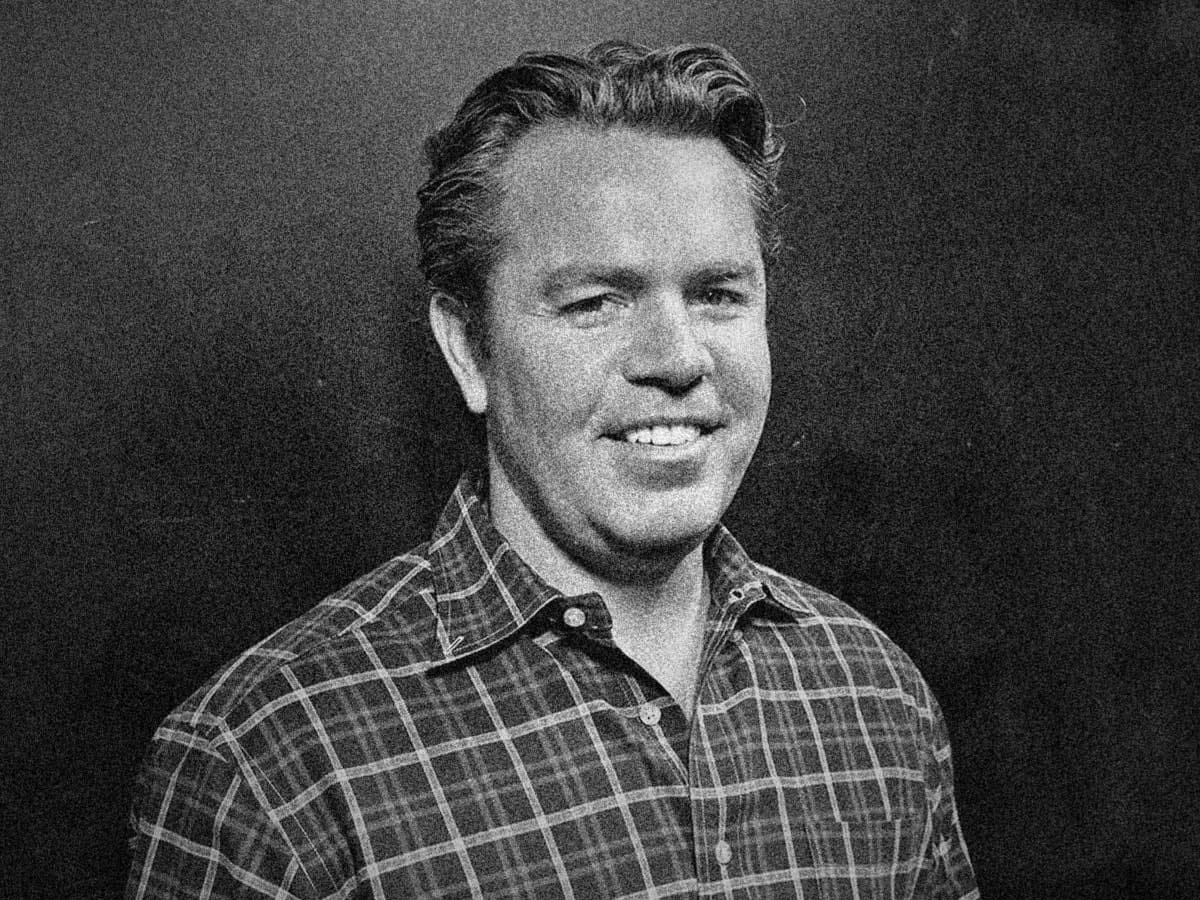

Keith McCullough is the founder and CEO of Hedgeye Risk Management, an investment research and online financial media company. He leads a team of 80, the stated aim of which is to dismantle the edifice of the old Wall Street.

The company uses proprietary models to assess markets and recommend positions, which includes a quad-based investing approach, risk ranges and even portfolio position and sizing.

Listen to the interview:

During his long tenure analysing the markets, McCullough has come to recognise an important feature that has governed his approach — namely that he should be paying attention to expensive stocks.

“I guess I was unaware when I was initially an analyst on Wall Street, and then trying to understand how to run a portfolio or a book at a hedge fund. I thought that you were supposed to do it the other way, which is to short expensive stocks and buy cheap stocks,” McCullough told Opto Sessions.

“Now that of course doesn't work,” he continued. “Maybe using the words ‘of course’ don't become readily apparent until you screw it up enough times. But what we've realised is that economic conditions perpetuate more expensive stocks getting more expensive and cheaper stocks getting cheaper.”

“But what we've realised is that economic conditions perpetuate more expensive stocks getting more expensive and cheaper stocks getting cheaper”

McCullough explained that during “quad four” of the economic cycle, for example, deflation — during which growth and inflation slow simultaneously — tended to force up the price of assets such as long-term bonds, gold and utilities.

“People are quite uncomfortable because most people didn't own those things so they're of course pooh-poohing them because they go up, up and up,” he said.

But nowadays, during “quad two”, McCullough notes that growth stocks are just getting pricier and pricier. “I say, look, if it wasn't getting more expensive, I suppose I wouldn't want to own it.”

McCullough continues along the same vein when considering the current argument for value stocks.

“I don't care if I'm long growth, value, growth at a reasonable price, you know, momentum, — I want to be long what’s going up and I think that that's something that takes you a while to get comfortable with,” McCullough considered.

“I don't care if I'm long growth, value, growth at a reasonable price, you know, momentum, — I want to be long what’s going up and I think that that's something that takes you a while to get comfortable with”

To hear more from McCullough, including how important fundamental data is to his strategy, listen to the full episode, and many more, on Opto Sessions.

Or for more ways to listen:

Listen to the full interview and explore our past episodes on Opto Sessions.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy