In this article Scott F. Klimo, portfolio manager of Saturna’s Sustainable ESG Equity HANzero™ UCITS ETF, discusses the likelihood of today’s highest capitalized companies remaining so by 2030.

With the new year now well behind us, we have all had time to read the many outlooks and predictions for equities for the year. We tend to avoid short-term market predictions. Instead, we find it better to take a longer-term view. So, what of the rest of the decade?

One dominant theme since the start of the pandemic has been the big getting bigger; the largest companies getting larger. While this trend dates back further in the 2010s, it appears to have been accelerated by the pandemic. At the start of 2022, Apple was flirting with $3 trillion market cap, reaching the line several times. This was closely trailed by Microsoft, which as of 7th January had a market cap of $2.36bn. Alphabet (Google’s parent company) and Amazon also appear among the top five largest companies. But the question is, can this trend continue? Where will they be in 2030?

Here, it is worth referring to history. Looking at the companies with the largest market cap in 2010, only two remain among the top 10 today: Apple and Microsoft. Going back even further to 2000, only Microsoft remains. It would appear that very few companies maintain their position at the top for more than a decade or two.

$3trillion

The landmark market cap Apple could reach in 2022

One notable example from history is Exxon. The oil giant appeared recurringly from 1980 through 2010. However, it now has dropped to around the 20th largest market cap in the US. Largely this reflects longer term changes with regards to energy, climate change and investor attitudes toward the environmental impact of the companies they own. Saudi Aramco has become the dominant listed energy producer, but fossil fuel demand can only go one way over the next decades based on the widespread commitment of major economies to achieving net-zero.

But what of the current top 10? In our view, it is not unreasonable to expect Microsoft to potentially maintain its position. The company is the dominant global provider of personal and business software, while it is also growing its cloud business and has the potential to be a key provider of augmented and mixed hardware and software. We also see network economies, current dominance, and the opportunity to extend into new areas providing a path forward for Alphabet, giving it the potential to maintain its top position.

Another contender for maintaining its dominant position in Apple. While Apple may not be a network in the traditional sense, it does have over one billion active users dedicated to its products. We think Apple’s unrivalled ability to integrate complex technology with a user-friendly customer experience positions it to extend into media content, augmented reality, the connected home, and, perhaps, EVs, all the while growing its profitable subscription revenue.

Less certain is Amazon’s position in the top 10. The company has failed to repeat its US strength overseas, potentially setting it up to fade. Meta (Facebook) is also potentially at risk of falling out of the top 10 by 2030. While the company features a dominant network, we believe it has demonstrated a talent for misadventure. It also strikes us as a service people use grudgingly. While competitors such as Google+ and other social networks failed to dislodge the dominance of Facebook, we don’t see Meta having such a durable advantage.

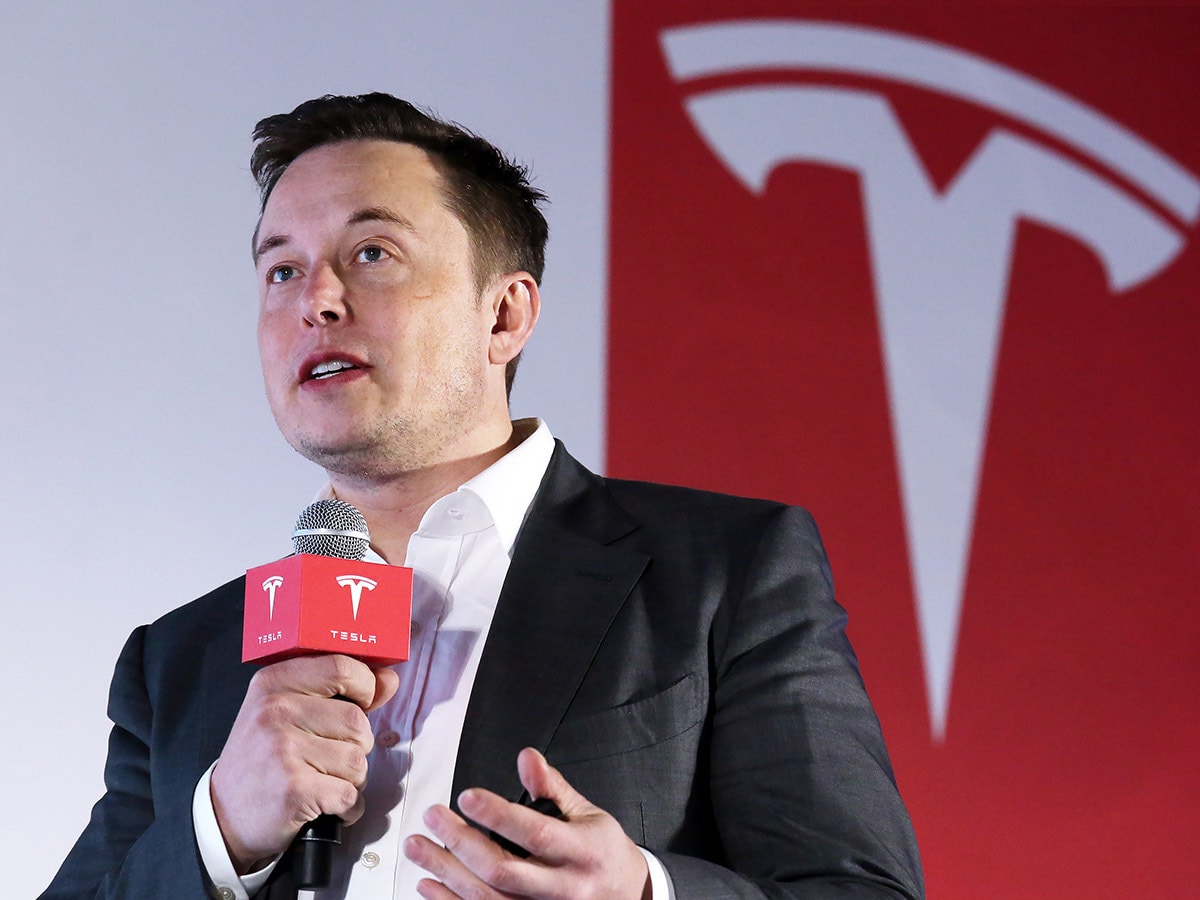

There are also question marks around Tesla’s place in the top 10. By 2030 almost every car company in the world will be producing e-vehicles making it hard to imagine Tesla maintaining its position. Nvidia carved out a strong business, but we do not view its position as unassailable given evolving markets and capable competitors.

Questions can also be raised about Taiwan Semiconductor. On one hand, semiconductors are foundational to the global economy and Taiwan Semiconductor dominates. But at the same time, Taiwan’s geopolitical vulnerabilities raise risks.

It’s also reasonable to assume a change of leadership at Berkshire Hathaway by 2030, partly given how reliant it is on Warren Buffett and Charlie Munger.

For investors, the key thing to keep in mind is that for any company that fades from dominance, another will take its place. Will the new giants be companies currently lurking at lower market capitalizations or something that doesn’t yet exist? Reviewing the list of the top 100 companies by market capitalization, few seem likely to advance in our view. We ascribe a higher probability of new companies rising to the top given the opportunities generated by the transition toward a carbon-free economy. Perhaps someone is tinkering with viable carbon capture. Battery technology could eliminate lithium and cobalt requirements. And what of fusion, which always stands a few years away? Success there and all bets are off. Our task is to identify these companies and hold them for the next couple of decades.

This article was written by HANetf and partners.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy