The Inflation Reduction Act (IRA), a key piece of legislation from the Biden administration which promised to shake up clean energy investment, passed in August 2022. One year on, Global X ETFs assesses its impact on stocks. McKinsey forecasts outsize growth for the sector, but elevated interest rates, among other factors, have weighed heavily on the theme.

- $271bn has been spent on renewable energy projects during first year of IRA.

- BCG forecasts falling price of carbon capture technology.

- Canadian Solar shares could be underpriced compared to competitors.

“The IRA has significantly boosted cleantech growth prospects since its passage in August 2022,” said Madeline Ruid, Research Analyst at Global X ETFs, in a video accompanying a September report examining the impacts of the Act.

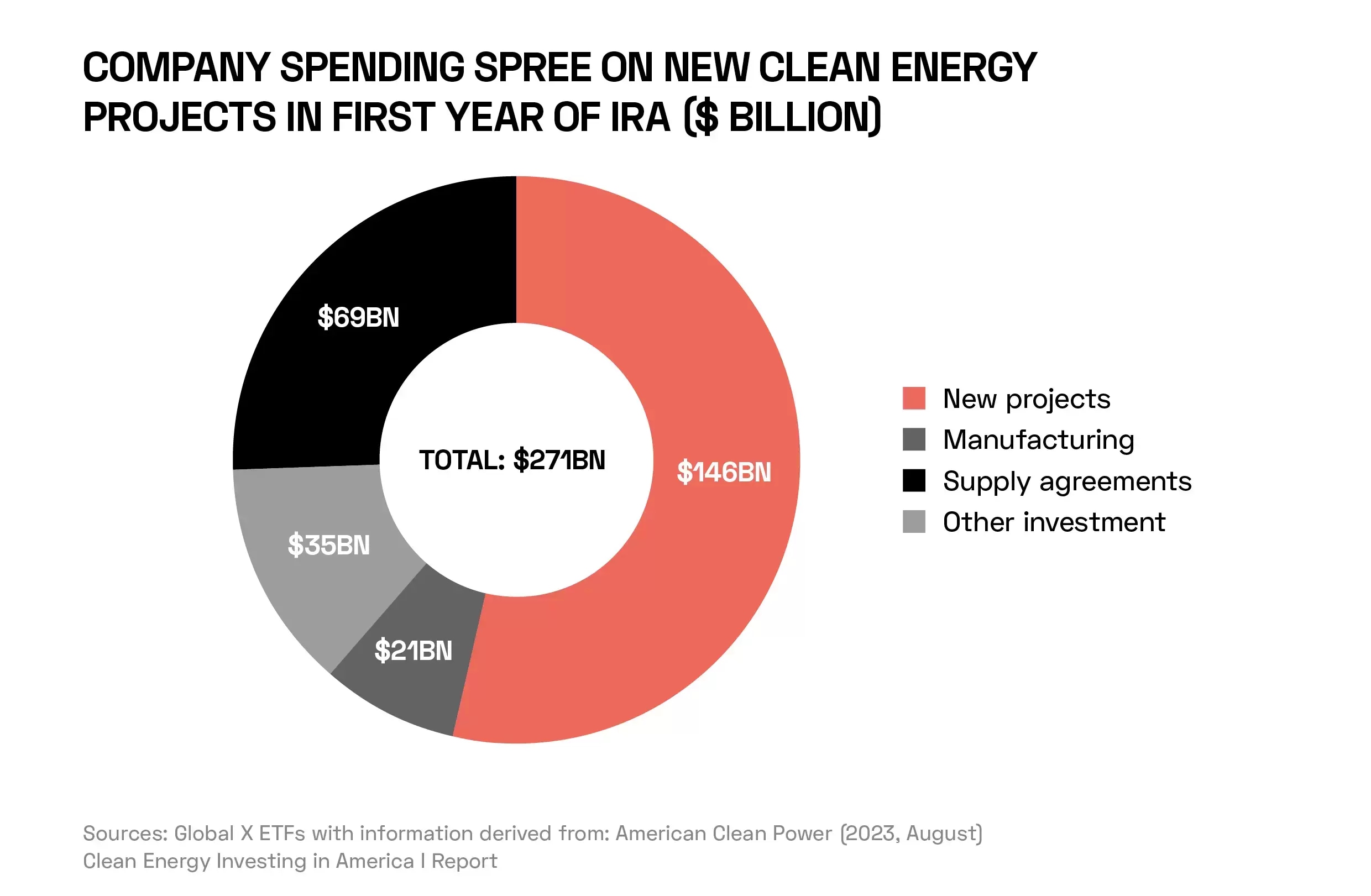

The IRA has spurred a flurry of new spend on clean energy projects. Citing data from American Clean Power’s (ACP) ‘Clean Energy Investing in America’ report, Ruid highlighted $271bn in announced investments in renewable energy projects, cleantech manufacturing and supply agreements in the first 12 months since the IRA came into effect.

Some $146bn of that (approximately 53.9% of the total) was invested into new clean energy projects. The original report from ACP puts the new power capacity announced in the IRA’s first year at 184,850 MW. Facilities announced include 14 utility-scale battery storage manufacturing facilities, 11 wind power manufacturing facilities and 6 offshore wind power manufacturing facilities.

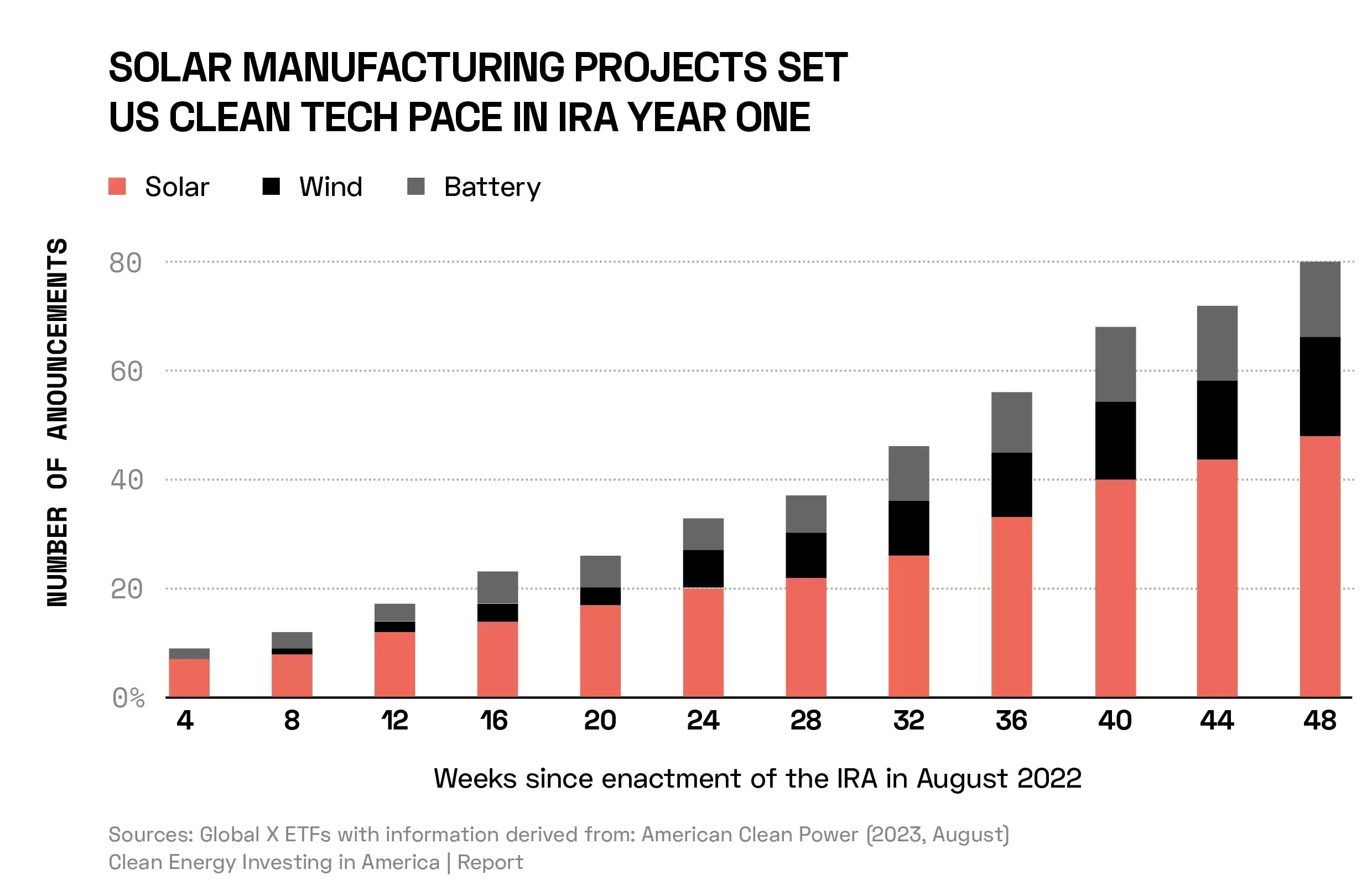

However, solar power producers have been most enthusiastic in their uptake of the incentives available under the IRA, with 52 solar manufacturing facilities having been announced since the law was passed.

Solar panel manufacturer First Solar [FSLR] has invested $2.8bn into US-based projects since the IRA passed. All told, over 70,000 MW of solar power capacity has been announced during that time by all suppliers.

The IRA was implemented in the context of rapid inflation in the US, driven by oil shortages provoked by Russia’s invasion of Ukraine. It was explicitly designed to boost the country’s domestic energy production capacity and reduce reliance on imports and international prices. It has, as a result, helped to drive the trend of US onshoring and reshoring. Global X cites ACP data which shows that, in the first year of implementation, over 80 commitments by cleantech firms were made to build new, or expand existing, US facilities.

Net Zero Push Will Drive Gains

However, the tailwinds provided to clean energy stocks by the IRA have yet to be felt in the stock market. In the year to 11 October, the S&P 500 Global Clean Energy Index fell 28.5%.

As McKinsey points out in its September report ‘Full Throttle on Net Zero: Creating Value in the Face of Uncertainty’, “higher energy prices, supply chain pressures, increased interest rates, higher input costs and lacklustre economic growth” have all proved headwinds to the clean energy sector during the year since the IRA was passed.

Despite this, the strategy consulting firm sees huge potential value in the continued move towards net zero. “Growing demand for net-zero offerings could generate $9trn to $12trn of annual sales by 2030,” says the report.

More broadly, Boston Consulting Group (BCG) sees decarbonisation potentially delivering $26trn in economic gains over the same period. BCG is also relatively bullish on the potential of carbon capture technology, which it believes will fall in price by 10–12% for each time that capacity doubles. By 2035, BCG believes that the overall abatement costs of carbon capture technology could be 80% of current levels.

Grand View Research estimates the global green technology and sustainability market will be worth $79.65bn by 2030, growing at a CAGR of 22.7% between 2023 and then.

Domestic Providers Undercut?

Despite the IRA having been designed to boost onshoring, the US’ clean energy industry, particularly solar, is still under threat from cheaper foreign imports, especially from China. First Solar CEO Mark Widmar called on the Biden administration in September to boost trade protections in order to safeguard domestic manufacturers.

“We need domestic capabilities, and renewable energy is one of them,” Widmar told Bloomberg in an interview.

A probe conducted by the US Commerce Department concluded in August that Chinese manufacturers were deliberately skirting sanctions by assembling solar panels in other, US-friendly Asian nations before exporting them to the US. Regional leaders in Germany have called on the national government as well as the EU to block imports of solar equipment that doesn’t meet the bloc’s standards on environmental footprint or forced labour protections.

However, the White House has delayed the implementation of expanded duties through to June 2024, in order to stay on track with solar installation and climate goals, according to Bloomberg.

Out of Thin Air

While carbon capture solutions typically focus on capturing carbon emissions at their source, trials of direct-air capture (DAC), in which carbon is captured from the atmosphere, are underway.

Saudi Aramco [2222.SR] has agreed to pursue a pilot carbon capture project with Siemens [SIE.DE], reports Bloomberg, with Aramco CEO Amin Nasser saying that the company believes “direct-air capture will work, but needs more innovation and technologies to bring the costs down”.

DAC is considered the most expensive means of carbon capture by the International Energy Agency. However, the organisation notes that if all DAC projects currently announced are completed, the estimated 75 MtCO2/year of sequestered carbon required to achieve net zero by 2050 would be reached by 2030.

Investing in Clean Energy Stocks

Investors looking for a pure solar power play can consider the likes of First Solar or SolarEdge Technologies [SEDG], two of the four largest solar companies in the world by trailing twelve-month (TTM) revenue, as of May 2023.

The second-largest company by this metric is Canadian Solar [CSIQ], which has TTM revenue of $8bn and, according to Morningstar, a P/S ratio of 0.2. This makes it a comparatively cheaper option than either SolarEdge, with a P/S ratio of 2.0, or First Solar, with a P/S ratio of 5.4.

Over the 12 months to 11 October, First Solar’s share price gained 15.4%, SolarEdge’s fell 38.6% and Canadian Solar’s fell 26%.

For a more diversified clean energy play, investors can consider NextEra Energy [NEE]. One of NextEra Energy’s subsidiaries is NextEra Energy Resources, the world’s largest generator of electricity from solar and wind. Between those two sources and energy storage, NextEra has a 20% share of the US market, according to Forbes. NextEra Energy’s share price is down 30.5% in the past 12 months.

Bloom Energy [BE] is a diversified alternative energy company that offers hydrogen fuel cells and carbon capture solutions among its suite of products. Bloom Energy’s share price is down 34.5%% in the last year.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy