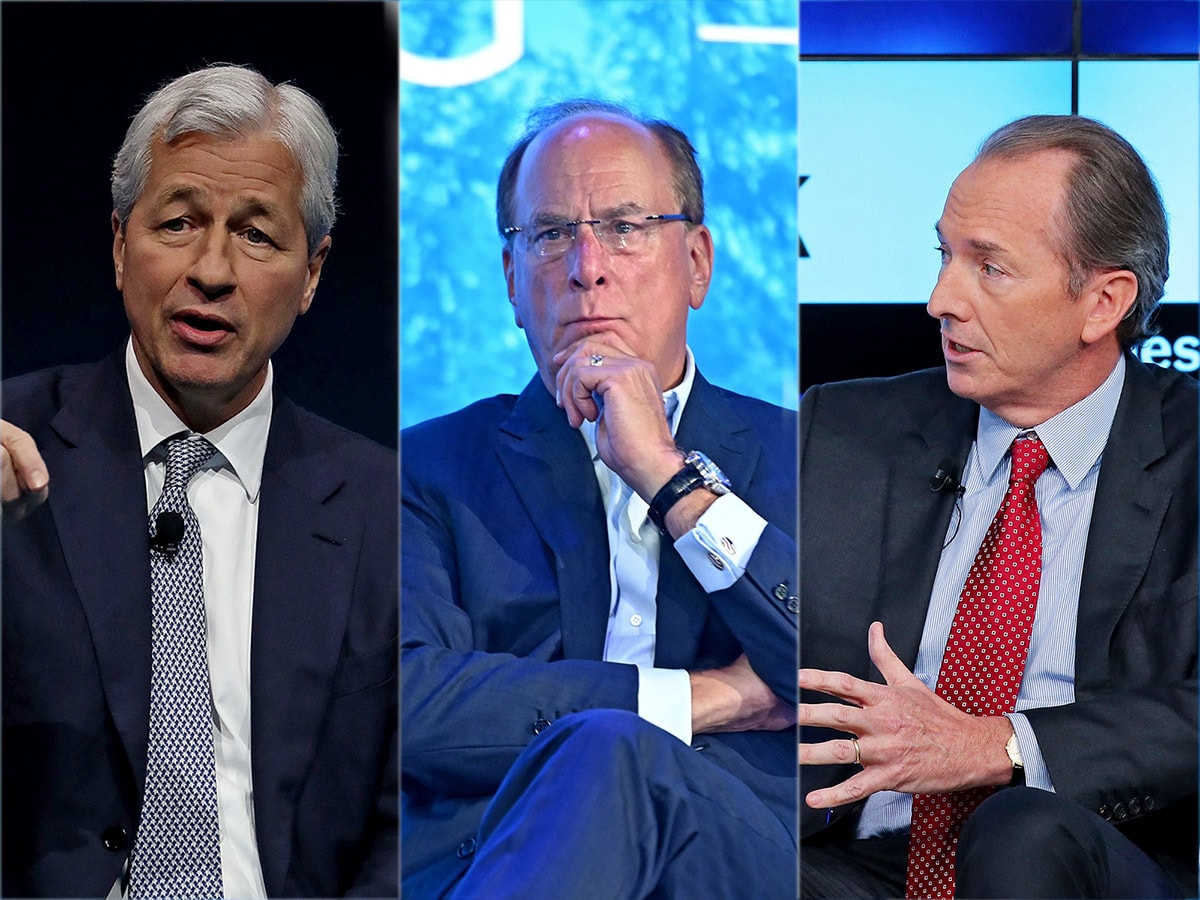

As third quarter earnings season kicks off, investors will be watching the results of US asset managers BlackRock, JPMorgan Chase and Morgan Stanley closely this week for signs of a rebound.

US asset managers BlackRock [BLK], JPMorgan Chase [JPM] and Morgan Stanley [MS] are due to report quarterly earnings this week. BlackRock’s announcement is expected before markets open on 13 October, while both JPMorgan and Morgan Stanley’s are due to announce before markets open on 14 October.

It has been a challenging year for all three stocks, with BlackRock falling 38.6% in the year-to-date (through 11 October). JPMorgan and Morgan Stanley are down 18.1% and 31%, respectively, over the same period.

The wider financial services market has also struggled, with the iShares US Financial Services ETF [IYG] falling 19.8% over the same period. The fund holds JPMorgan as its top holding, with a 9.7% weighting as of 11 October, followed by Morgan Stanley at 3.3% and BlackRock at 2.6%.

Analysts forecast a fall in BlackRock’s earnings

In BlackRock’s last earnings report, it had announced adjusted earnings of $7.36 per share on 15 July, 7.30% below analyst expectations of $7.94 and down 30% from the equivalent period the preceding year. Revenue of $4.53bn was 6% down year-over-year and 2.6% shy of analyst expectations according to the Financial Times.

Despite the underwhelming results, BlackRock’s share price gained 2% following the announcement, which coincided with positive economic news in the US from the easing of fears that the Fed was about to drastically hike interest rates.

Looking to this quarter, Zacks analysts expect EPS to edge up to $7.73, which would represent a fall of 29.41% year-over-year. Even the most optimistic analysts see year-over-year EPS falling to $9.16, while the low estimate of $6.62 represents a 39.5% fall from the $10.95 announced a year ago. Financial Times analysts expect BlackRock’s Q3 revenues to decline year-over-year by 17.6% to $4.16bn, with estimates ranging from $3.71 bn to $4.33 bn.

Among the 15 analysts polled by CNN Money, majority yielded a ‘buy’ consensus for BlackRock, with 10 giving this rating compared to one ‘outperform’ and four ‘hold’ ratings. The median 12-month price target among 12 analysts polled of $648 sees a 17.7% increase from the 10 October close.

Analysts expect a sales jump for JPMorgan

JPMorgan’s 14 July announcement posted diluted EPS of $2.76, 3.16% below analyst expectations. Revenues of $31.63bn were 1% below analyst expectations and 4.5% down year-on-year.

The JPMorgan share price fell 3.5% on the day of the announcement, but given the positive note on which US financial stocks ended the week, recovered the following day.

For the upcoming quarter, Zacks analysts yield a consensus estimate of $2.98 EPS, with a low estimate of $2.76 and a high estimate of $3.20. The consensus estimate represents a fall of 20.32% in earnings year-over-year.

Sales are expected to rise 8.28% year-over-year to $32.31bn, with the lowest estimation at $31.18bn. The high estimate of $33.44bn would see sales increasing 12.8% year-over-year.

JPMorgan is a ‘buy’ according to the consensus yielded from 27 analysts polled by CNN Money. 13 analysts gave this rating, while three said the stock would ‘outperform’, 10 recommended to ‘hold’ and one to ‘sell’. The median 12-month price target of $135 anticipates a 27.4% increase on its last close of 105.98.

Morgan Stanley earnings expected to dip

Morgan Stanley’s earnings report on 14 July also trailed analyst expectations by 7.1% with an EPS of $1.44. Sales of $13,132 were also disappointing at 2.40% below what had been forecast. The Morgan Stanley share price fell 0.4% following the announcement, before rebounding by 4.50% the following day, back into its price range two weeks prior.

This quarter, Financial Times 19 analysts yield a consensus estimate of $13.21bn in revenue and $1.49 in EPS. The sales target would represent a 10.4% drop in sales year-over-year if accurate, with the high estimate of $14.2bn also falling short of the year-ago figure of $14.75bn. The low estimate of $12.36bn assumes sales will be falling 16.2% year-over-year.

Similarly, the consensus EPS estimate sees earnings falling 24.7% year-over-year, and the most optimistic estimate of $1.72 still anticipates a fall from last year’s figure of $1.98. Some analysts have an even gloomier outlook, with earnings potentially falling 39.9% to $1.19 per share.

CNN Money received ratings from 28 analysts regarding the shares of Morgan Stanley, 16 of which provided the consensus ‘buy’ rating, while three said the shares would ‘outperform’, eight ‘hold’ and one ‘sell’. The median 12-month price target for the stock of $95 would see it gaining 21.2%.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy