This week is a crucial one as Nvidia gets set to report its Q1 2025 results. The AI chip king’s revenue in the previous quarter was up 265% year-over-year. Investors will be keeping a close eye on sales growth and whether demand is getting softer. Analog Devices and Synopsys also report.

Nvidia [NVDA] CEO Jensen Huang’s compensation increased by 60% in the previous fiscal year as the chipmaker benefitted from the artificial intelligence (AI) rally.

According to a US Securities and Exchange Commission filing issued last week, Huang’s total pay for fiscal year 2024, which ended 28 January, amounted to $34.2m. This included a base salary of $996,515 and stock awards of $26.7m.

Whether Huang should receive such a hefty payout is up for debate, but he has been instrumental in driving Nvidia to the front of the AI chip race.

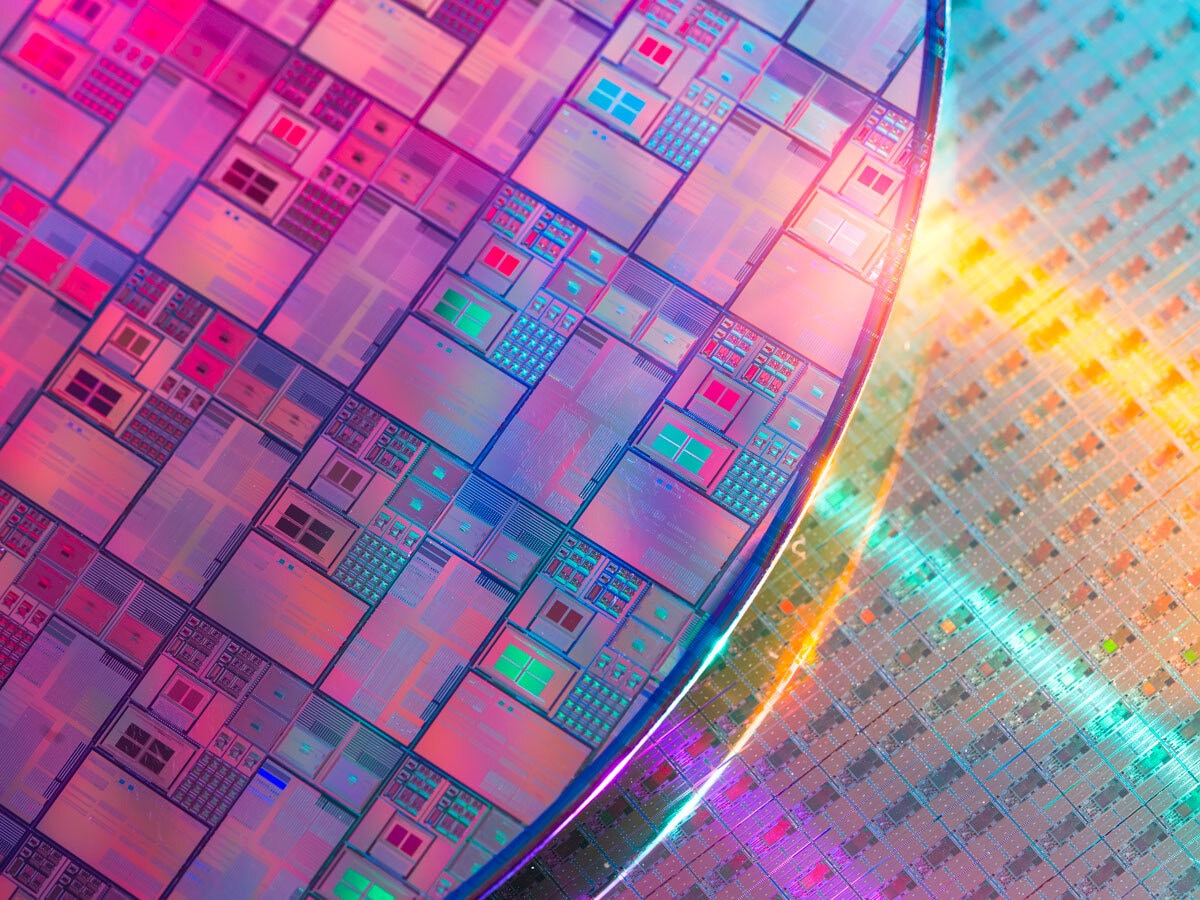

In March, Nvidia announced its Blackwell AI graphics processing units (GPUs), which HSBC analysts estimate could cost between $30,000 and $3m, depending on the model. These GPUs can handle bigger and more complex workloads and reduce cost and energy consumption by up to 25 times.

Investors are hoping Nvidia provides more updates about its Blackwell chips when it reports Q1 2025 earnings on Wednesday.

KeyBanc Capital Markets Managing Director and Senior Research Analyst John Vinh wrote in a note last week that while sales of Blackwell chips are not anticipated until the second half of the fiscal year, “we see limited signs of a demand pause”. He expects Nvidia to report Q1 results and Q2 guidance “meaningfully above expectations”.

On its Q4 2024 earnings call, Nvidia estimated total revenue of $24bn, give or take 2%, for the three months to 30 April. Vinh expects Q1 revenue to be $26bn and Q2 guidance around $28.5bn.

Read more exclusive stories in the OPTO app for free

Ansys Acquisition to Boost Synopsys’ Revenue

Nvidia is not the only semiconductor stock reporting on Wednesday; another is Synopsys [SNPS].

The chip design company was in the news last week after it disclosed in a regulatory filing that it is working with regulators in China to finalize a proposed $35bn acquisition of Ansys [ANSS].

The deal, which is set for the first half of 2025, is expected to boost the company’s annual revenue by $400m within three years and by $1bn in the longer term.

“The complexity of system design is driving our customers' need for the fusion of electronics and physics augmented by AI. We're combining a leader in semiconductor design technology with a leader in simulation and analysis to address this rapidly emerging customer need,” said Synopsys President and CEO Sassine Ghazi in a conference call in January discussing the announcement.

Revenue for Q2 2024, which ended 30 April, is forecast to be around $1.6bn, up 10.7% from $1.4bn reported in Q2 2023.

Non-GAAP earnings per share (EPS) are forecast to be $3.09–3.14, up from $2.54 per share in Q2 2023.

Analog Devices Grapples with Excess Inventory

Analog Devices [ADI] is also reporting its latest results on Wednesday.

In February, Analog Devices agreed to extend its long-term wafer capacity through TSMC [TSM] subsidiary Japan Advanced Semiconductor Manufacturing. This will “enable us to manufacture our products in multiple geographic locations, enhancing our resiliency and giving our customers greater optionality and assurance over their supply chains”, the company said in its Q1 2024 report.

Revenue in Q1 declined 23% year-over-year, and EPS was $1.73, down from $2.75 a year earlier. Revenue for Q2 is guided to be $2.1bn versus $3.3bn a year ago, while EPS will be $1.26 per share versus $2.83 in Q2 2023. The chipmaker has been wrestling with uncertain demand for automotive and industrial chips, which has led to an excess of inventory.

“We expect customer inventory rationalisation to largely subside in our second quarter, and thus enter the second half in a more favourable business backdrop,” CEO Vincent Roche said in a statement.

Semiconductor Stocks Could Fall on Earnings Miss

Risto Puhakka, Director of Market Research at Techinsights, told OPTO that he expects Nvidia and Synopsys to report good results, though the former is “likely to give a more muted outlook as they want to manage very frothy expectations. Analog Devices is likely to show some turnaround from their cyclical downturn”.

However, as their “valuations are really high, any forecast that is short of expectations will cause price drops”, Puhakka warned.

Other than holding these stocks outright, another way to gain exposure is through thematic ETFs.

The Defiance 5G Next Gen Connectivity ETF [FIVG] holds Nvidia, its second-biggest holding with a weighting of 5.4% as of 21 May; it also holds Synopsys and Analog Devices. The fund is up 27.8% in the past year through 20 May and up 10.4% year-to-date.

The ROBO Global Artificial Intelligence ETF [THNQ] has Nvidia as its biggest holding and Analog Devices as its sixth as of 21 May, with weightings of 2.6% and 2.4%, respectively. The fund is up 35.5% in the past year and up 8.1% year-to-date.

The Global X Artificial Intelligence & Technology ETF [AIQ] has Nvidia as its biggest holding as of 20 May, with a weighting of 4.4%, and allocated 1.4% to Synopsys. The fund is up 36.6% in the year and up 10.7% year-to-date.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy