Walmart [WMT] has become the world’s biggest retailer since it was founded in 1962 and became public in 1971.

If you had bought $1000 of shares in Walmart on 2 January 1980, when the share price was $0.05 after dividends and stock splits, your investment would today be worth almost $2 million.

While traditionally known for its big-box hyper markets and discount stores, it’s been the company’s online sales that have recently been driving growth.

What happened with Walmart’s earnings this quarter?

Thursday’s robust Q3 earnings announcement saw online sales rise 43% compared to the same period last year. The company is now firmly on track to meet its goal of 40% growth in ecommerce by the end of the financial year.

Elsewhere, same-store sales are up 3.4% in the US compared to 3.1% last quarter. Total revenue came in at $124.89 billion, while $1.08 adjusted earnings per share beat market expectations. These results follow a blistering Q2 which saw revenue of $128 billion, up 3.6% from the same period last year.

| Revenue percentage change, Q3 YoY | +1.4% |

| Performance YTD | 0.7% |

| Market cap | $286.1bn |

| PE Ratio (TTM) | 55.89 |

Walmart stock vitals, Yahoo finance, as at 19 November 2018

The retailer is clearly confident in its future, raising full-year guidance for earnings per share to between $4.75 to $4.85.

"We have momentum in the business as we execute our plan and benefit from a favourable economic environment in the US," CEO Doug McMillon said in a statement.

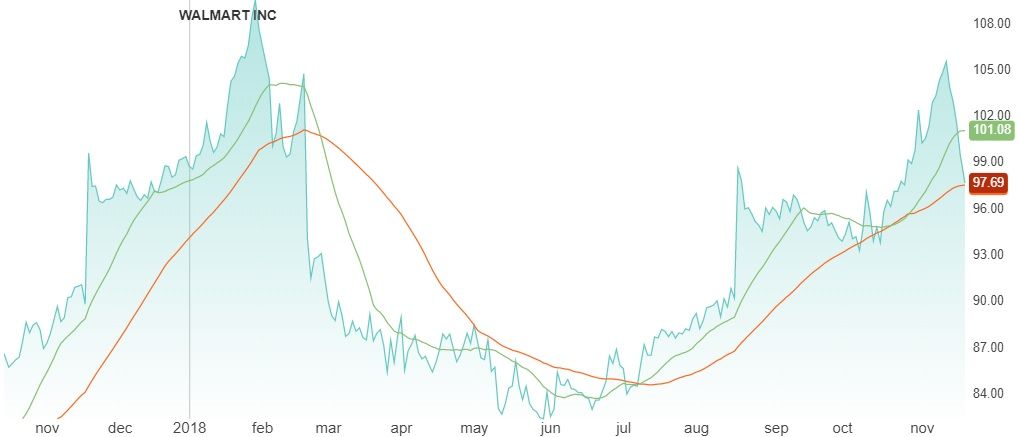

Walmart ended Thursday’s session down 2%. However, the share price is up 10% on the year, having touched a $109.55 high in January.

Walmart share price performance, NASDAQ interactive chart, as at 19 November 2018

How Walmart drove growth in online sales

Powering the impressive online sales has been the digitising of its 4,700 plus stores. Where this vast collection of stores was once seen as a burden, now it is considered a boon.

Since buying Jet.com in 2016 for $3 billion, Walmart has continued to gobble up other online businesses. The US shopping giant now offers free shipping, same-day delivery and other perks as it continues to take on Amazon’s turf.

Customers can now click-and-collect groceries from 2,100 stores, with 600 offering home delivery. That’s a serious head start on Amazon [AMZN] which offers grocery delivery from Whole Foods Market in 22 cities.

Walmart’s omnichannel approach has seen footfall to its stores grow by 2.2% this year, with extra cash pocketed from customers who pick up additional shopping when they collect online orders.

The next battleground will be Black Friday followed by Christmas. Walmart stumbled last holiday season with growth in digital sales slowing to 23%. This triggered a sharp 12.6% drop in the share price when Q4 results came out in February.

Investors will want to see what lessons Walmart has learnt. One hurdle is the company’s $35 minimum spend to qualify for free shipping. Rivals Amazon, Best Buy and Target don’t have one.

Where’s the opportunity?

UBS expect the $3 trillion global ecommerce market to grow by 10-20% annually over the next 10 years. This is being driven by the rise of smartphone adoption and increased customer confidence in online shopping.

Investors looking to invest in ecommerce might consider Walmart shares better value for money than its competition. The company’s price to earnings (P/E) ratio of 56.81 is relatively modest compared to Amazon’s hefty 127.66.

10-20%

Annual growth in the ecommerce market expected by UBS over the next ten years

According to eMarketer, Walmart is expected to overtake Apple to become the third-largest ecommerce retailer by sales, behind only eBay and Amazon. Walmart’s ability to challenge established ecommerce players could see a sustained increase in the share price.

This will need to be tempered against long-term strength in the US economy and the impact of US tariffs on China, where Walmart sources many of its goods.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy