Momentus’ plans to go public via a special purpose acquisition company (SPAC) has been anything but momentus so far, after the US Securities and Exchange Commission (SEC) pulled the plug last week on the imminent prospect of the startup going ahead with an IPO.

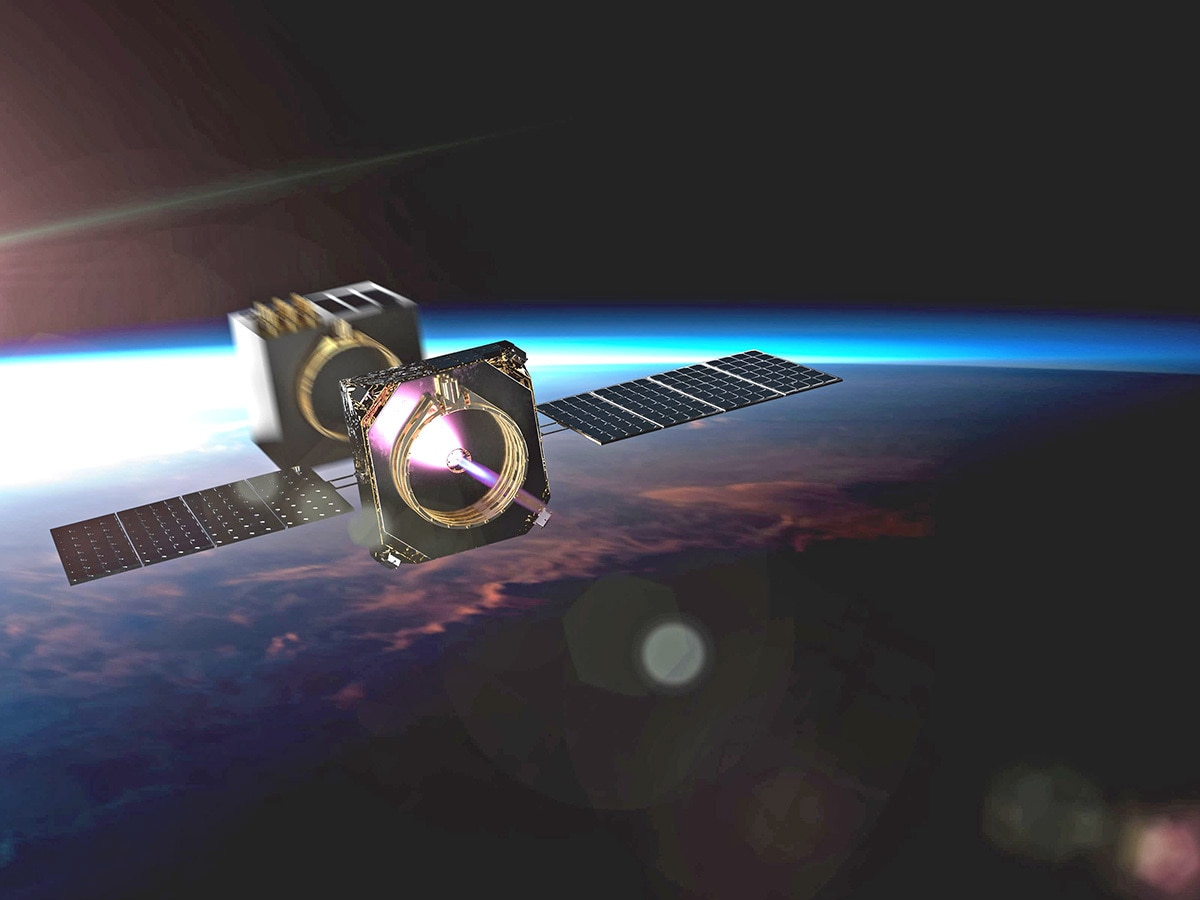

Momentus, founded in 2017, aims to provide a space tug transportation service for satellites already in orbit through a unique water-based propulsion system that drags satellites from one orbit into another. It had agreed to be taken public last October with the SPAC Stable Road Acquisition Corp. [SRAC], in a deal reportedly worth around $1.2bn.

$1.2billion

Valuation of Momentus deal with Stable Road Acquisition Corp.

SEC investigation puts brakes on Momentus SPAC launch

The SEC charged space infrastructure startup Momentus and its founder, Russian immigrant Mikhail Kokorich, with allegedly misleading investors about its propulsion technology and downplaying regulators’ national security concerns relating to Kokorich. The SEC has also charged Stable Road Acquisition Corp., its CEO Brian Kabot, and sponsor SRC-NI.

According to the SEC, Momentus misled investors by claiming it had “successfully tested” its technology in space, reported The Verge. As it turned out, the company had only tested its tech in space once, unsuccessfully. Stable Road Acquisition Corp. failed to review the test’s results, even though it claimed it had undertaken “extensive due diligence”.

The SEC also said that Stable Road Acquisition Corp. didn’t obtain the documents to check whether Kokorich was a national security risk. US authorities’ concern that Momentus’ technology could end up in the hands of foreign adversaries triggered the SEC’s investigation and ultimately delayed its public listing plans. To sidestep the issue, Kokorich resigned as CEO in January.

Momentus has paid $7m to settle, with Stable Road Acquisition Corp. paying $1m, while Kabot has paid $40,000. Coupled with the fines levied, the SEC will enforce “tailored investor protection undertakings, and the SPAC sponsor’s forfeiture of [the] founder’s shares”.

Momentus SPAC valuation halved

After Momentus was forced to admit its failings, the space SPAC’s projected value was slashed from $1.1bn to $566.6m, according to a revised registration statement filed by Stable Road Acquisition Corp. with the SEC, reported Space News recently. The filing noted Momentus’ technology is still new and unproven. “The technology underlying its anticipated service offerings (including its water plasma propulsion technology) is still in the process of being developed and has not been fully tested or validated in space,” it said.

“This case illustrates risks inherent to SPAC transactions, as those who stand to earn significant profits from a SPAC merger may conduct inadequate due diligence and mislead investors” - SEC chair, Gary Gensler

SEC chair, Gary Gensler, issued a warning to prospective SPAC investors: “This case illustrates risks inherent to SPAC transactions, as those who stand to earn significant profits from a SPAC merger may conduct inadequate due diligence and mislead investors.”

With Momentus’ SPAC listing delayed, how can investors get on board?

While this space SPAC has hit a hitch and is now expected to finally take off in August, around six months later than envisaged, there’s little doubting the growth potential in the space sector. Other notable space-focused trading opportunities include the Ark Space Exploration & Innovation ETF [ARKX], which is an actively managed fund tracking the performance of companies involved in the development of space-related products and services. Top holdings include Trimble [TRMB], Iridium [IRDM] and Amazon [AMZN], which sit within one of four categories: orbital aerospace, suborbital aerospace, enabling technologies and aerospace beneficiary.

The iShares US Aerospace & Defense ETF [ITA] is a passively-managed ETF seeking to track the investment results of the Dow Jones US Select Aerospace & Defense Index, which comprises US-based equities within the aerospace and defence sectors. This includes manufacturers, assemblers and distributors of commercial and military aircraft, other defence equipment and aircraft parts. Major holdings include Boeing [BOE], Lockheed Martin [LMT] and Northrop Grumman [NOC].

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy