The UK’s second-largest energy supplier is investing in a number of clean power projects, with £12.5bn earmarked for 2026. The Scotland-based energy company, which is focused on renewables, recently escaped a government windfall tax, giving its stock a lift — year-to-date SSE’s share price has outperformed the market. Positive earnings could help lift it further.

Scottish power company SSE [SSE.L] is reporting its first-quarter trading statement on 21 July at its AGM. While no analysts provided forecasts for the upcoming earnings update, it has generally been a positive year for energy stocks, with companies benefitting from higher wholesale prices. As a result, the announcement is expected to be positive — SSE projected in its fiscal 2022 results that earnings growth would average at around 7–10% per year through to 2026.

Year-to-date, SSE’s share price is up 10.6% at the close on 18 July, significantly outperforming the FTSE 100. However, since reaching a 52-week high of 1,933p during trading on 23 May, the SSE share price has fallen 9.3% to 1,795p on 18 July.

Lifting sentiment for SSE’s stock and the energy sector as a whole, outgoing prime minister Boris Johnson ruled out a windfall tax on energy firms similar to the one imposed on oil and gas producers on 11 July. SSE’s share price rose 3% on the day of the announcement. The stock had previously fallen by 11% in May following the news that a tax on energy companies could be a possibility.

How did SSE perform at its last earnings release?

In May, SSE reported a healthy rise in profits for full-year fiscal 2022 of 23% to £1.2bn. The company delivered adjusted earnings per share of 95.4p, which was an increase of around 9% from 87.5p in 2021, and at the higher end of its previously anticipated 92-97p per share.

At the end of June, SSE announced that it will increase its dividend to 60p from September, which would represent a yield of 5.1%.

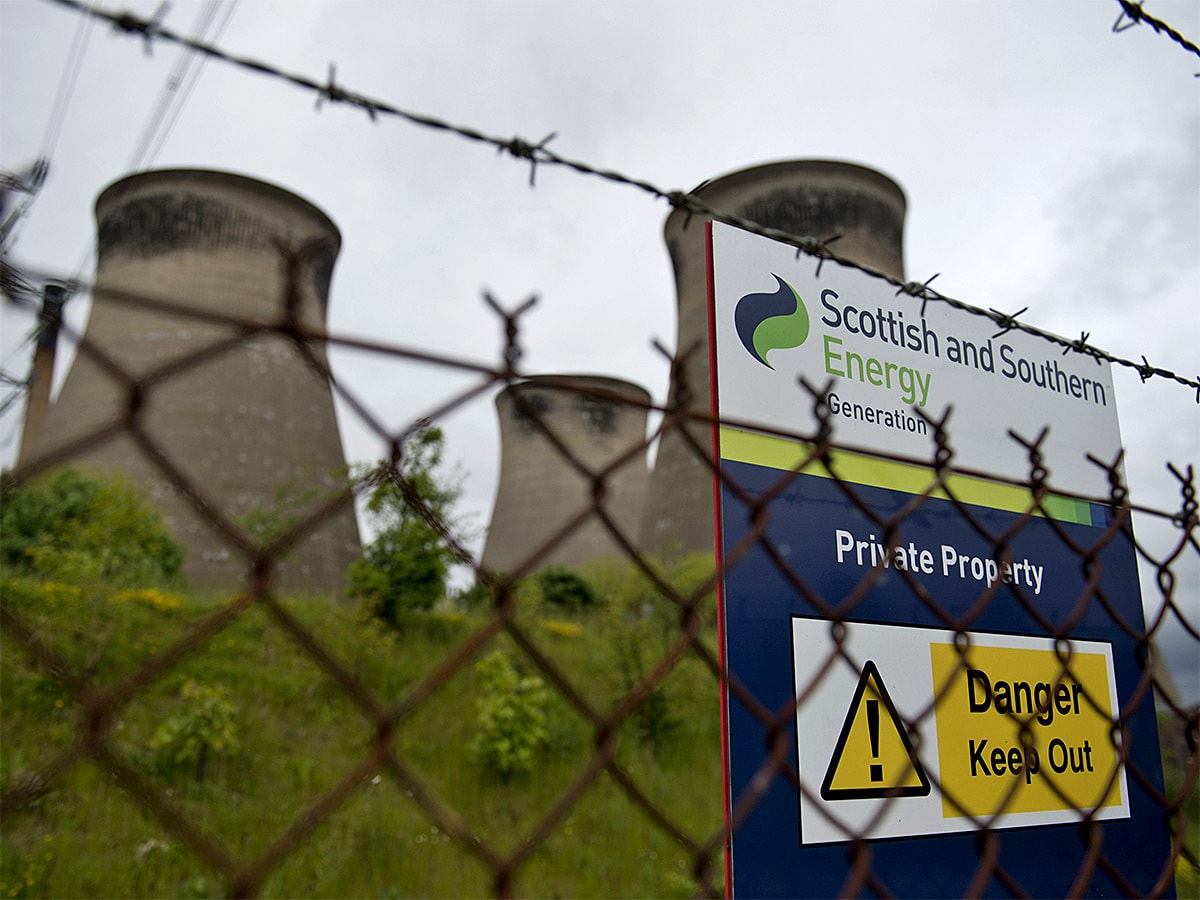

With the climate emergency becoming a stark everyday reality, SSE is focusing on greener energy solutions. The company, which supplies electricity to 3.8 million UK homes and businesses, has plans to invest up to £24bn into national energy infrastructure by 2030, including wind and hydroelectric projects. SSE has earmarked £12.5bn for renewable energy projects over the next four years.

These include Dogger Bank, off England’s northeast coast, which is due to be the world’s largest global offshore wind farm when it is fully completed in 2026 and is expected to be able to power 6 million homes. In June, SSE also teamed up with Norwegian company Equinor [EQNR.OL] to buy Triton Power Holdings from Energy Capital Partners for £341m, with plans to use three plants for low-carbon projects.

On 7 July, SSE also announced it had secured a low-carbon power contract for its Viking Energy Wind Farm in Shetland, for 220 MW (half of the facility’s total capacity). The farm, due to be completed in 2024, should be the country's most productive onshore wind farm.

Analysts give a mixed outlook for SSE

SSE is a major player in the UK for clean energy. However, despite its ambitions to play a part in a greener future, the current outlook from analysts remains mixed.

Brokers recently offering coverage on SSE stock include JPMorgan Chase, which reiterated a ‘neutral’ rating at the end of June. In early July, Berenberg Bank restated its ‘buy’ recommendation and offered a 2,200p target on SSE shares, which would represent a 22.6% increase from its 18 July closing price.

A consensus of nine analysts polled by MarketBeat give a rating of ‘moderate buy’ for SSE.

They are offering a target price of 1,843.43p, which represents an upside of 2.7% from its closing price on 18 July.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy