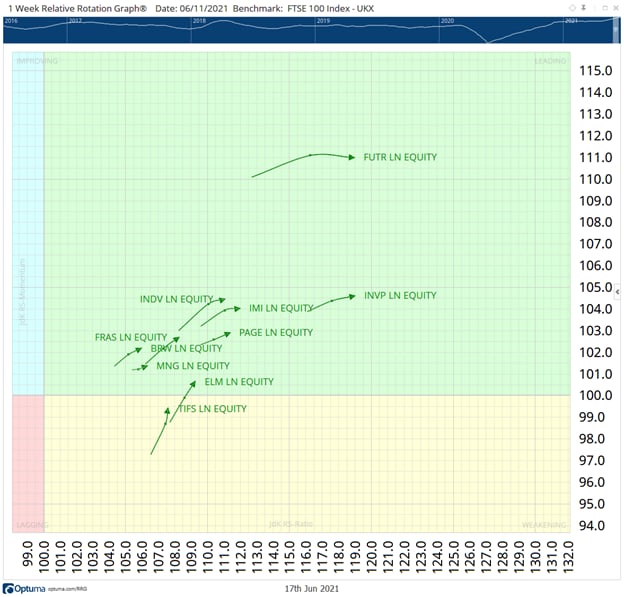

After a good start to the year that continued into Q2 after the rebalancing of the basket in March, stock markets in general - including in the UK - started to lose strength and trade in a choppy, sideways fashion. Such markets do not suit momentum driven strategies/stocks, and the environment subsequently took its toll on the performance of the RRG® UK Momentum+ share basket, causing an underperformance of around 5%.

However, going into Q4 the RRG® model selected 10 new stocks that are exhibiting strong, relative momentum.

The constituents come from six different sectors:

- Financials: Investec, Brewin Dolphin, and M&G

- Communication Services: Future

- Industrials: IMI and PageGroup

- Healthcare: Indivior

- Materials: Elementis

- Consumer Discretionary: Frasers group and TI Fluid systems

This results in a very diversified basket which, in the light of the current market choppiness, could prove to be a good thing going into Q4.

The RRG® Momentum+ range

In April, we added six new baskets to the RRG® Momentum+ range.

These new baskets cover the following indexes:

- SPX 500

- NDAQ 100

- Australia 200

- US Growth 1000

- Hong-Kong Large Cap

- Germany Large 100

The strategy that will be applied to these groups is the same RRG® Momentum+ strategy used for the initial UK 350 RRG® Momentum+ basket.

These baskets started trading halfway into April, so they had little chance to come to life and little history. The research that we did for all those baskets however shows strong results over longer time periods. So, we’re excited to track their development going into the new quarter.

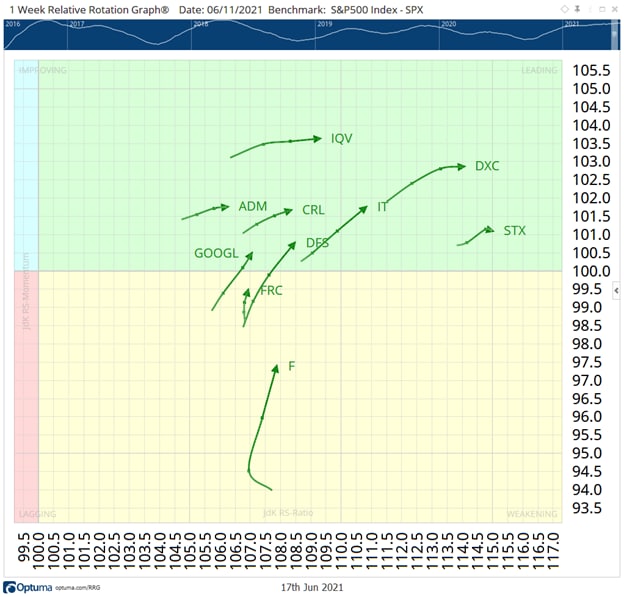

One of the new baskets selects its constituents from the SPX 500 index. Going into the new quarter these stocks are included in the recently launched SPX 500 RRG® Momentum+ basket.

This basket also has constituents from 6 sectors:

- Information Technology: DXC Technology, Gartner Inc, and Seagate Technology

- Consumer Discretionary: Ford

- Healthcare: IQVIA Holdings, Charles River Laboratories

- Financials: Discover Financial Services,First Republic bank

- Communication Services: Google,

- Consumer Staples: Archer Daniels Midland

The Technology sector is heavily represented with 3 stocks. All in all, this basket is also a mix between more defensive and offensive sectors without a clear bias towards one or the other.

This composition is probably a good indication and representation of the current ‘mixed’ state of equity markets.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy