ETFs: Can AI-powered funds outperform the market?

Inflation may be cooling and interest rates may be nearing a peak, but the spectre of recession still looms over the market. At a time like this, investors could do with any help they can get navigating choppy economic conditions.

Given the buzz around chatbots and large language models, retail investors might be tempted to turn to ChatGPT for advice. However, ask the chatbot to provide a bucket of stocks that can outperform the market and it’ll reply with generic advice on how to design an ETF and the need to diversify portfolios to minimise risk.

For now, it seems that AI and machine learning-powered stock-picking is likely to remain the realm of institutional investors. Even then, however, AI won’t necessarily help fund managers to deliver better returns than the market. But it can help to eliminate some of the errors that creep into human decision-making.

“We don’t have HR, it works weekends, it doesn’t take holidays. It can do this so much more quickly than a human could and it can go extremely deep,” Christina Bargeron, client portfolio manager at Voya, told the Financial Times last week. Voya developed the proprietary model behind the WisdomTree International AI Enhanced Value Fund [AIVI].

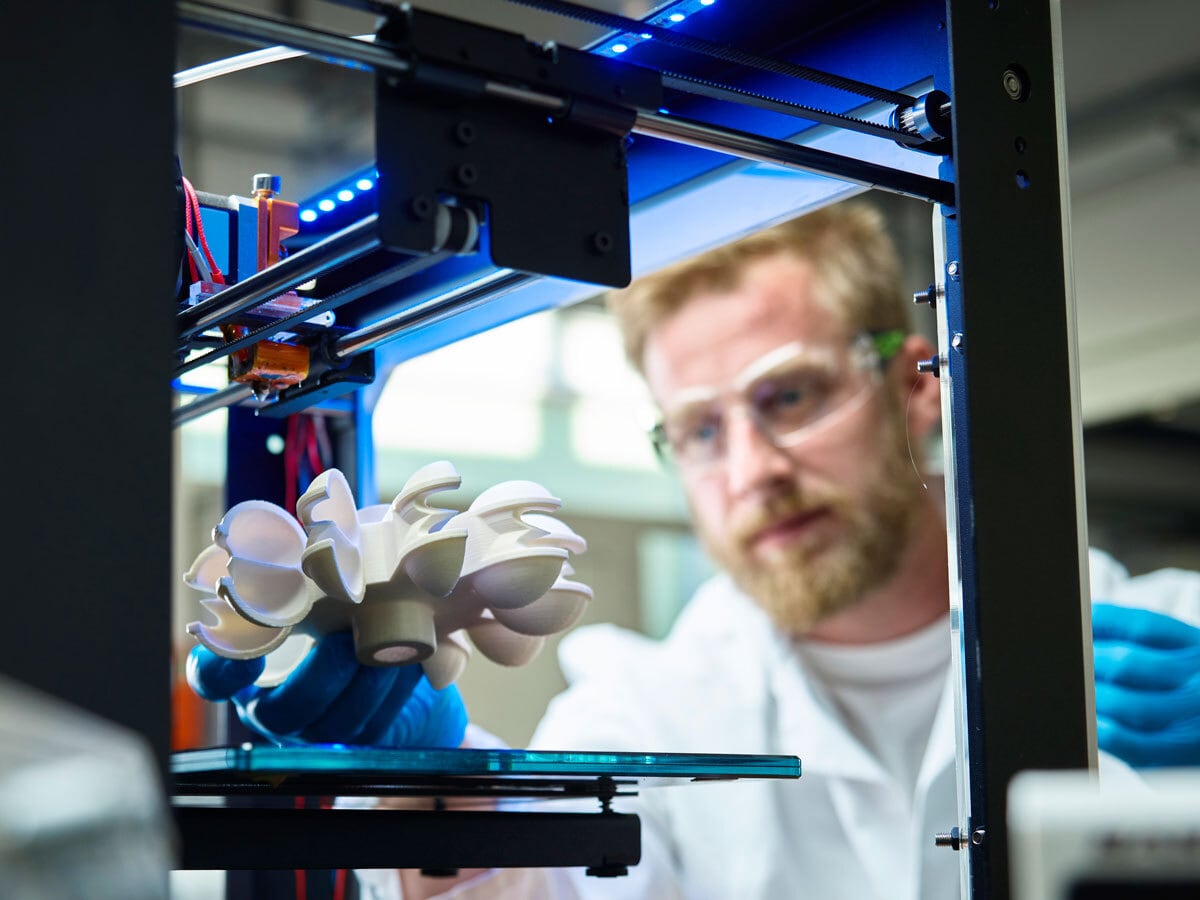

Space: Can 3D-printed satellites take off?

When SpaceX’s rideshare missions blast off over the next couple of years, the cargo will include 3D-printed satellites built by Sidus Space [SIDU] in partnership with additive manufacturing specialists Markforged [MKFG].

While satellites can be complex to design and build, Sidus Space has been able to use additive manufacturing to “fabricate components quickly and effectively” and “meet customer requirements in a cost-effective and timely manner”, according to a statement from the space engineering company.

Naturally, any 3D-printed materials and parts need to meet high standards in order to endure the heat and intense force of space travel. Scientists at NASA have developed a 3D-printed superalloy which has the potential “to dramatically improve the strength and toughness of components and parts used in aviation and space exploration”, Dr. Tim Smith of NASA’s Glenn Research Center said last week.

Exploring the use of additive manufacturing in space-related applications is far from novel — NASA was working on 3D-printed food systems a decade ago. But, as the space race accelerates and the world inches ever closer to one day being able to inhabit the moon, 3D printing and space is set to become a bigger theme of interest.

China: Can ecommerce drive big tech shares higher?

The big question following Alibaba’s [BABA] surprise split announced in March is whether it’ll help to unlock value for shareholders.

All of the China tech giant’s business, barring ecommerce, will be able to raise funds and explore IPO options separately. The ecommerce business — the only profitable division — will remain wholly-owned by Alibaba.

Rakesh Bordia, principal and portfolio manager at Pzena Investment Management, told Opto Sessions in April that the selloff of Chinese technology stocks in the past couple of years had pushed them into deep value territory. But now they’re poised for a rebound, with Alibaba set to lead the charge.

“We believe that [Alibaba] is one of the most amazing value stocks in the emerging markets universe right now,” said Bordia, adding that domestic ecommerce competitor JD.com [JD] is “just not there yet”.

While there are signs that China’s consumer spending is recovering, it hasn’t been strong enough to lift shares in JD.com. The company has lagged its peers in the Hang Seng Tech Index benchmark so far this year, according to Bloomberg.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy