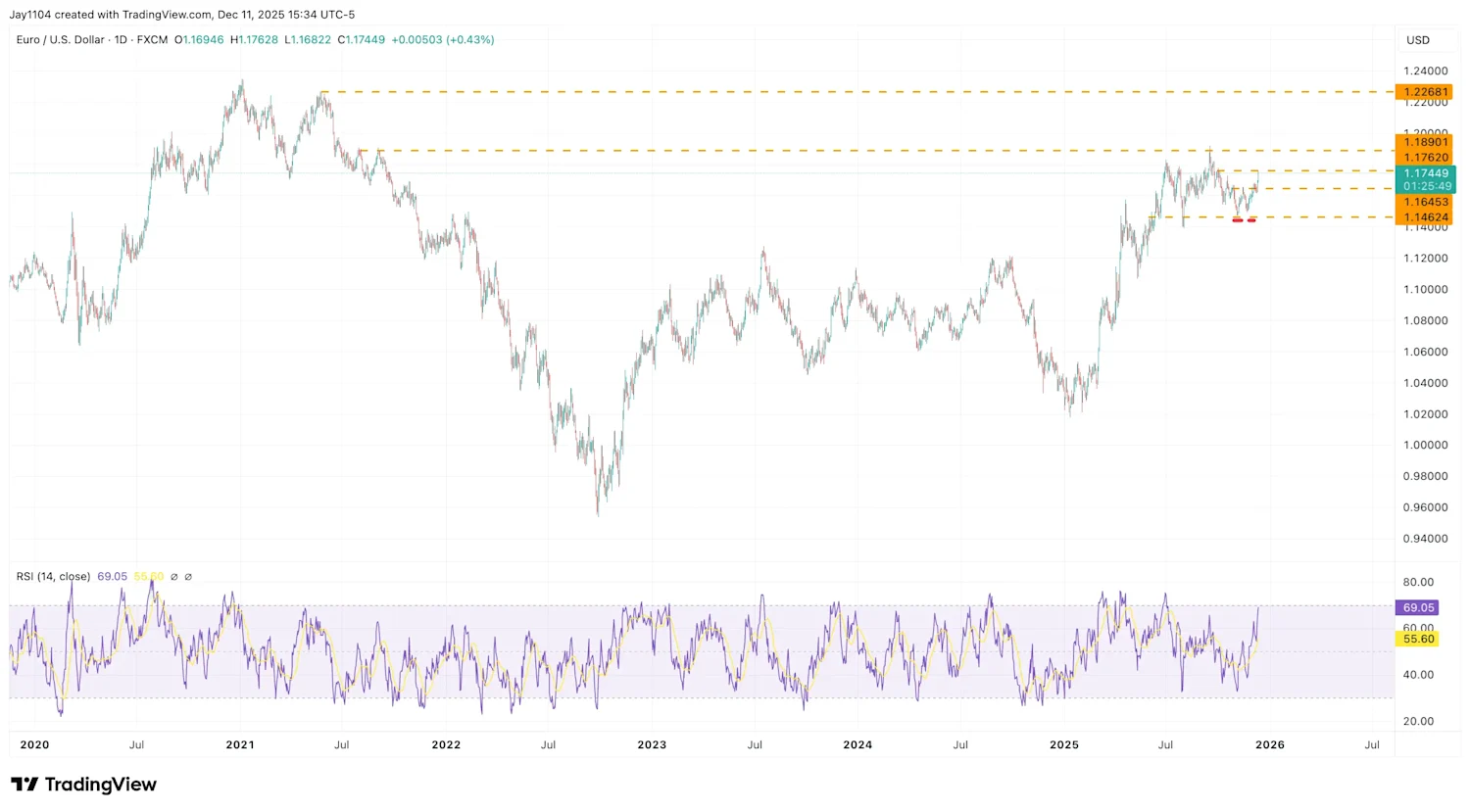

On Friday the euro climbed to $1.17 against the dollar, its highest level since early October. If EUR/USD breaks above resistance at $1.175 in the near term, it could climb towards the year-to-date high near $1.185. A sustained move above $1.185 might open a pathway for an advance towards $1.22, an area the currency pair last touched in 2021. Given the current setup, a hawkish, pro-rate hike message from the ECB could support gains for EUR/USD heading into 2026.

EUR/USD, January 2020 - present

Sources: TradingView, Michael Kramer

Micron Technology Q1 earnings

Wednesday 17 December

Analysts expect Micron Technology to report that its first-quarter earnings more than doubled to $3.91 a share as revenue grew an estimated 46.8% to $12.8bn. Gross profit margin is forecast to have risen to 51.4%, up from 39.5% a year ago. Looking ahead to Q2, analysts see earnings again doubling year-on-year, reaching $4.59 a share, with revenue projected to grow 72.7% to $13.9bn and gross profit margin expected to increase to 53.5%, up from 37.9% a year earlier.

The memory and data storage company’s shares, a component of the Nasdaq, have soared almost 200% this year to $258.46, as of Thursday’s close. But amid investor concerns over AI spending, the stock could make sharp moves in the coming days. Options markets imply traders are expecting the Micron share price to move by an average of 9% in either direction after the Q1 earnings announcement.

Options positioning in the stock is bullish, notably for options expiring on 19 December. Implied volatility for these options is likely to be high. This carries the risk that, once the company reports its results, call premiums may experience sharp declines, which could cause the shares to fall post-results as hedges unwind. That’s unless the results deliver a significant upside surprise.

The technical chart indicates that, despite the stock’s roughly 25% gain since 20 November, the relative strength index (RSI) – a measure of momentum – is trending lower. This is known as a bearish divergence. If the Q1 results are in line with expectations and the stock drops below support at $250, it could sink towards $225 – the next area of support – or even towards $210 in the medium term.

Micron share price, October 2025 - present

Sources: TradingView, Michael Kramer

Market Calendar

Tuesday 16 December

Country | Event | Impact |

US | NY Fed Empire State Survey – Manufacturing Index | 🟠🟠 |

US | Housing Index – NAHB – Housing Market Index | 🟠🟠 |

US | US Federal Reserve – New York Fed President Williams Speech | 🟠🟠 |

Wednesday 17 December

Country | Event | Impact |

US | Employment – Average Earnings – MoM | 🟠🟠 |

US | Employment – Average Earnings – YoY | 🟠🟠 |

US | Employment – Non Farm Payrolls | 🔴🔴🔴 |

US | Employment – Overall Workweek Hours | 🟠🟠 |

US | Employment – Private Payroll | 🟠🟠 |

US | Employment – Unemployment Rate | 🔴🔴🔴 |

US | Housing Starts – Building Permits – Number | 🟠🟠 |

US | Housing Starts – Housing Starts – Number – MoM | 🔴🔴🔴 |

US | Retail Sales – Retail Sales – Control Group | 🟠🟠 |

US | Retail Sales – Retail Sales – MoM | 🔴🔴🔴 |

US | Retail Sales – Retail Sales Ex Auto – MoM | 🟠🟠 |

US | Purchasing Managers Index – Flash Estimate – PMI – Markit – Manufacturing | 🟠🟠 |

US | Business Inventories – Total Inventories – MoM | 🟠🟠 |

NZ | Balance of Payments – 12 Months | 🟠🟠 |

NZ | Balance of Payments – Current Account Percentage of GDP (Not Adjusted) | 🟠🟠 |

NZ | Balance of Payments – Quarter | 🟠🟠 |

US | US Federal Reserve – New York Fed President Williams Speech | 🟠🟠 |

Thursday 18 December

Country | Event | Impact |

US | EIA/DOE Weekly Petroleum Status Report – Crude Oil Stocks (Net Change) | 🔴🔴🔴 |

US | US Federal Reserve – Atlanta Fed President Bostic Speech | 🟠🟠 |

NZ | Gross Domestic Product – GDP – 12 Months Average | 🟠🟠 |

NZ | Gross Domestic Product – GDP – Annualised | 🟠🟠 |

NZ | Gross Domestic Product – GDP – Expenditure – QoQ | 🔴🔴🔴 |

NZ | Gross Domestic Product – GDP – Production – QoQ | 🔴🔴🔴 |

Friday 19 December

Country | Event | Impact |

US | Business Outlook Survey – Philadelphia Fed – Business Activity | 🟠🟠 |

US | Consumer Price Index – CPI (Not Adjusted) | 🔴🔴🔴 |

US | Consumer Price Index – CPI – MoM (Seasonally Adjusted) | 🔴🔴🔴 |

US | Consumer Price Index – CPI – YoY (Not Adjusted) | 🔴🔴🔴 |

US | Consumer Price Index – Core CPI (Seasonally Adjusted) | 🔴🔴🔴 |

US | Consumer Price Index – Core CPI – MoM (Seasonally Adjusted) | 🔴🔴🔴 |

US | Consumer Price Index – Core CPI – YoY (Not Adjusted) | 🔴🔴🔴 |

US | Employment – Continuing Unemployment Claims | 🟠🟠 |

US | Employment – Unemployment Claims – WoW | 🔴🔴🔴 |

US | EIA/DOE Weekly Natural Gas Storage Report – Total Working Gas in Storage (Net Change) | 🟠🟠 |

NZ | Trade Balance – Exports | 🟠🟠 |

NZ | Trade Balance – Imports | 🟠🟠 |

NZ | Trade Balance – Trade Balance – MoM | 🟠🟠 |

NZ | Trade Balance – Trade Balance – YoY | 🟠🟠 |

Disclaimer: This article provides general information only. It has been prepared without taking account of your objectives, financial situation or needs. It is not to be construed as a solicitation or an offer to buy or sell any financial instruments, or as a recommendation and/or investment advice. It does not intend to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any financial instruments. You should consider your objectives, financial situation and needs before acting on the information in this article. CMC Markets believes that the information in this article is correct, and any opinions and conclusions are reasonably held or made on information available at the time of its compilation, but no representation or warranty is made as to the accuracy, reliability or completeness of any statements made in this article. CMC Markets is under no obligation to, and does not, update or keep current the information contained in this article. Neither CMC Markets nor any of its affiliates or subsidiaries accepts liability for loss or damage arising out of the use of all or any part of this article. Any opinions or conclusions set forth in this article are subject to change without notice and may differ or be contrary to the opinions or conclusions expressed by any other members of CMC Markets.