Jeff Booth, General Partner of bitcoin-only venture fund egodeath.capital, and author of the book The Price of Tomorrow, returns to OPTO Sessions to discuss Bitcoin as an alternative financial system, and the potential impact of government bans on its adoption.

LINKS TO THE INTERVIEW:

Jeff Booth is a technology entrepreneur, General Partner of bitcoin-only venture fund egodeath.capital, and author of the book The Price of Tomorrow: Why Deflation is Key to an Abundant Future. In the book, Booth takes aim at the unsustainable levels of debt that underpin the global economy, and advocates for a “brighter future in a world driven by technology”.

“The natural state of a free market is deflation,” he tells OPTO Sessions. He bases this on an economic principle, derived from the work of Alfred E. Kahn, which states that, over a long enough time period, prices in a free market fall to “the marginal cost” of production.

Booth asserts that it is regulation that prevents this from happening. “What could stop prices from falling to the marginal cost of production? A government could regulate an industry and say ‘Nope, prices can’t fall here, because I’m going to force that to stop falling.’”

In this way, says Booth, industries become protected monopolies within a country that has regulated them. The only downward pressure on price then comes from competitors from other countries whose governments haven’t regulated the industry.

He cites the example of technology, particularly considering how artificial intelligence (AI) has reduced the incremental costs of technological advancements: as Booth puts it, “What is the marginal cost of production of a line of code created by other lines of code?”

Reasons to be Fearful

Costs of technology tend to fall rapidly. It is in this context, Booth argues, that large technology companies are now calling for the regulation of AI on safety grounds: “the only way the monopoly can protect its purchasing power is to scare you into believing that they’re helping you.

“Why are we led to believe that prices are supposed to rise? Because that’s the only way that the monopoly of money can survive,” says Booth.

He estimates that the “natural rate of deflation in the market would be approximately 5% per year”, given recent technological progress. Booth believes that undisturbed natural progression would negate fears of job losses thanks to automation: “in that world, when people lost their jobs to AI, prices would have already fallen.”

Inflation eats into the purchasing power of fiat currencies. In effect, says Booth, this amounts to theft of the productive power of humans. Throughout history, he says, monetary systems (and related commodities such as gold) have been centralised and controlled in order to cream off profit.

Countries with influential fiat currencies — specifically, the US — can sustain this inflationary system by effectively outsourcing inflation to other countries, says Booth. With most of the world’s fiat currencies being pegged to the dollar, an increase in the purchasing power of the dollar relative to these currencies can cause hyperinflation of their local currency.

“The system still operates like that in the US, and actually extends for quite a while, because it means all of the US’ imports just got that much cheaper.”

Another Way

Tied to this is the enormous mountain of debt on which the US and the global economy are built. According to the World Economic Forum, global debt hit $307trn in 2023. Paying this level of debt back at a dollar per second would take nearly 13 million years, says Booth.

“The house I’m sitting in right now was $1.4m three and a half years ago. Now it’s $2.1m. It was 300 bitcoin three and a half years ago, and now it’s 40 bitcoin.”

If the natural state of the free market is deflation, “the only thing that could measure that is something fixed in units and outside of the system.”

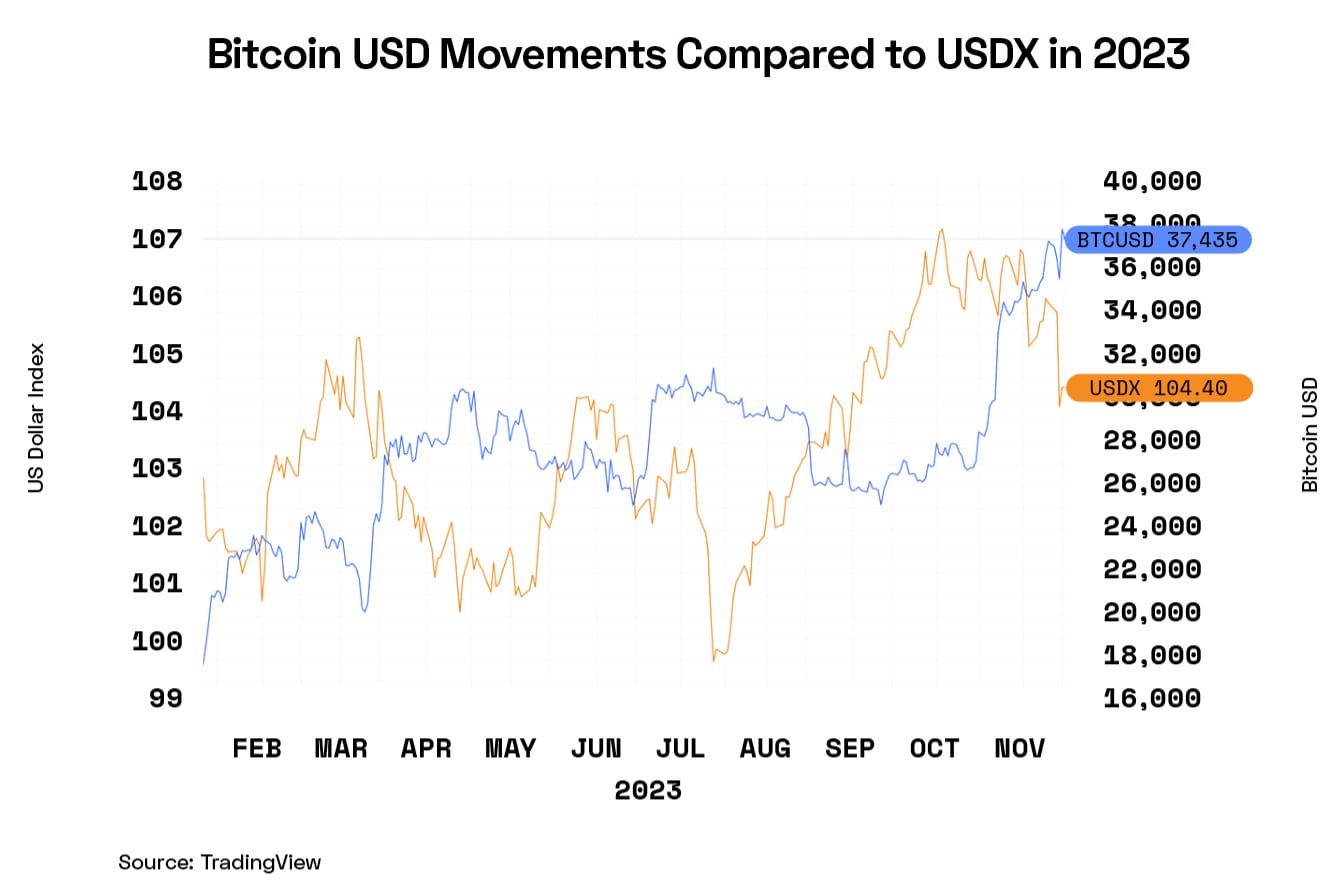

Bitcoin meets both these criteria, and Booth demonstrates its deflationary effect over time compared to that of fiat currencies. While things are becoming more expensive in fiat currencies, they are becoming cheaper in Bitcoin because, says Booth, “the free market is pricing everything”.

“The house I’m sitting in right now was $1.4m three and a half years ago. Now it’s $2.1m. It was 300 bitcoin three and a half years ago, and now it’s 40 bitcoin.”

While Booth’s ideas sound radical at first, the change he envisages (and observes) is gradual.

“As this [fiat-based] system gets worse, more people move. Bitcoin is getting stronger and stronger.

“What scares people is that they think of it as a light switch moment.”

Attempts by governments to stifle bitcoin through regulation are futile, says Booth. Individual countries blocking access would prompt inflows to jurisdictions that have a more permissive stance. On the other hand, a global, supranational attempt to regulate it — which Booth says would be extremely unlikely in practice — would create a black market which could, Booth says, grow faster than Bitcoin would do otherwise.

Regulation Tightening Regardless

While national attempts to regulate cryptocurrencies have hit speed bumps of late, governments seem unlikely to slow down their attempts to do so.

The Securities and Exchange Commission has amassed a string of court defeats against crypto firms in the second half of the year, most recently dropping claims against two executives of Ripple Labs.

The executives in question, CEO Brad Garlinghouse and Co-Founder Chris Larsen, were accused of aiding and abetting sales of cryptocurrency XRP, which had previously been ruled to be an unregistered security. Reuters reported that a July ruling found Ripple’s own sales of XRP did not amount to selling unregistered securities.

However, JPMorgan analysts have suggested these defeats won’t ease the tightening regulatory pressures on the crypto market. In a note seen by Bitcoin.com, analysts at the investment bank said, “It is far from clear that the regulatory tightening of the crypto industry will lessen significantly going forward.”

Ripple’s Managing Director of South Asia, Middle East and North Africa, Navin Gupta, has called for “technology-neutral” regulation; in other words, regulation that targets specific activity related to cryptocurrencies, rather than the technology itself.

Elsewhere, the UK is making moves towards regulating the cryptocurrency market. On 30 October, the Treasury published a response to a consultation on regulation of the sector, which included proposals to regulate stablecoins (cryptocurrency tokens pegged to an existing currency) under the Payment Services Regulations umbrella that currently regulates traditional payment services.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy