Semiconductor stocks, biotech firms and clean energy funds were in the spotlight in today’s headlines. Meanwhile, Bloomberg also identified 10 key stocks it expected to benefit from underlying market trends, and Morningstar downgraded the ARK Innovation ETF.

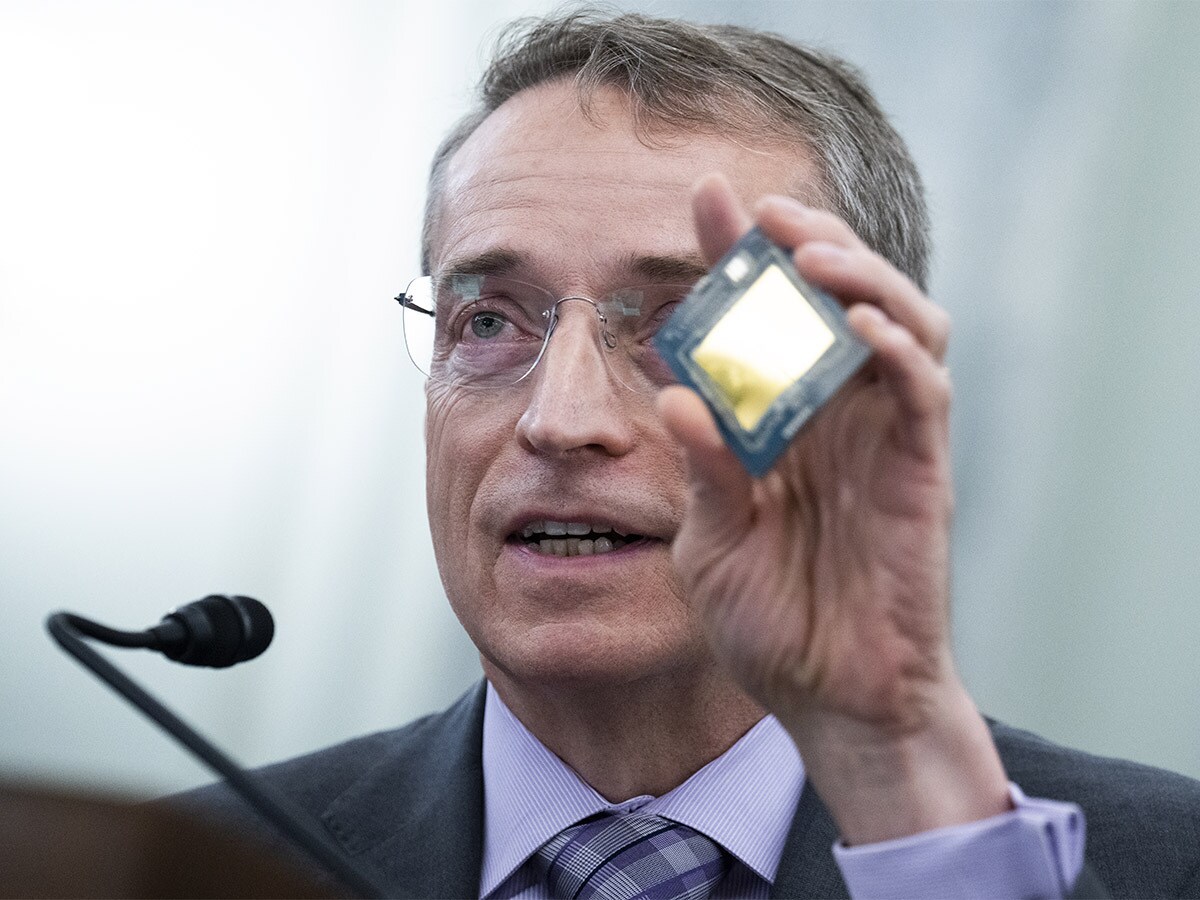

Chips set to outpace S&P 500

Based on consensus earnings estimates for semiconductor stocks, MarketWatch has found that the sector is currently trading at a discount compared to past performance, making it a better bet than the S&P 500. The iShares Semiconductor ETF [SOXX], which has holdings in Broadcom [AVGO], AMD [AMD], Qualcomm [QCOM], Nvidia [NVDA] and Intel [INTC], has a two-year estimated sales CAGR of 13.1% to reach revenue per share of $98.21 by 2023.

Brewin Dolphin jumps on RBC deal

Shares in the UK wealth management firm Brewin Dolphin [BRW.L] leapt 61% at the end of March, following news that it had been acquired by the Canadian financial services company in a £1.6bn deal. The takeover comes amid a robust wealth management market in the UK, which analysts expect could be fertile ground for further consolidation.

Bloomberg’s top plays

Bloomberg analysts have forecasted 10 stocks that could benefit from broad trends in Q2. In the biotech sector, Pfizer’s [PFE] Paxlovid anti-viral pill could see strong demand based on US orders, while Moderna’s earnings could take a hit as governments scale back Covid-19 booster shot campaigns. Efforts to lessen the world’s reliance on Russian gas is also set to be a tailwind for Vestas [VWS]. Other stocks to watch include CrowdStrike, Volkswagen [VOW3], Welltower [WELL], T-Mobile [TMUS], Sun Hung Kai [0086.HK], DNB [DNB] and Equinor [EQNR].

Possible takeover of Rolls-Royce

Investors have speculated that the car maker might be a potentially attractive acquisition target, sending shares in Rolls-Royce [RR.L] up 19% on 25 March. However, the initial flurry of excitement was soon dampened after the UK government’s ‘golden share’ of the company, which gives it veto power over company changes, was flagged as a potential blocker.

Morningstar downgrades ARK’s flagship fund

Robby Greengold, an analyst at financial services company Morningstar [MORN], revised his rating on the ARK Innovation ETF [ARKK] from ‘neutral’ to ‘negative’, citing that Cathie Wood’s strategy had become “more vulnerable to severe losses”, according to Financial News. The fund has become one of the worst-performing ETFs in the US, falling 30% in the first quarter of 2022. Not only does ARK have “no risk-management personnel”, but Wood has “doubled down on her perilous approach”.

Biotech enters bear market

Despite seeing a boom in investment during the spring of 2020, the biotech sector is experiencing one of its worst market runs in years. The SPDR S&P Biotech ETF [XBI] saw losses of 19.7% in the first quarter of 2022, with CureVac [CVAC] and Novavax [NVAX] leading declines. The unfavourable economic landscape of high interest rates and rising consumer prices indexes have weighed on investor sentiment, with many opting for less risky companies.

Clean energy funds in the spotlight

After three consecutive months of declines, renewable energy funds have seen a rush of inflows of about $642m in March, data from Morningstar seen by CNBC showed. The Invesco Solar ETF [TAN] and iShares Global Clean Energy ETF [INRG] captured $319.7m and $274.9m, respectively, of the inflows. While investors had yanked $1.9bn during the past three months, Russia’s invasion of Ukraine has made the case for clean energy more attractive.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy