Ali Urman, a genomic revolution analyst at ARK Investment Management, explains why the convergence of DNA sequencing, artificial intelligence and gene-editing/gene therapy technologies hold the key to potentially curing disease.

The seeds of what Ali Urman, genomic revolution analyst at ARK Invest, believes will be the next frontier in medicine were sown with the Human Genome Project. That inward journey of discovery kickstarted a billion-dollar genomics market that unearthed next-generation sequencing and gene-editing — a technology that Urman sees as the driving force behind the revolution. ARK Invest forecasts that long-read sequencing revenues will grow at an annual rate of 82% to $5bn by 2025.

DNA sequencing has made it possible to read DNA and is the foundation for a myriad of technologies that range from precision medicine and drug discovery to finding therapeutics that can treat diseases. “Next-generation sequencing is the first fork in the road because it diagnoses diseases, without which we couldn’t have therapeutics,” Urman tells Opto from her home in Florida.

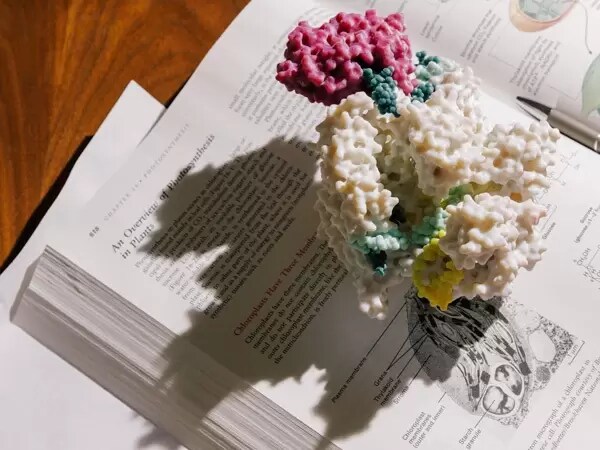

The next step is gene editing towards a functional cure for the genetic mutations that cause disease. “The ability to alter a person’s DNA makeup in order to potentially cure any genetic mutation is really exciting,” she explains. Much of the genomics revolution in life sciences is being driven by “classical programmable therapeutics”, and Urman predicts that gene editing will reach the clinic first. She’s most interested in technologies, such as CRISPR Cas9 and new enzymes, base editing and prime editing, which are molecular tools that enable precise gene correction rather than a clumsy gene disruption. But notes that this is a limitation of much of the current tools we have today.

Urman’s enthusiasm for the industry stems from the discovery of meaningful solutions for patients — “the idea of giving potential cures to people is life changing”, she says. Despite working on the financial side of this thriving industry, Urman believes that funding the most interesting and innovative companies to help them potentially cure patients is the most important mission to be on.

As part of that mission, the investment firm — which manages more than $68bn in assets as of 30 September 2021 — has fostered a collaborative and transparent research process similar to the teamwork that made the Human Genome Project successful. Open access data sharing was instrumental to the success of the international 13-year effort to map the entire chemical makeup of the human genetic code. The groundbreaking project, which sparked the entire genetic shakeup, triggered the next big wave of innovations. As advances in biological sciences combine with the accelerating development of computing power, Urman expects to see a major shift from treating diseases to preventing them with the help of genetics.

The next frontier in medicine

ARK Invest’s rigorous research process to uncover investment opportunities culminates at the end of every week, with a brainstorming session between all the ARK analysts, investment team and theme developers. This transparent research approach has helped the firm discover major investment themes — one of the biggest being the convergence of DNA sequencing, artificial intelligence and gene editing technologies, which ignited the genomics theme’s revolutionary potential.

Cathie Wood, CEO of ARK Invest, believes gene editing will introduce science into healthcare decision-making for the first time. “We can honestly say that until now, more than half of all healthcare decisions were in some part made through guesses or experiences.

Now, we’re going to have the data,” she told CNBC in early 2021. As a genomic analyst on the ARK Genomic Revolution ETF [ARKG] — which has gained 229.1% from its inception in 2014 to 31 December 2021 — Urman explains that she looks for companies that have strict scientific rigour and an impact across multiple countries and sectors.

When considering a potential investment, Urman explains that she looks for companies that have rigorous science that has been validated by academia. She clarifies that while a niche biotech business may still capture value without theoretical or experimental findings, it will typically fail without any good science behind it.

Urman also specialises in finding disruptive companies with a quantifiable cost decline curve. For example, the technique to determine the sequence of the four chemical building blocks of DNA has been one of the most disruptive technologies to the healthcare market with rapid cost declines — it went from $100,000 to below $1,000 in two decades.

“DNA sequencing has really advanced and created a precipitous cost decline that is probably the largest we’ve seen among almost any technology” – Ali Urman

“DNA sequencing has really advanced and created a precipitous cost decline that is probably the largest we’ve seen among almost any technology,” Urman explains. ARK Invest applies the Wright’s Law model — which states that for every cumulative doubling of units produced, costs will fall by a constant percentage — to determine the fall in cost to clients. “Sequencing the first human genome took approximately 13 years to complete and cost $1bn. Today, it costs hundreds to thousands, and it takes just one to two days.” The decline in costs comes with an inflexion in demand and adoption.

“We believe that the number of whole human genome sequences per year can scale up to about 110% at an annual rate, and that means that you can go from sequencing 2.6 million in 2019 to circa 105 million in 2024.” This growth is going

to be driven by a multitude of treatments, including liquid biopsies, tumour profiling, germline testing, immuno-oncology and prenatal testing, which is what she loves about DNA sequencing — “It’s a Venn diagram of so many different applications.”

The ARK Genomic Revolution ETF’s holdings are in the molecular diagnostics and bioinformatics sub-themes, with targeted therapeutics. Other sub-themes within the fund include instrumentation, agricultural biology, gene therapy, stem cells and next-generation oncology. ARK estimates that allogeneic cells and cellular immunotherapies could command a total addressable market estimated to be more than $260bn. Urman sees all the sub-themes as being “powerful drivers of worldwide economic growth for the foreseeable future”.

Top holdings in the fund include CRISPR Therapeutics [CRSP] and Intellia Therapeutics [NTLA], both of which are using CRISPR enzymes for editing the human genome. ARK Invest is also one of the largest stakeholders in Beam Therapeutics [BEAM], which develops precision genetic medicines using base editing, which can correct simple ‘misspellings’ in the genome.

A journey to the genetic revolution

Like many of the analysts at ARK Invest, Urman doesn’t have a traditional background in finance. Before joining the firm, she worked in cancer research and corporate consulting roles. “That taught me the importance of convergences, for example, the fusion of medicine and artificial intelligence (AI), which, as we’ve seen, can be really impactful.”

Urman’s career trajectory into medicine started at an early age. When asked what she wanted to be when she grew up, it was to become a doctor. That fascination started with the human body and was heightened by personal tragedy when her grandmother was diagnosed with lung cancer. The trauma of living a finite lifespan overcast by disease frustrated Urman, which prompted her to pivot to academia.

She decided to focus on epidemiology and biostatistics at the New York Medical College and McGill University in Montreal. Urman then took up research positions at the Memorial Sloan Kettering Cancer Centre and Montefiore Health System between 2010 and 2017. Driven to explore the intersection between medicine and technology, she went on to work at IBM’s AI programme for close to two years, where she helped build out clinical decision support systems called Watson for Oncology, Watson for Clinical Trials and Watson for Genomics.

The combination of Urman’s experience in healthcare and technology provided the perfect springboard for her transition to consulting and, eventually, investment research. While working as a consultant, she became interested in the idea of funding and attended an event where she met Jason Mingelgreen, director of investments at Stifel Financial.

At the time, Urman was unaware of ARK Invest, but Minglegreen saw her potential and submitted her CV to the firm. This was followed up with a coffee between Urman and Simon Barnett, a genomics analyst at ARK Invest. Before long, Urman had landed her role as genomic analyst, which started in February 2020.

Since then, she has been using her expertise to uncover technological and scientific advances in the field of genomics. And because it’s such a fast-moving space, external factors like a company press release can change the course of her working day in an instant, making every day unique.

When a news release is announced, she considers questions such as, does this affect a scientific discovery? Is it a new functionality? Does it impact the investment thesis? For example, if a new patent is disclosed, Urman may drop what she’s working on and start focusing on how the patent could affect other portfolio companies, or if a new technology or partnership is announced, Urman will asses its impact on the investment strategy and companies more broadly.

Urman collaborates with a network of experts she’s built out through her social channels, and the firm’s For Your Innovation (FYI) podcast, where she interviews guests about disruptive innovations. She also avidly reads scientific journals and books to stay abreast of the changing ecosystem — in 2022, she is challenging herself to read a different book every week. She is even exploring a non-fungible token (NFT) project that will display scientific discoveries in a meaningful way.

From lab to clinic

As the genomics market matures, recent breakthroughs in science are being taken from the lab to the clinic. Urman sees a large number of innovations coming from small and mid-cap companies. Based on Urman and ARK’s research, biotech companies that utilise DNA sequencing, AI and gene editing/gene therapy technologies could accelerate their time to market by 25% and improve failure rate reduction by 25%.

This would improve the net present value of the assets at each stage of the clinical trial process, but most significantly at the pre-clinical stages, which are responsible for 40% of research and development costs.

Merger and acquisition activity will also potentially become a prevailing theme in the coming years, she forecasts. Urman expects the consolidation of the market to be driven by cash-rich virology companies that benefitted from an uptick in demand for COVID-19 therapeutics during the pandemic.

“One of the largest catalysts in the genomic or healthcare space is obviously going to be about data. We have interesting therapeutics in the clinic that can be validated and then moved onto the commercial phase” – Ali Urman

However, there are challenges. From data sharing and privacy concerns to rising competition, the biotech industry is fraught with risk. In the broad healthcare sector, Urman highlights the mounting concerns that human labour and non-human primate shortages could delay data readouts from trials.

Indeed, the developmental timeline of various treatments has been shifted amid a lack of patients because of the pandemic. “What will be interesting about that is a lot of the readouts that should have been released earlier will then compound and be announced in 2022,” Urman says, adding that she expects a lot of interesting data to come out of it.

“One of the largest catalysts in the genomic or healthcare space is obviously going to be about data. We have interesting therapeutics in the clinic that can be validated and then moved onto the commercial phase.” Navigating government policies and regulatory agencies for the nascent field of genomics-based therapeutics is also expected to be a challenge.

Urman will be keenly watching drug policy reform on the horizon in 2022. “A lot of the companies, especially in the therapeutics industry, are pre-revenue or are just getting into their strides,” she says, making gene editing and gene therapy some of the most exciting spaces in the market to watch. “Gene editing and gene therapy companies might be able to exceed $1trn in market value over the next five years,” Urman explains.

With Grand View Research predicting the genomics market will reach $62bn by 2028, she sees the upcoming growth as exceptionally exciting and interesting. “The rate of innovation and pace of scientific discovery has accelerated to astounding levels.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy