The US government remains shut down as of 17 October, meaning that economic data releases are still on hold. However, the Bureau of Labour Statistics is scheduled to release the consumer price index report on Friday (24 October). Meanwhile US earnings season continues, with many investors keeping a close eye on Tesla’s latest earnings, and analysts' guidance. UK banks, namely Barclays, Lloyds and NatWest, also release quarterly updates this week.

- Market News

- Weekly outlook

- The Week Ahead: UK and US CPI, Tesla results

The Week Ahead: UK and US CPI, Tesla results

- 1.UK consumer price index

- 2.Tesla Q3 earnings

- 3.US consumer price index

- 4.Economic and company events calendar

UK consumer price index

Wednesday 22 October

Since bottoming in October 2024, inflation rates have been rising steadily, from a low of 1.7% to 3.8% year-on-year in September 2025. This persistent rise in inflation hasn’t prevented the Bank of England from cutting interest rates, and based on market expectations, the rate-cutting cycle isn’t over yet.

If the inflation trend continues at the current pace, it seems likely that further rate cuts from the Bank of England will be harder for bond market investors to stomach, especially when coupled with the fiscal strains that have recently taken centre stage. While one might assume that a steeper yield curve would be bullish for the pound, the opposite is likely to be true.

For now, GBP/USD appears bullish, with a potential falling wedge pattern, and the relative strength index seems to be breaking out, suggesting it may rise first, potentially even ahead of Wednesday’s CPI report.

GBP/USD chart, May-16 October 2025

Sources: TradingView, Michael Kramer

Tesla Q3 earnings

Wednesday 22 October

The NASDAQ-listed company will report earnings after the close of trading on Wednesday. Analysts forecast revenue growth of 3.8% to $26.1bn, while earnings are expected to decline by 26.3% to $0.53 per share, with gross margins slipping to 17.4% from 19.9% a year ago. Total automotive revenue is projected to fall to $19.5bn.

The company doesn’t provide formal guidance, but analysts expect Q4 revenue to decline by 1.3% year-on-year to $25.4bn, and earnings to drop by 35.5% to $0.47 per share, with gross margins of 17.2%. The stock is expected to rise or fall by around 7.4% following the earnings release.

Given the sharp run-up in the stock, options positioning is highly bullish, and implied volatility levels are likely to remain well above 100% for the options expiry on 24 October. This suggests that once the company reports, implied volatility may fall sharply, leading to a decline in call premiums and potentially creating additional stock for sale.

The chart appears to show a topping, diamond-like pattern, suggesting that if the stock falls below support at $410, it could drop towards approximately $370, or even lower to the next major support level at $350. Given the bullish positioning, a very strong outlook or significantly better-than-expected results are likely to be needed to propel the stock higher, towards resistance at $470.

Tesla share price, May-16 October 2025

Sources: TradingView, Michael Kramer

US consumer price index

Friday 24 October

Inflation is expected to deliver a hot reading, with headline CPI forecast to rise by 0.4% month-on-month, the same as in August, and increase by 3.1% year-on-year, up from 2.9%. Core CPI is expected to remain unchanged in September, rising by 0.3% month-on-month and 3.1% year-on-year.

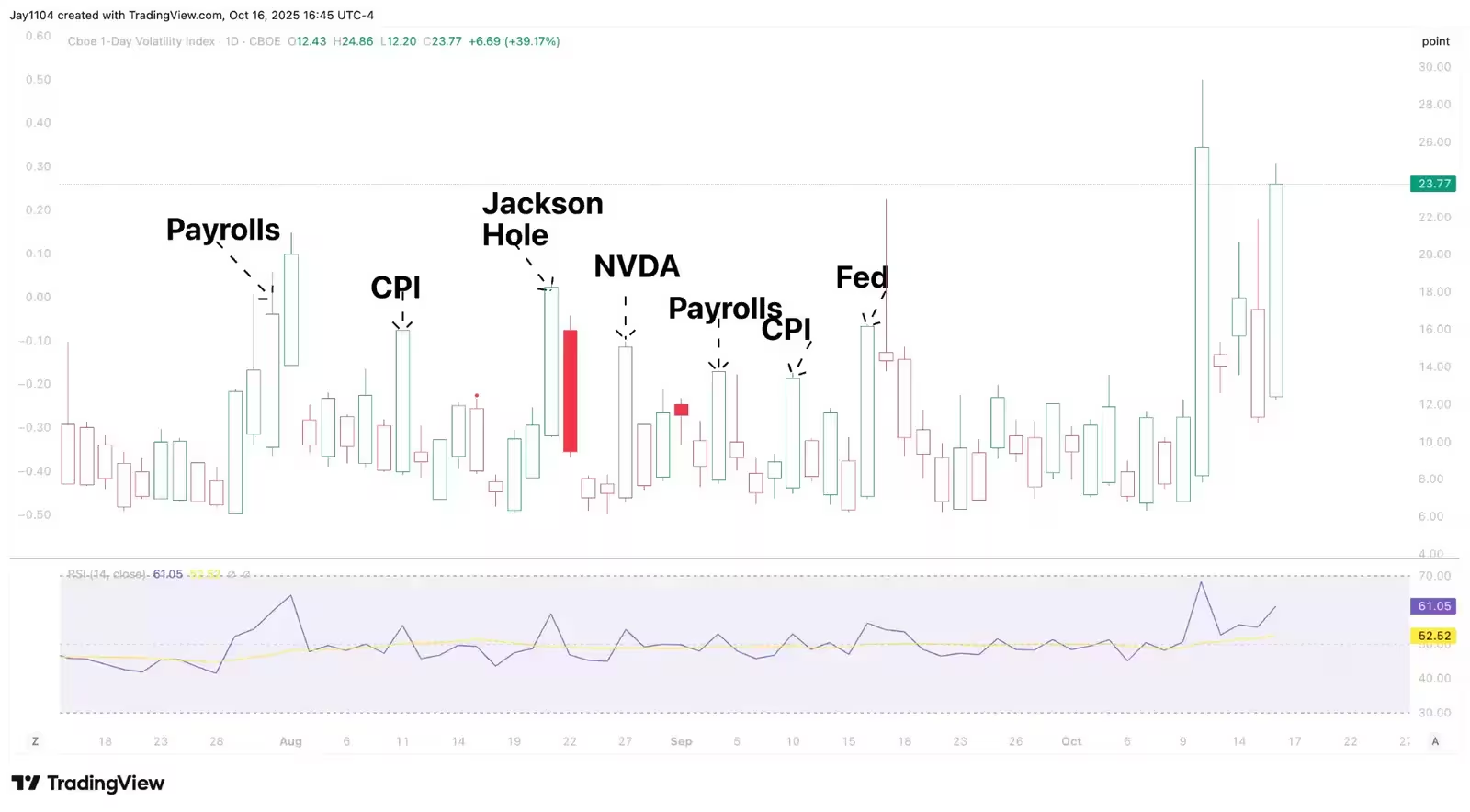

Implied volatility is likely to be elevated heading into the CPI release, similar to what has been seen before previous reports, particularly given the recent lack of economic data. Generally, when the VIX 1-Day rises sharply ahead of key economic data and the figures come in as expected or better, implied volatility tends to fall rapidly, providing a short-term boost to stock indices. This suggests that if the VIX 1-Day remains elevated going into the CPI report on Friday, there is a strong possibility that the stock market could rally – unless the data comes in significantly worse than expected.

Cboe 1-Day Volatility Index, 18 August-16 October 2025

Sources: TradingView, Michael Kramer

Economic and company events calendar

Major upcoming economic announcements and scheduled US and UK company reports include:

Monday 20 October

China: GDP (Q3)

UK: Rightmove house price index (Oct)

Results: WR Berkley (Q3)

Tuesday 21 October

Canada: CPI (Sep)

UK: Public sector net borrowing (Sep)

Results: Coca-Cola (Q3), Netflix (Q3), Phillip Morris International (Q3), RTX (Q3), Texas Instruments (Q3)

Wednesday 22 October

UK: CPI (Sep), producer price index (Sep), retail price index (Sep)

Results: AT&T (Q3), Barclays (Q3), GE Vernova (Q3), International Business Machines (Q3), Lam Research (Q1), Sofcat (FY), Tesla (Q3), Thermo Fisher Scientific (Q3)

Thursday 23 October

Australia: Manufacturing PMI (Oct); services PMI (Oct)

Eurozone: Consumer confidence (Oct)

US: Existing home sales (Sep); new home sales (Sep)

Results: Blackstone (Q3), Intel (Q3), Lloyds Banking Group (Q3), T-Mobile (Q3)

Friday 24 October

Eurozone: Manufacturing PMI (Oct); services PMI (Oct)

UK: Consumer confidence (Oct); retail sales (Sep); manufacturing PMI (Oct); services PMI (Oct)

US: Consumer price index (Sep); manufacturing PMI (Oct); services PMI (Oct); Michigan consumer sentiment index (Oct)

Results: NatWest Group (Q3), Procter & Gamble (Q1)

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.

Disclaimer: This article provides general information only. It has been prepared without taking account of your objectives, financial situation or needs. It is not to be construed as a solicitation or an offer to buy or sell any financial instruments, or as a recommendation and/or investment advice. It does not intend to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any financial instruments. You should consider your objectives, financial situation and needs before acting on the information in this article. CMC Markets believes that the information in this article is correct, and any opinions and conclusions are reasonably held or made on information available at the time of its compilation, but no representation or warranty is made as to the accuracy, reliability or completeness of any statements made in this article. CMC Markets is under no obligation to, and does not, update or keep current the information contained in this article. Neither CMC Markets nor any of its affiliates or subsidiaries accepts liability for loss or damage arising out of the use of all or any part of this article. Any opinions or conclusions set forth in this article are subject to change without notice and may differ or be contrary to the opinions or conclusions expressed by any other members of CMC Markets.