About a week after Silicon Valley Bank failed, the banking meltdown reached Europe. In a transaction swiftly arranged by regulators, Switzerland's largest bank UBS agreed to buy its old rival, Credit Suisse, for roughly $3.25bn on 19 March, after the latter was close to insolvency with a downturn in investor confidence. But will UBS manage to tame the beast, or will it weigh it down?

- UBS acquired troubled Credit Suisse on 19 March for about $3.25bn. UBS shares are up 22% since the deal as of 23 March.

- $17bn of Credit Suisse AT-1 bonds were written down, and investors are preparing to sue the Swiss government.

- UBS executives are optimistic the takeover will bolster the bank’s earnings per share by 2027 at the earliest, FT said.

- The combined business creates the second-largest private bank in the world, with $3.4tn of wealth management assets, closely following Morgan Stanley.

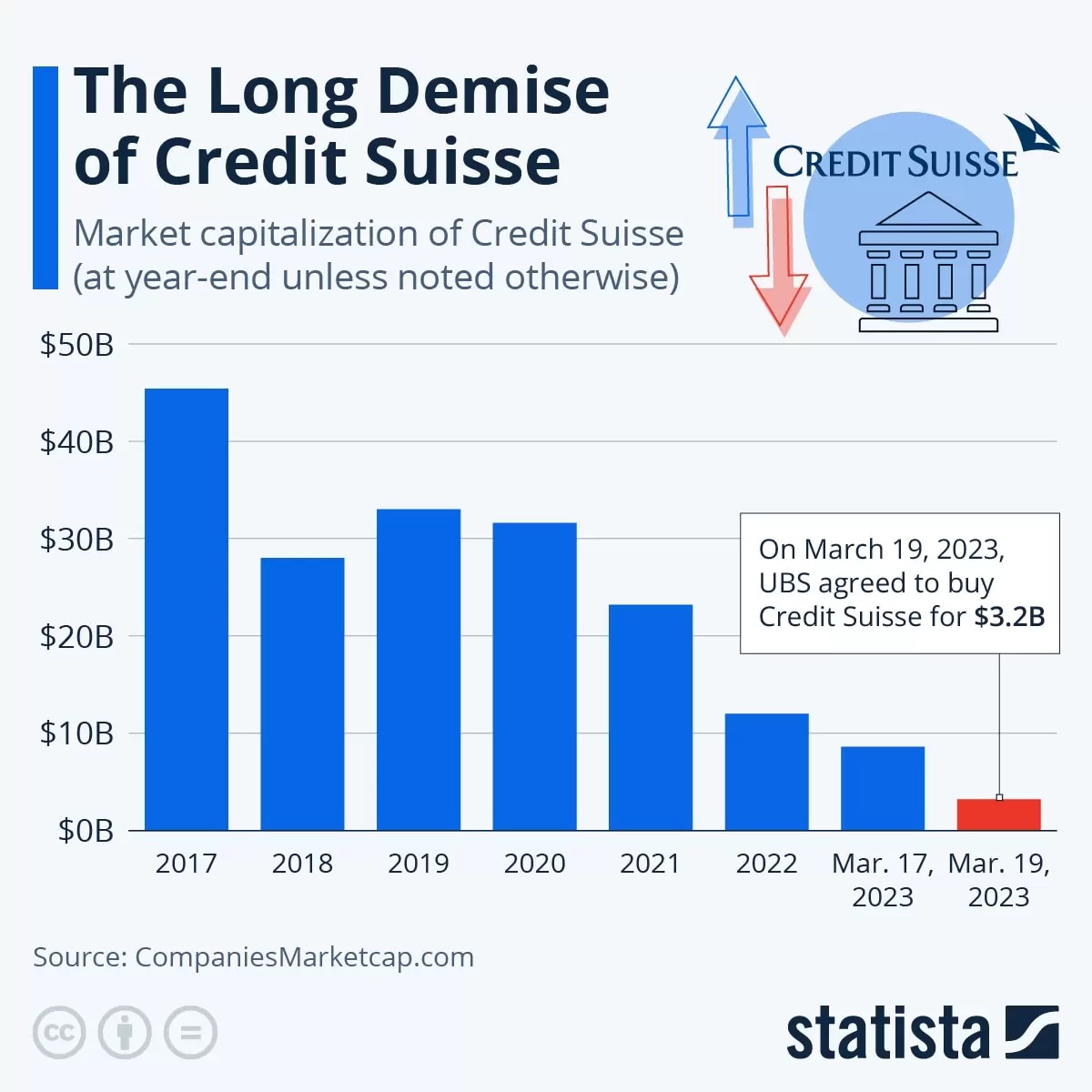

In what UBS [UBSG] chairman Colm Kelleher dubbed "an emergency rescue", UBS agreed to acquire the troubled Credit Suisse [CS] on 19 March for about $3.25bn, in a deal priced almost 60% below Credit Suisse's market capitalization as of market close on 17 March.

The UBS share price was down 14.6% on Monday morning, 20 March, a day after the deal was struck. The stock has since rebounded, jumping nearly 22% by market close on 23 March.

Meanwhile, Credit Suisse shares suffered a 60% drop in value on 20 March.

Credit Suisse’s demise

The troubled Swiss banking group raised major red flags for investors after admitting to “material weakness” in its earnings reported 14 March, delivering a staggering $7.9bn in losses for 2022 with a grim liquidity outlook in its worst performance since the 2008 crisis.

Credit Suisse acknowledged significant deposits and other assets under management withdrawals, which "have exacerbated and may continue to exacerbate" liquidity risks. Clients and stockholders alike were already alarmed by the volatile banking environment in the US, and the bank's stock price plummeted. After a steep nearly 70% drop in 2022, it fell an additional 25% by 17 March.

Credit Suisse ultimately suffered from a severe loss of confidence in the financial system, which turned the bank's most recent annual report into a huge warning sign for customers and investors, even though it was not directly related to the failure of Silicon Valley Bank [SVB] and Signature Bank [SNBY].

Credit Suisse has been on a downhill trend for a while, with its market valuation falling from $45 bn in 2017 to $12 bn by the end of 2022 due to its involvement in numerous scandals and disastrous deals in recent years, according to Statista.

Angry AT-1 bondholders

As part of the transaction, Swiss regulators wrote down the value of $17bn worth of Credit Suisse-issued AT-1 bonds to zero. While AT1s are a type of debt designed to absorb losses when institutions face difficulties, they are typically seen as ranking above equity on the balance sheet.

Angry investors are fighting back as US distressed debt investors and corporate litigators prepare to sue the Swiss government over its decision.

“If this is left to stand, how can you trust any debt security issued in Switzerland, or for that matter wider Europe, if governments can just change laws after the fact,” David Tepper, founder of Appaloosa Management, told FT. “Contracts are made to be honoured.”

Meanwhile, Saudi National Bank [1180.SR], Credit Suisse's largest shareholder, suffered about $1bn, or an 80% loss on its investment. The Riyadh-based bank held a 9.9% stake in the Swiss bank and invested approximately $1.5bn in November 2022. It refused to throw the struggling bank another lifeline before its UBS takeover.

What next for UBS?

The deal marks an end to the 166-year-old Credit Suisse and cements UBS's position as the largest Swiss bank and one of the biggest financial institutions in Europe.

UBS executives are optimistic that it will bolster the bank’s earnings per share by 2027 at the very least, FT said.

The consolidation creates the world’s fourth-largest bank by assets, with $5tn in assets under management, and the second-largest private bank in the world, with $3.4tn of wealth management assets, closely following Morgan Stanley, according to a Citigroup analyst.

However, analysts note the combined business could lose some clients who are customers of both banks and are looking to diversify their banking partners.

UBS is planning “tens of thousands” of layoffs in the wake of the takeover. Credit Suisse was already planning 9,000 layoffs to save itself, a number likely to be multiplied now, given the merger creates several overlaps.

On 19 March, the company stated it plans to slash the consolidated company’s annual cost base by over $8bn by 2027, nearly half of Credit Suisse’s expenses for 2022.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy