Following a disappointing first-half to 2019 with trade war uncertainty continuing to disrupt markets, US chipmakers’ shares have rallied after JPMorgan took a decidedly bullish stance on semiconductor demand.

JPMorgan [JPM] analysts said the outlook for demand in the sector had brightened in response to the US and China agreeing to re-open trade talks in October.

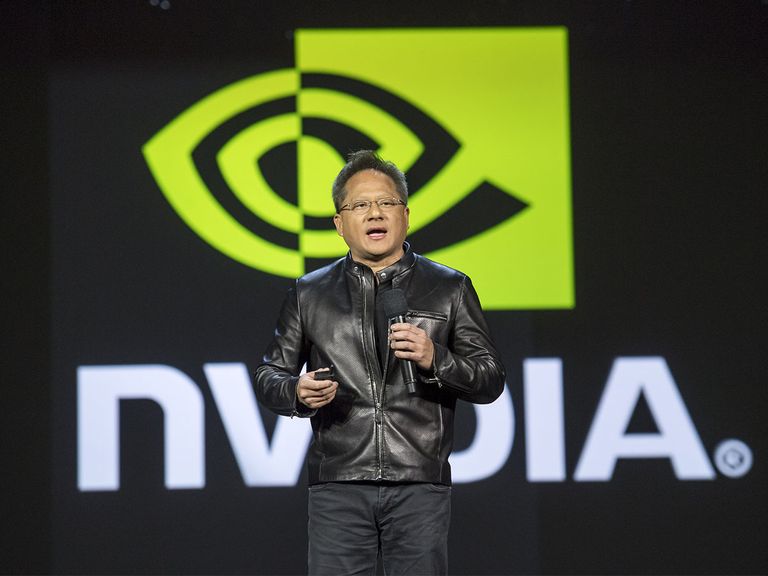

Analysts at the bank, according to the FT, said that they “remain confident” in a second-half pick-up in overall demand. JPMorgan’s current large cap ‘top picks’ include Nvidia [NVDA] and Micron [MU], as well as Marvell Technology Group [MRVL], Texas Instruments [TXN] and Intel [INTC]. In a note to clients, JPMorgan analysts said: “Semi industry revenues (ex-memory) are tracking down 6% (Y/Y) - down from the industry 2018 exit rate of +8% Y/Y. However, we expect industry fundamentals to improve as we move through the remainder of the year.

“Assuming no further major negative developments on the trade front post the tariff increases we expect semiconductor stocks to continue to outperform for the remainder of the year.”

The industry is preparing for a strong product launch season such as Apple’s [AAPL] iPhone 11, as well as PCs, smartphones and gaming spends from other tech giants, which could further bolster the sector as market leaders look to strengthen their positions.

So, with trade war tensions easing, equity investors have turned their attention back to technology, pouring new life into the market.

“Assuming no further major negative developments on the trade front post the tariff increases we expect semiconductor stocks to continue to outperform for the remainder of the year” - JPMorgan analysts

But is it good news across the board for the semiconductor sector?

The 5 September saw Nvidia and Intel recording stronger performances at market close, falling in line with JPMorgan’s assurances that the market will see a strong end to the year. Surprisingly, Advanced Micro Devices [AMD] shares fell below expectations for the day’s trading, closing on $31.50.

AMD’s performance is again looking comparatively lacklustre over a 52-week period, with highs of $35.55 per share, lows of $16.03 per share and earnings per share coming in at $0.17, according to NASDAQ. With a one-year target of $36.50, AMD could still hit its target if the second-half of the year for the global economy remains steady.

In comparison, Nvidia is seeing $4.43 earnings per share and closed 5 September trading $168.76, although it has yet to reach the heights of 2018, when it closed on $286.48 per share on 10 February. Nvidia has seen an equally wide spectrum in average share price over the 52-week period (highs of $292.76 and lows of $124.46), which shows how macroeconomics are set to continue to impact the stability of sector performance.

| Nvidia | AMD | Micron | |

| Market cap | $104.834bn | $34.375bn | $52.206bn |

| PE ratio (TTM) | 41.36 | 170.00 | 5.74 |

| EPS (TTM) | 4.43 | 0.18 | 8.65 |

| Quarterly Revenue Growth (YoY) | -17.40% | -12.80% | -38.60% |

Nvidia, AMD & Micron share price vitals, Yahoo Finance, 9 September 2019

Long-term growth is in the green

Despite sector performance tying itself to the stability of the global economy, the long-term focus appears to be far more positive as semiconductors have seen strong growth in demand over a five-year period.

Nonetheless, according to NASDAQ, analysts’ forecasts for average earnings per share for each of these companies over the next five years has proven to be more varied. AMD leads the way by a healthy margin with an estimated 23.61% average annual rate growth in earnings. Qualcomm [QCOM] is forecasted to grow by 12.77% year-on-year, Nvidia by 9.56%, INTC by 7.5% and Micron forecasted to flatline on earnings per share with an average annualised rate of 0%.

What if…?

With the level of friction between the two global superpowers ongoing, the possibility of trade war talks ending without a resolution is a possibility investors cannot ignore.

There is the distinct possibility that sectors, such as semiconductors, shaken in the past by changeable macroeconomic circumstances could see their stock price falling in the short-term. Nonetheless, the long-term focus looks much brighter.