Trade on over 40 government bond and interest-rate instruments with leverage on our award-winning CMC Next Generation platform, with tight spreads and lightning-fast execution.

More than a bonds trading platform

- Over 40 global rates & bonds

Trade CFDs on interest rates and government debt obligations, such as gilts, bonds, bunds and treasury notes.

Trade CFDs on interest rates and government debt obligations, such as gilts, bonds, bunds and treasury notes. - Minimise slippageWith fully automated, lightning-fast execution in 0.040 seconds*

- No partial fillsGet the trade you want – we don't reject or partially fill trades based on size.

- Local customer supportOur support team is available whenever the markets are open.

*0.040 seconds CFD median trade execution time on CMC Markets' web and mobile platforms, 1 April 2023-31 March 2024.

40+ rates and bonds at your fingertips

Get exposure to interest rates and government debt obligations, with spreads from as low as 1 point.

Most popular treasuries

Pricing is indicative. Past performance is not a reliable indicator of future results. Client sentiment is provided by CMC Markets for general information only, is historical in nature and is not intended to provide any form of trading or investment advice - it must not form the basis of your trading or investment decisions. Number of instruments available on MT4 may vary.

Other popular treasuries

Product |

|---|

- |

- |

- |

- |

Min spread | Buy | Day | Week | Trend |

|---|---|---|---|---|

- | - | -% | -% | |

- | - | -% | -% | |

- | - | -% | -% | |

- | - | -% | -% |

Our bonds trading costs

Whatever you trade, costs matter. We’re committed to keeping our costs as competitive and transparent as possible, whether you trade on the US T-Note, UK Gilt or Eurodollar.

Product |

|---|

- |

- |

- |

- |

Min spread | Holding cost (buy) | Holding cost (sell) | Margin rate |

|---|---|---|---|

- | -% | -% | -% |

- | -% | -% | -% |

- | -% | -% | -% |

- | -% | -% | -% |

We offer a range of advanced order types, including trailing and guaranteed stop losses, partial closure, market orders and boundary orders on every trade, so you have the flexibility to trade your way.

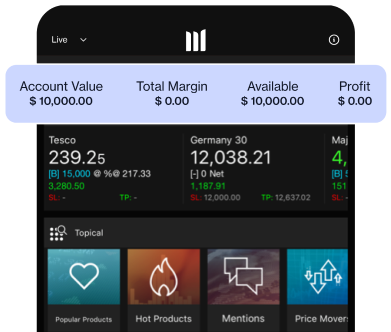

Our client sentiment tool shows you where the market is bullish and where it’s bearish, based on real-time trades. Identify trends based on how that sentiment changes over time across our whole client base or just our top traders.

Learn the art of CFD trading

- What is CFD trading and how does it work?Learn More

A contract for difference is a financial derivative product that pays the difference in settlement price between the opening and closing of a trade. CFD trading enables you to speculate on the rising or falling prices of fast-moving global financial markets (or instruments) such as shares, indices, commodities, currencies and treasuries.

- NYSE vs NASDAQ: What's the difference?Learn More

Take a look at the world’s largest listed companies: Amazon, Berkshire Hathaway, JP Morgan Chase, Microsoft. They all rank among the largest companies in the world, and they are all listed in the US. With a combined value of more than $49 trillion, US-based stocks account for around 70% of the global market.

- What is forex (FX) trading?Learn More

FX trading, also known as foreign exchange trading or forex trading is the exchange of different currencies on a decentralised global market. It's one of the largest and most liquid financial markets in the world. Forex trading involves the simultaneous buying and selling of the world's currencies on this market.

Join over 1 million global traders and investors

Winner 2023

#1 web platform

ForexBrokers

Winner 2024

Best Mobile Trading Platform

ADVFN International Financial Awards 2024

Winner 2025

Most Currency Pairs

ForexBrokers

Winner 2025

#1 Commissions & Fees

ForexBrokers

New to rates and bonds trading?

Frequently asked questions

One of the advantages of trading CFDs is that you only need to deposit a percentage of the full value of your position to open a trade, known as trading on leverage. Remember, trading on leverage can also amplify losses, so it’s important to manage your risk.

A bond is a fixed-income instrument, or debt security, and represents a long-term lending agreement between a borrower and lender – effectively an ‘IOU’. The bond issuer is often a corporation or a government, and the funds are used to finance a project or operation.

There are a number of costs to consider when CFD trading, including holding costs (for trades held overnight which is essentially a fee for the funds you borrow to cover the leveraged portion of the trade), rollover costs (for expiring forward positions) and guaranteed stop-loss order charges (if you use this risk-management tool).

Find out more about our costs