Video games have been getting pricier — to produce at least — with increasingly advanced tech used and a larger amount of people needed. Thus, it is almost strange that the standard retail price has remained the same since 2005. With a $10 increase confirmed by Take-Two Interactive(NASDAQ: TTWO) and Sony’s (NYSE: SNE) Playstation for soon-to-be-released titles, the new price ceiling is about to be set at $70. This now begs the question: will this help or hinder the video game industry?

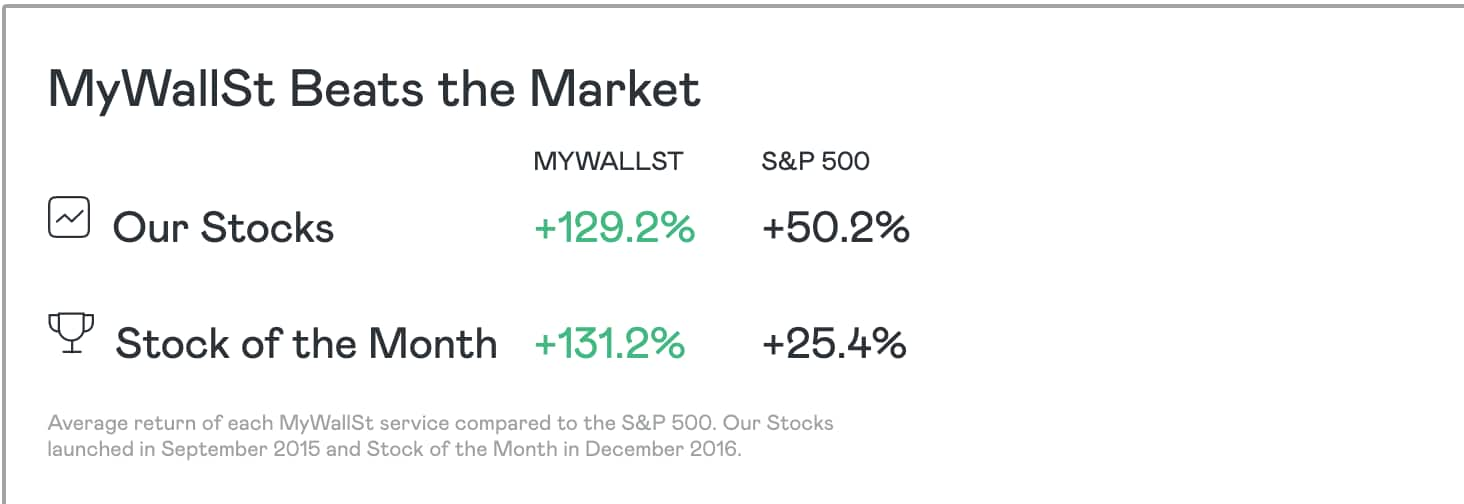

This article was originally published on MyWallSt — Investing Is for Everyone. We Show You How to Succeed.

New generation, new prices

With two new consoles launching in November, expectations are running high as they are predicted to change gaming for the better. Both the Xbox Series X and the PS5 will have improved storage and quicker loading times through the use of lightning-fast SSD hard drives. Indeed, progressing through a game’s story could become much more seamless, creating a better playing experience.

Both consoles will be delivering higher frame rates per second and better graphics whilst pushing gaming into a new era of ray-tracing — essentially making games look even more realistic and crisp. Nvidia in particular has encouraged this in recent years with its GeForce RTX graphics cards. Several titles, including ‘Call of Duty: Warzone’, ‘Minecraft’, and ‘Fortnite’, already have ray-tracing abilities, with many games expected to join them next year.

While this all sounds fantastic, for those behind the scenes it does come with extra costs. ‘The Last of Us Part II’ took six years to develop, double that of its predecessor, and is rumored to have cost over $100 million. Typically, a game can cost up to $80 million to make, whereas in 2005 that number was around $20 million. As the money needed to make video games continues to increase, it makes sense that the consumer price needs to rise too.

The players

Top gaming companies such as Take-Two Interactive, Activision Blizzard, Electronic Arts, etc. will most likely see another bump in their stocks over the next year. When the PS4 and Xbox One came out, game-publisher stocks rose an average of 41% over the following twelve months — Take-Two alone saw its share price rise from around $17 in November 2013 to $26 the following year. It has risen over 850% since the PS4 was first launched.

The gaming industry has long since left its seasonal sales-cycle roots behind and, particularly during the pandemic, game consoles are a common sight in living rooms across the world. Investors should look at this industry as similar to TV and film, with productions and titles continuously being produced while its growth seems more like that of a tech stock.

Investors should also take note that esports is a growing segment of this industry, one in which a large portion of revenue is derived from sponsorship, advertisement, and ticket sales. It is a market that is predicted to be worth $1.8 billion by 2022. This is a sector in which Take-Two, Activision, and Tencent play large roles and connect with those hard-to-reach, ‘pesky’ millennials.

So, how could this affect the industry?

So far, players have only experienced the rising cost of game development in the form of longer wait-times between game sequels and through the microtransactions many games have implemented — which are now banned in many countries. By upping the price of games, it will remove the need to squeeze players for money throughout the game itself. Many parents would be relieved to know that hundreds of microtransactions aren’t going to surprise them on a future bank statement.

Additionally, riskier, less mainstream games could now be given the green light as profit anxiety will be less pervasive in the industry. Currently, most games fall into one of three categories: shoot & loot, open-world, and annually released sports simulators. With faster loading times and the potential for better profit margins, the types of games produced could become more creatively diverse.

Overall, upping the standard price by $10 will not break the bank for those who were already willing to fork out for a new game. Instead, it will hopefully allow gaming to continue growing in new creative ways and thus give me an excuse to miss out on another family dinner.

MyWallSt makes it easy for you to pick winning stocks. Start your free trial with us today— it's the best investment you'll ever make.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy