Joint venture set to challenge Tesla’s charging power

Seven key car manufacturers, including General Motors [GM] and Hyundai [005380.KS] have formed a new company set to challenge Tesla’s [TSLA] dominance of US electric vehicle charging infrastructure. The joint venture aims to install 30,000 chargers across North America, though Reuters reports that some lawyers suspect there may be antitrust concerns. White House press secretary Karine Jean-Pierre called the deal “an important step forward”.

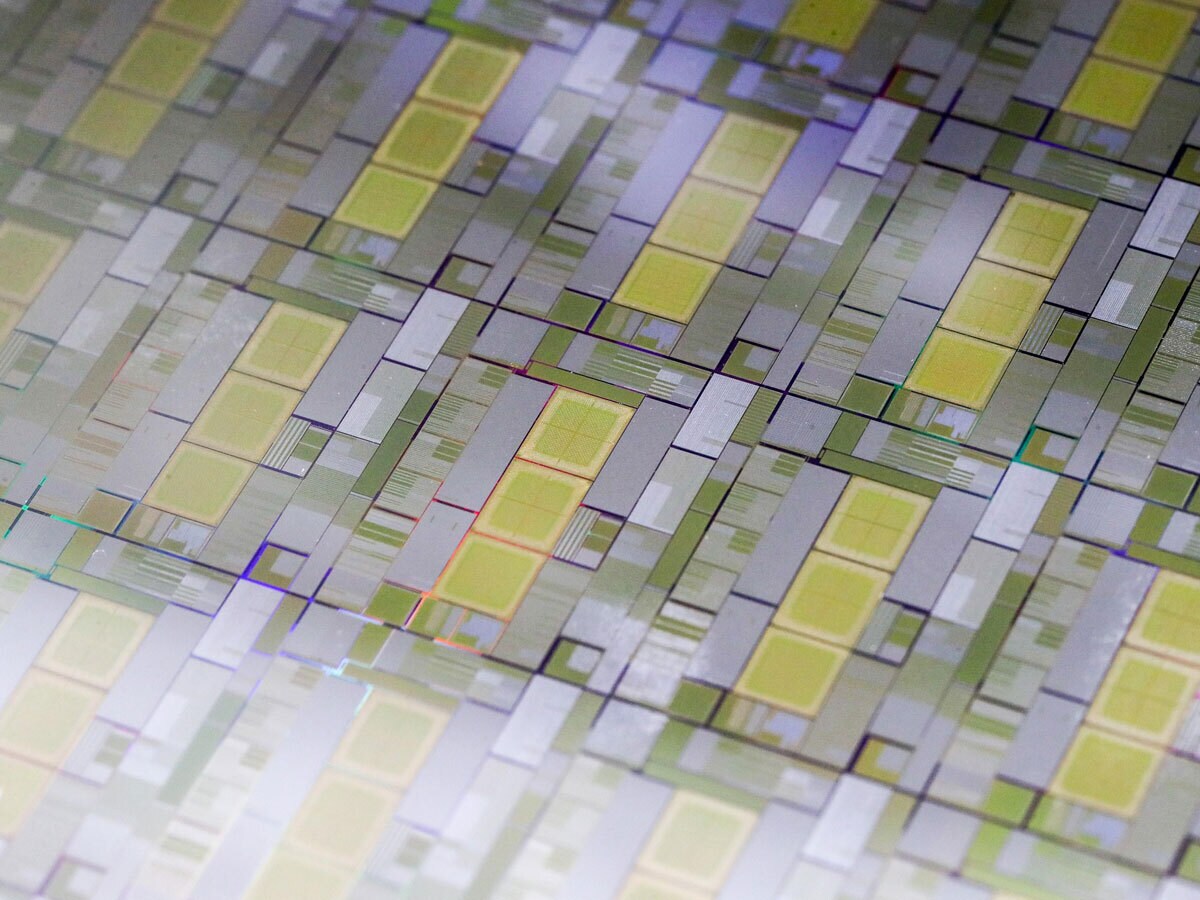

Demand for chips is down, says Samsung

Samsung’s [005930.KS] profits fell 95% year-over-year in the second quarter, according to results announced Thursday, citing weak demand for memory chips. While Samsung expects demand to recover in the second half of 2023, it pledged to maintain output cuts while awaiting an artificial intelligence (AI)-driven recovery. Samsung’s shares gained 2.7% on Thursday, but rival SK Hynix [000660.KS] gained 9.7%, despite the launch of Samsung’s new foldable smartphone.

STMicro grows revenues by 13%

Franco-Italian chipmaker STMicroelectronics [STM] boosted second-quarter revenue by 13% to $4.33bn, narrowly exceeding expectations of analysts surveyed by Bloomberg. STMicro CEO Jean-Marc Chery attributed the increase to growth in automotive and industrial markets. However, JP Morgan [JPM] analysts, including Sandeep Deshpande, wrote that the results indicated that “the strong earnings momentum shown by the business in the past two years [is] losing steam”.

Top AI firms form group for responsible development

Microsoft [MSFT] and Google [GOOGL], together with their respective subsidiary AI houses OpenAI and Anthropic, have formed the Frontier Model Forum. The group seeks to research increasingly sophisticated AI and ensure its “safe and responsible development”. The initiative, which follows closely on from AI safety pledges agreed with the White House, “is a vital step to bring the tech sector together in advancing AI responsibly”, according to Microsoft’s vice-chair and president Brad Smith.

Intelligent recommendations paying off for Meta

Meanwhile, Meta’s [META] investment into AI-driven improvements to feed and personalised recommendations is “already paying off”, according to CEO Mark Zuckerberg. Meta’s revenue rose 11% in the second quarter, the first time it has reached double digits since 2021, with net income increasing 16%. Recovering ad sales could drive revenue growth as high as 20% in the current quarter, the company said on Wednesday, buying time for Zuckerberg’s long-term Metaverse ambitions.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy