The Ford [F] share price has motored higher in the past week after the iconic automotive maker said it would power a new lineup of electric vehicles (EVs) by building an auto production complex in the US.

On 27 September, Ford announced that it was teaming up with energy firm SK Innovation [996770.KS] to invest $11.4bn in the construction of two mega-sites located in Tennessee and Kentucky to build electric pick-up trucks and batteries. =

According to Ford, its $7bn slice of the investment is the largest manufacturing spend in its 118-year-old history and is the biggest by any automotive manufacturer in the US.

It is also a significant chunk of Ford’s more than $30bn investment in EVs through 2025. It expects 40% to 50% of its global vehicle volume to be fully electric by 2030.

“This is a transformative moment where Ford will lead America’s transition to electric vehicles and usher in a new era of clean, carbon-neutral manufacturing,” Bill Ford, Ford’s executive chairman, said.

“This is a transformative moment where Ford will lead America’s transition to electric vehicles and usher in a new era of clean, carbon-neutral manufacturing” - Bill Ford, Ford’s executive chairman

Ford’s share price picks up speed

The Ford share price climbed 2.7% to $14.16 on the day of the announcement, and while it continued to rise in the following sessions, the stock has since levelled out at $14.29 on 5 October.

Shares in the automaker have already had a stellar 2021 so far, rising 62.6% in the year to date (through 5 October). The Ford share price appears to be in full coronavirus pandemic recovery mode as workers return to factories, buyers go to dealers, and people restart travelling to work and for leisure.

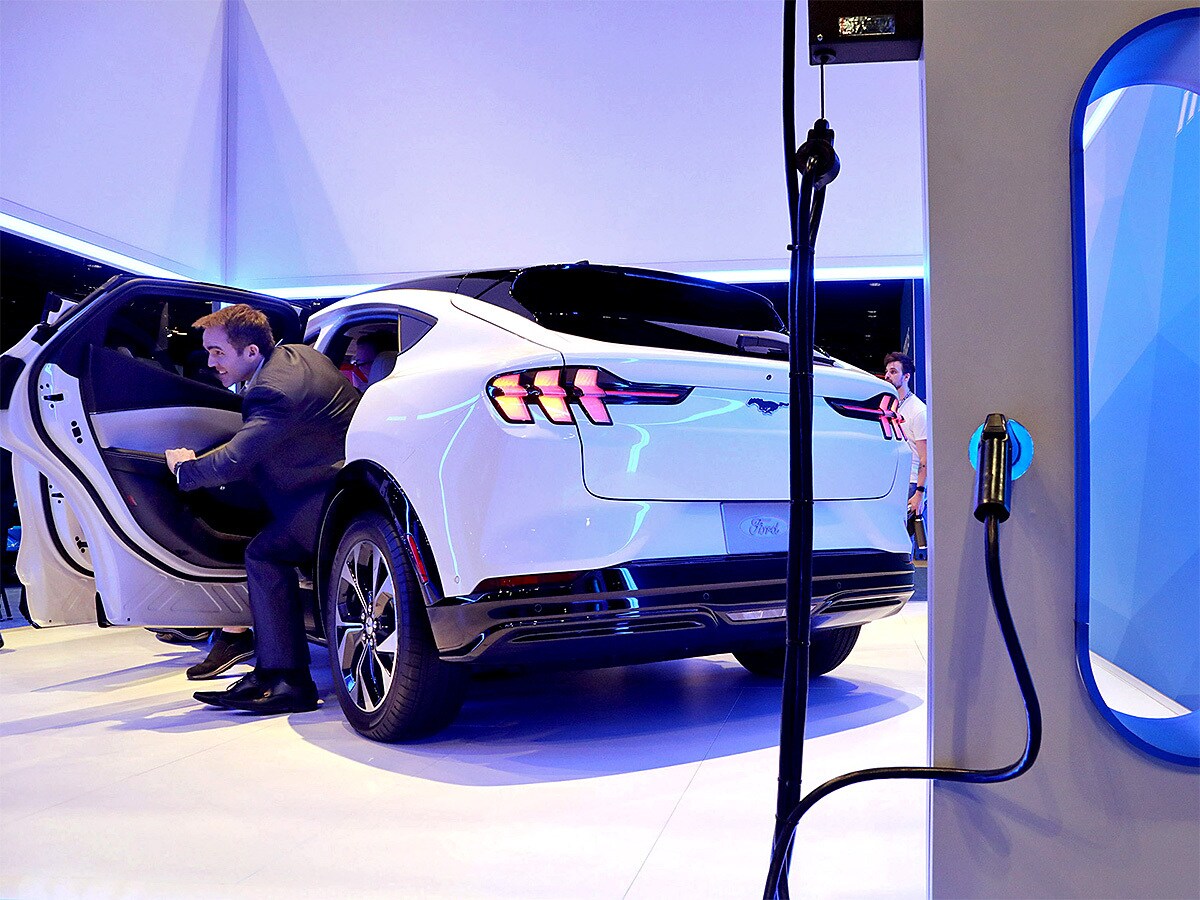

A semiconductor shortage has battered all automakers, but Ford has responded by holding smaller inventories and modernising its sales processes. It has also seen strong demand for its Mustang Mach-E and electric SUVs as consumers increasingly go green.

Over the last 12-months, the Ford share price has climbed 103.5%, with peer General Motors [GM] up 78.7% over the same period.

General Motors is also in the EV race, declaring earlier this year that it planned to only sell EVs by 2035 and announcing a new battery research centre to help cut costs by 60%.

With the two legacy carmakers revving into the future, the share prices of EV maker Tesla [TSLA] has gained 88.5% in the past 12-months. Over the same period, the S&P 500 has climbed 29.3%.

Is Ford stuck in reverse?

Ford saw a drop in annual sales and earnings in 2020 and 2019. It sees EVs along with connected, autonomous vehicles and online purchasing services for its customers as being its way out of the mire.

Under former chief executive Jim Hackett, the company stalled in its EV drive. Indeed, Hackett, as reported by CNBC, once remarked that he saw “no advantage” in Ford producing its own battery cells.

In contrast, Tesla has been powering forward with its battery production both in the US and in China.

According to GM Authority, Tesla’s Model Y has a 42% share of the US battery market, with General Motors’ Chevy Bolt on 11%. The Ford Mustang Mach-E has 6%.

“We have a lot of incredible upside. I would say this is the largest transformation of Ford since the Model T. I don’t think we’ve been fully recognised, yet, for our winning status in this digital transformation of our industry” - Jim Farley, Chief Executive of Ford

Ford’s chief executive Jim Farley believes its EV focus will give shares “room to run”. “We have a lot of incredible upside. I would say this is the largest transformation of Ford since the Model T. I don’t think we’ve been fully recognised, yet, for our winning status in this digital transformation of our industry,” he told CNBC.

Ford has said that its F-150 Lightning electric truck has more than 120,000 reservations. However, there is intense competition from General Motors’ upcoming GMC Hummer and Tesla.

EV truck market set to hit $1.8bn by 2027

Ford’s hiring of Apple employee, Doug Field, to become its advanced technology and embedded systems officer has been heralded as a coup by Dan Ives, an analyst at Wedbush, according to the Financial Times. “It’s a blow to Apple’s ambitions on the automotive front,” he added.

Overall, analysts are bullish. According to Market Screener, there is a consensus outperform rating and an average target price of $16.03, representing a 12% climb from 5 October.

According to Allied Market Research, the EV truck market is set to climb from $422.5m in 2019 at a CAGR of 25.8% to $1.8bn by 2027.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy