With decarbonisation leading to a squeeze on supply for energy transition materials like copper and uranium, and emerging markets making huge waves in the global tech scene, the investment universe is in constant flux. TheOpto app is updated every month with the latest, cutting-edge themes to capture that perpetual change.

Discover the six new additions to Opto’s universe, including one set to benefit from trillions of dollars of government investment.

The Opto app is currently only available to UK and US users. We’ll alert subscribers to our daily newsletter as new regions come online.

The Opto methodology

We aim to identify themes offering significant, long-term growth potential. Our rigorous selection process ensures that most themes don’t make the cut.

Themes must exhibit long-term, secular tailwinds, rather than short-term, cyclical fluctuations. They must have a minimum time horizon of two years to ensure significant runway, and a minimum market value of $1bn to ensure a reasonable level of maturity and market adoption. Each theme must also project a minimum market value of $2.5bn by 2026-27, to ensure sufficient investment potential.

ETFs must have a minimum market cap of $5m, ensuring size and liquidity, and must offer pure-play exposure to a theme, meaning that each fund’s constituents should derive the majority of their revenue from a business activity related to the relevant trend. Only non-leveraged, equity funds are included.

Copper

As a key element for electrical transmission, copper is fundamental to the energy transition, particularly in electric vehicles. This month, copper inventory in London Metal Exchange (LME)-approved warehouses fell to its lowest levels since late 2021, with Robert Friedland, founder and executive co-chairman of Ivanhoe Mines Ltd [IVN.TO], warning of a “train wreck” as supply struggles to meet increasing demand. Friedland suggested in an interview with Bloomberg that the copper price could increase tenfold as a result.

Data Bridge Market Research suggests that the global copper market was worth $304.79bn in 2023, and will rise to $453.76bn by 2030, at a CAGR of 5.1%.

The two leading funds for the theme are the Global X Copper Miners ETF [COPX] and the Sprott Junior Copper Miners ETF [COPJ]. COPJ is the top performer over the past quarter, gaining 2.87% in the three months to 27 June.

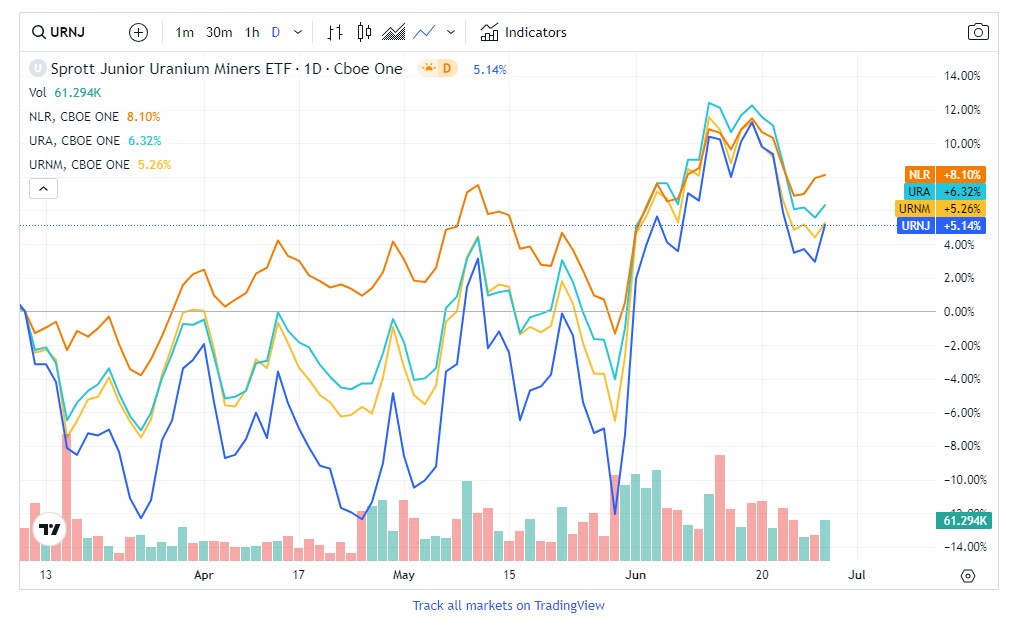

Uranium

As the world shifts away from fossil fuels, nuclear is likely to play a bigger role in energy production. Uranium supply, however, is being squeezed, with the US in May signing into a ban on Russian imports. Cameco [CCJ], however, plans to double production volumes from 10.4 million pounds in 2022 to 20.3 million in 2023.

Research from ReportLinker anticipates growth of $1.6bn in the industry between 2022 and 2027, with a CAGR of 7.06% during this period.

The four ETFs included in the Opto theme are the VanEck Uranium+Nuclear Energy ETF [NLR], the Global X Uranium ETF [URA], the Sprott Uranium Miners ETF [URNM] and the Sprott Junior Uranium Miners ETF [URNJ]. The latter is the top performer with gains of 11.5% in the three months to 27 June.

China tech

China’s mobile payment adoption has surpassed all others, reaching a 40.4% penetration rate in 2022. Subsequently, fintech firms and other public companies bolstering tech adoption in the region have seen their shares skyrocket. The theme’s clear frontrunners are the country’s major tech platforms: Tencent [0700.HK], Baidu [9888.HK] and Alibaba [9988.HK]. All three logged encouraging revenue growth in their most recent earnings reports, following the government’s crackdown on technology platforms it felt were becoming too powerful.

In November 2022, GlobalData valued China’s enterprise information and communications technology market (including hardware, software and services) at $494.4bn in 2021, and anticipated it growing to $743bn by 2026 at a CAGR of over 8%.

Seven ETFs are included in the theme: the Global X China Innovation ETF [KEJI], the iShares MSCI China Multisector Tech ETF [TCHI], the Global X MSCI China Communication Services ETF [CHIC], the KraneShares CSI China Internet ETF [KWEB], the Global X MSCI China Information Technology ETF [CHIK], the Invesco China Technology ETF [CQQQ] and the Global X China Biotech Innovation ETF [CHB]. Of these, KEJI is the top performer, falling 7.47% over the three months to 27 June.

India tech

Since Reliance Jio, a subsidiary of Reliance Industries [RELIANCE.NS] entered the market in 2016, India has enjoyed widespread, cheap internet access, which has driven a technology boom in verticals such as payments, ecommerce, over-the-top content and food delivery. Kevin T. Carter, founder and chief investment officer of EMQQ Global, told Opto Sessions last month: “I don't know of any sector on the planet that's growing their revenue as fast as the emerging market internet companies,” and particularly those in India.

Not-for-profit industry trade group Nasscom estimates that India’s technology market could be worth $245bn in the 2022-23 financial year, gaining $19bn from the previous year. Nasscom president Debjani Ghosh recently said the country’s tech industry is on track to pass $500bn by 2030.

ETFs include the VanEck Digital India ETF [DGIN] and the India Internet & ECommerce ETF [INQQ]. The latter has outperformed the former, gaining 26.9% over the three months to 27 June.

Metaverse

Meta [META] dominates this theme, but it faces competition from various corners. One of the latest entrants is Improbable, backed by SoftBank [9984.T], which has outlined plans for Msquared, an open network of connected metaverses.

While companies within the metaverse are under pressure to monetise, the growth prospects are huge. Fortune Business Insights estimated the market’s size was $63.83bn in 2021, with scope to grow at a CAGR of 47.6% to $1.53trn by 2029.

Over the past three months, the top-performing ETF within the theme has been the ProShares Metaverse ETF [VERS] with gains of 18.9% in the period to 27 June. Other ETFs in the space include the Roundhill Ball Metaverse ETF [METV], the Global X Metaverse ETF [VR], the iShares Future Metaverse Tech and Communications ETF [IVRS], the Fidelity Metaverse ETF [FMET], the First Trust Indxx Metaverse ETF [ARVR] and the Fount Metaverse ETF [MTVR].

Infrastructure

Governments around the world are increasingly turning to infrastructure spending to drive economic growth. The US signed the Infrastructure Investment and Jobs Act into law in November 2021, which pledged $1.2trn in spending. The share price for Eaton Corporation [ETN], one of the companies leading in long-term infrastructure contracts, has gained 56% over the past 12 months.

Zion Market Research values 2020’s global infrastructure market at $3.1trn, and expects it to reach $5.9trn by 2028, at a CAGR of approximately 11%.

The leading ETF is the Global X US Infrastructure Development ETF [PAVE], with gains of 12.3% in the three months to 27 June. Additionally, the iShares US Infrastructure ETF [IFRA], the SPDR S&P Global Infrastructure ETF [GII] and the iShares Global Infrastructure ETF [IGF] provide exposure.

With the pace of technological change accelerating all the time, Opto’s thematic universe is updated monthly, keeping you constantly informed. Look out for next month’s update.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy