In this week’s episode of Opto Sessions, Angus Shillington, Emerging Markets Deputy Portfolio Manager at VanEck, explains the rapid digitalisation of India, how this trend has been driven by government policy, and why it benefits Tata Consultancy Services, as well as the other top holdings of VanEck’s Digital India ETF.

As he explains on this week’s Opto Sessions, underpinning Angus Shillington’s bullish outlook for India’s growth prospects is the rapid digitalisation that the country has seen in recent years.

In just over half a decade, India has undergone a transition from a predominantly cash economy to an overwhelmingly digitalised one. According to VanEck’s research, 72% of the country’s payments were made in cash in 2017; by 2022, this number had fallen to 27%. India has one of the highest rates of digital payment adoption in the world, at 87%, compared to a global average of 64%.

Government policy has been a key driver of this trend. Shillington explains that one of Prime Minister Narendra Modi’s first moves upon taking office was to crack down on corruption by encouraging a system of digital ID, which prompted an explosion in online banking and, in turn, allowed small bills to be taken out of the system.

“I was there when this happened,” says Shillington. “It was insanity. Modi’s government announced, ‘We're taking all small bills out of the economy’ — large bills were allowed for a little while — and there was a deadline of two weeks to get your cash into a bank account.”

This had the knock-on effect of increasing tax compliance and government revenue, which duly drove improvements in infrastructure and logistics. It is thought that these will, in time, reduce inflation and interest rates.

“That’s why I talk about a flywheel effect,” says Shillington. “You’ve now got plenty of cash, so you can build new roads. Those roads mean better logistics, and that means lower inflation — and this thing starts to drive itself.”

Digital Driving Growth

Digitalisation is the theme that Shillington singles out as the key driver for India’s growth story. He discusses several of the underlying themes that are contributing to a “sharp modernisation” in India — particularly logistics, infrastructure and renewable energy — that will, he believes, contribute to lower inflation and interest rates over time.

These results will in turn increase home ownership and access to healthcare. Digitalisation, however, is the sine qua non of all these developments.

“There’s no question that the businesses that are set up off pure digital, whether it’s retail, e-commerce or direct logistics, are going to do well”

“Digitalisation means better connectivity with bank customers, better flow of credit to the bottom of the social pyramid.”

Shillington believes that India’s digital ecosystem is characterised by relatively active government participation. “There isn’t a PayPal [PYPL] per se,” he says. India’s equivalent is the Unified Payments Interface (UPI), developed by the National Payments Corporation of India and regulated by India’s central bank.

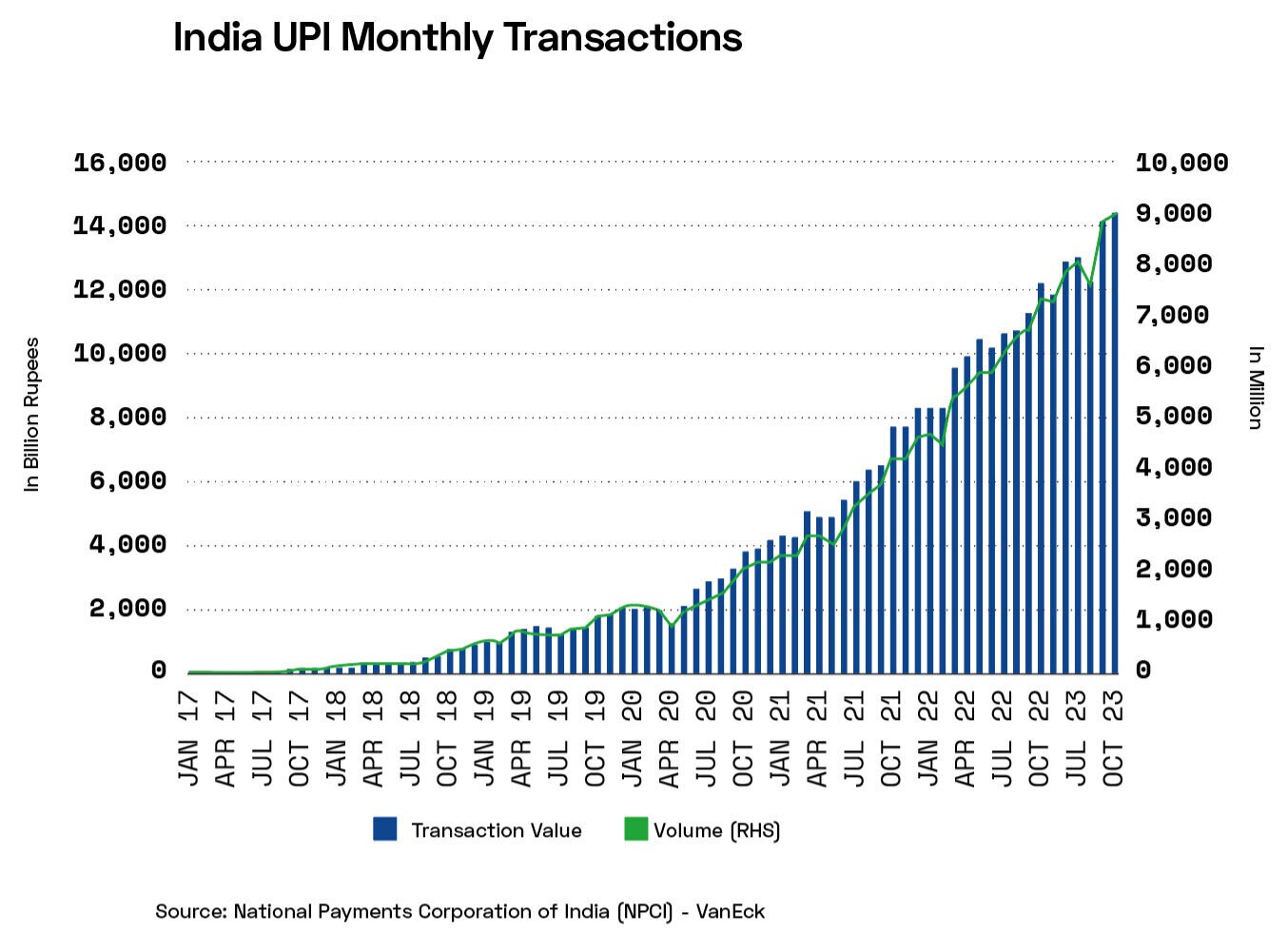

Since launching in 2016, UPI has exploded to over nine billion transactions, accounting for over ₹14trn in value.

“There’s no question that the businesses that are set up off pure digital, whether it’s retail, e-commerce or direct logistics, are going to do well,” says Shillington.

Revolutionising the Payments Space

The VanEck Digital India ETF [DGIN] tracks an index of companies involved in supporting the digitalisation of the Indian economy.

“We've always tried to provide slices of exposure that will hopefully be successful in portfolios,” says Shillington.

For India’s digital sector, an indexed approach is favoured because “we believe that, at the end of the day, the accrual and performance in broader markets is as much to do with what you don't hold as what you do hold.

“We're active where we think the index is very inefficient”, such as in commodities or emerging market debt, “and then we tend to follow an ETF approach where they’re more efficient and a low-cost index type solution will work, or we can create an index of real value in the long run.”

DGIN’s top three holdings, as of 20 September, are Infosys [INFY], Reliance Industries [RIGD.IL] and Tata Consultancy Services [TCS.NS], comprising 8.1%, 7.8% and 5.9% of the fund respectively.

VanEck’s research highlights Tata in particular as capitalising on the potential for India’s digital payments industry. Its merchant solutions, including point-of-sale (POS) systems, mobile payment acceptance and e-commerce payment integration are singled out as revolutionising the ways in which businesses accept digital payments.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy