David Heinemeier Hansson, Co-owner and Chief Technology Officer (CTO) of 37signals, discusses why he thinks that the software industry is about to change. The software-as-a-service (SaaS) era, he says, served a purpose during its time, but buyers are increasingly frustrated at the amounts they now pay. 37signals is launching a new business, ONCE, to capture this shift.

“SaaS, with recurring revenue, has had an absolutely glorious run,” David Heinemeier Hansson, Co-owner and CTO of 37signals, tells Opto Sessions. “We built our business on it, and there are a ton of businesses that have grown really large on the back of that.”

SaaS is an approach to distributing cloud-hosted software applications over the internet by charging customers a recurring fee to access the service. These fees are typically charged monthly, and are measured by vendors as either monthly recurring revenue (MRR) or annual recurring revenue (ARR).

According to Harvard Business Review (HBR), such subscription businesses grew over 300% between 2012 and 2018, five times faster than the average rate of revenue increases for S&P 500 companies during that period.

SaaS’s rise was prompted, according to Hansson, by a realisation within the industry that “most people don’t want to run their own servers”, and wanted to swap, exchange and distribute data over the internet without using physical storage devices like disks. “There are a lot of good reasons for why SaaS took off,” he says.

The End of the SaaS Road?

Hansson’s expertise goes beyond the tech world — the serial entrepreneur, best-selling author and Danish programmer has also won stages in the 24 Hours of Le Mans endurance race. Like any good racing driver, Hansson is always thinking about what’s around the next corner. He believes that the current software sales model’s time has come. “I think we're over SaaSed,” he says.

Given the number of subscriptions many businesses pay for, “a lot of them will grumble and say, ‘I cannot believe that it costs me this much every month to own nothing’”.

According to HBR, the SaaS Capital Index peaked in 2021, before crashing months later. In the two years to 9 November 2021, the SPDR S&P Software & Services ETF [XSW] gained 93.3%. It has since fallen 29.8%, but remains 35.6% above its 11 November 2019 share price.

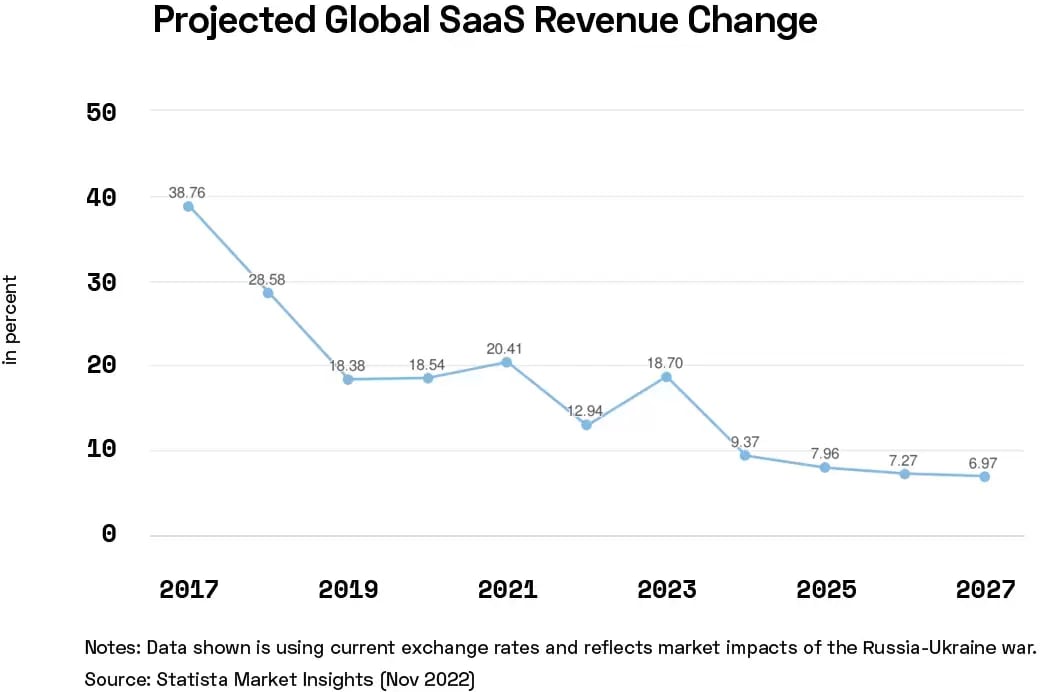

According to Statista, global SaaS revenues rose 38.8% in 2017. By 2022, that figure had fallen to 12.9%.

Statista forecasts that revenue growth in the sector will slow to 7% by 2027.

“I think there's a switch coming,” says Hansson. “It's not 2004 anymore. There are new ways of distributing software, and there are new ways of selling software.”

The Post-SaaS Era

“Perhaps some of those new ways of selling software will not include subscriptions,” posits Hansson.

37signals, he says, is actively positioning itself for a future in which SaaS — the model which saw it and the businesses it spawned flourish — no longer dominates. “I think that's going to be one of the frontiers in the next decade,” he says. “We’re trying to position ourselves to be ready for that.”

Earlier this month, 37signals launched Once, a new branch of its site. At the time of writing, Once is a single-page site with a manifesto setting out Hansson and his colleagues’ stance on the standard SaaS model in greater detail.

It outlines many of the downsides to SaaS that Hansson discusses with Opto Sessions, such as:

“Buying [SaaS] enters you into a perpetual landlord-tenant agreement. Every month you pay for essentially the same thing you had last month. And if you stop paying, the software stops working. Boom, you’re evicted.”

It promises a new set of products to overhaul this paradigm, that will operate on a set of principles including one-off payments in return for perpetual ownership; transparency over source code; and customers’ ability to host their software. These products, the site promises, will come to market towards the end of this year.

On Opto Sessions, Hansson says this manifesto is 37signals’ “big stick in the sand”.

“In the early 2000s, we were among the early pioneers leading the industry into the SaaS revolution,” reads the announcement. “Now, 20 years later, we intend to help lead the way out. The post–SaaS era is just around the corner.”

For more ways to listen:

Listen to the full interview and explore our past episodes on Opto Sessions. You can also check out all our episodes via our YouTube Channel.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy