Over the course of its history, certain visionary investors have developed entirely new ways to play the stock market, garnering outsized returns and inspiring generations of both institutional and retail investors.

The core argument of this new series from OPTO is that understanding the methods of such visionaries can help investors optimise their own approaches.

Fittingly, the series begins with one of the best-known names in investing history: Warren Buffett, the ‘Oracle of Omaha’.

Buffet’s core philosophy — buy strong businesses at attractive valuations — has enabled his holdings firm, Berkshire Hathaway [BRK-B], to post market-beating results over the long term.

Early Start

Buffett was born into the world of investing. His father, Howard Homan Buffett, was a stockbroker and a member of the US congress, and it didn’t take long for his son to dip his toe into the markets.

According to CNBC’s Warren Buffett Archive, Buffett made his first stock purchase at the age of 11: three shares of the oil company Cities Service, priced at $38.

The stock then dipped before rising to $40, whereupon the young Buffett sold his shares, only to then see the stock surge still further. This taught him an early lesson about timing the purchase and sale of a stock.

This experience could be the root of Buffett’s long-term perspective on investing. One of his most famous maxims is: “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes”.

As well as investing, Buffett dived into hard graft, working a paper route and selling soft drinks during his early teens. At 14 years old, he used his earnings to acquire 40 acres of land, which he then rented out.

He was accepted to the University of Pennsylvania at 16 and then entered a graduate program at Columbia University (having been rejected by Harvard).

“If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

At Columbia, Buffett was mentored by Benjamin Graham, who is considered the ‘father of value investing’. In essence, this approach consisted of calculating stocks’ intrinsic value based on their assets, earnings and dividend pay-outs; buying stocks whose market price was below their intrinsic value, and then selling them once their market price reflected their intrinsic value.

A Run on a Mill

After graduating, Buffett worked with Graham at the Graham-Newman Corporation.

When Graham retired in 1956, Buffett founded his first firm, Buffett Associates. Then, in 1962 — barely into his 30s and already a millionaire — Buffett joined forces with the man who would become a lifelong business partner, Charlie Munger.

The pair bought a run-down textile mill called Berkshire Hathaway, turned it around, and used the cash flows to purchase other businesses. In 1985, the textile arm was mothballed, and Berkshire Hathaway became one of the world’s most famous holding companies.

Buffett and Munger developed a new take on Graham’s philosophy, going beyond the principles of value investing in terms of deciding which stocks to buy and when to sell them, by concentrating on the money-making potential of those businesses. In other words, Buffett looked for undervalued stocks that could generate earnings over the long term, regardless of whether or not the market price ever reflected their intrinsic value.

Buffett’s investment strategy revolves around using careful analysis to identify these high-potential, undervalued businesses. He assesses metrics such as:

- Return on Equity (ROE): (net income ÷ shareholder’s equity) X 100 (the higher, the better)

- Debt-to-Equity (D/E) Ratio: total liabilities ÷ shareholders’ equity (the lower, the better)

- Profit Margins: (the higher, the better)

As well as picking stocks they are willing to hold long-term, Buffett also advises investors to concentrate on industries they understand well, and to resist the temptation to sell their stocks when the price falls — if they are confident in the business.

The Silver Standard

Buffett’s cautious approach has led to him missing opportunities in the past. For example, he previously passed on opportunities to invest in Amazon [AMZN] and Alphabet [GOOGL] because of his unfamiliarity with the workings of the internet.

Buffett’s focus on investing in businesses that generate earnings (as opposed to appreciating in value) means that he is dismissive of gold as an investment opportunity, In 2011 he told shareholders that:

“If you own one ounce of gold for an eternity, you will still own one ounce at its end. What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade, that belief has proved correct. Beyond that, the rising price has, on its own, generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis. As ‘bandwagon’ investors join any party, they create their own truth — for a while.”

Similarly, Buffett has been an outspoken critic of bitcoin and other cryptocurrencies despite holding a significant position in Nu Holdings [NU], the parent of crypto-friendly fintech Nubank.

Buffett is, however, a keen silver investor; in his view, the various medical and industrial applications of silver make it, unlike gold, a useful investment.

“As ‘bandwagon’ investors join any party, they create their own truth — for a while.”

Buffett’s Best Investments

However, Buffett’s strategy mainly involves buying excellent businesses at or below their fair price, and this has led to many a standout success.

One of the most famous is Coca-Cola [KO], which he first bought in 1988 for $2.73 per share; as of 7 February, that investment has gained 2,096%. Berkshire Hathaway’s most recent 13F filing with the US Securities and Exchange Commission shows that Buffett still holds a significant number of shares in the soda company.

However, one of his best positions of all time was made more recently. Between 2016 and 2019, Buffett bought approximately $35bn worth of Apple [AAPL] shares. Since the end of 2019, Apple’s share price has gained 165%.

According to WhaleWisdom.com, Berkshire Hathaway’s five largest holdings as a percentage of its portfolio in its most recent quarterly disclosure were:

- Apple: 49.4%

- Bank of America [BAC]: 8.9%

- American Express [AXP]: 7.1%

- Coca-Cola: 7.1%

- Occidental Petroleum [OXY]: 6.2%.

It is worth noting that, quarter-over-quarter, there was no change in the number of shares the fund held for its top four positions — demonstrating Buffett’s long-term commitment to the companies in which he’s most confident.

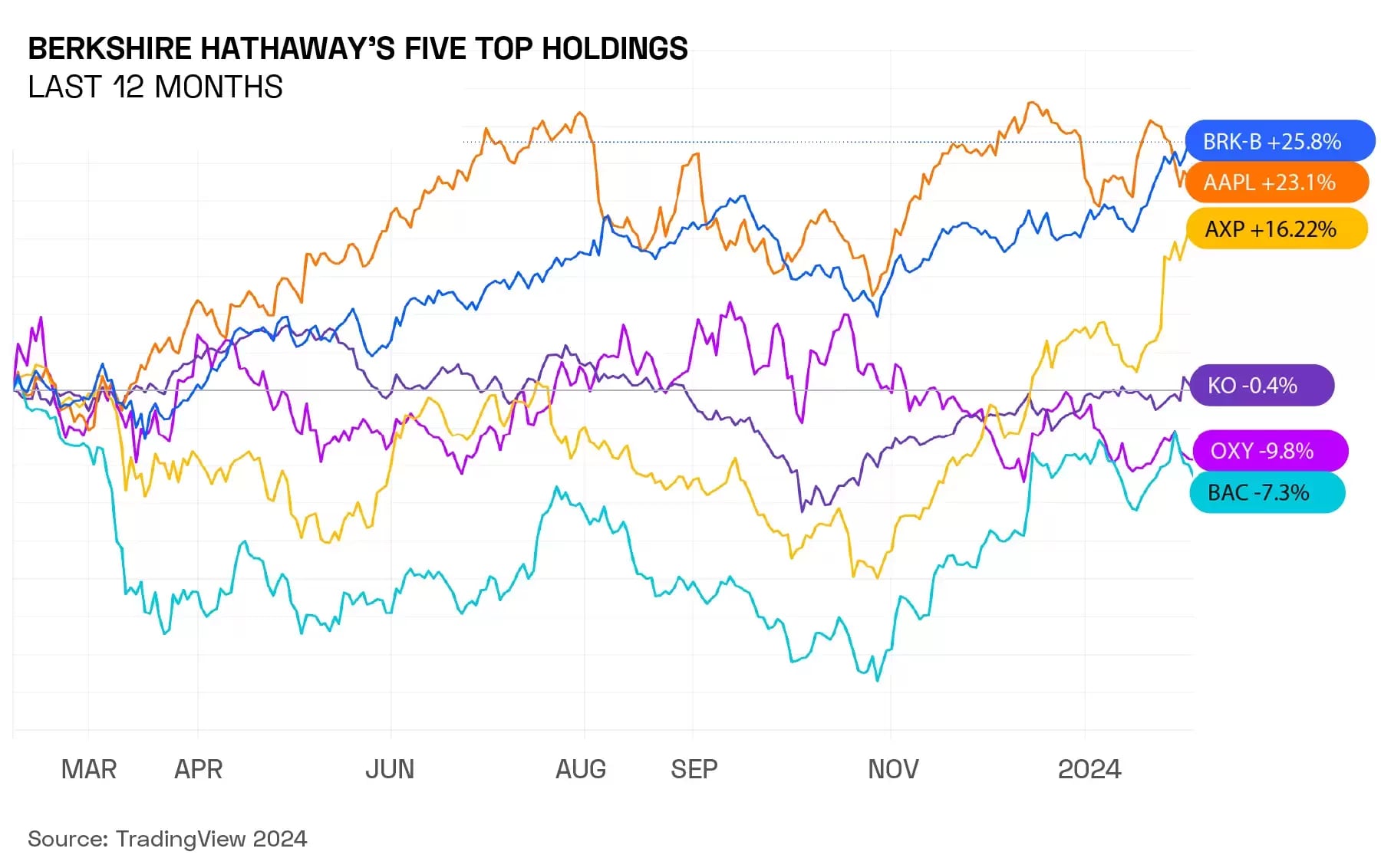

Over the past 12 months, these stocks have had contrasting fortunes. While Apple has gained 23.1%, Bank of America and Occidental have fallen by 7.3% and 9.8% respectively.

Berkshire Hathaway’s stock has risen 25.8%, outperforming all of these — even Apple, which accounts for nearly half of its portfolio.

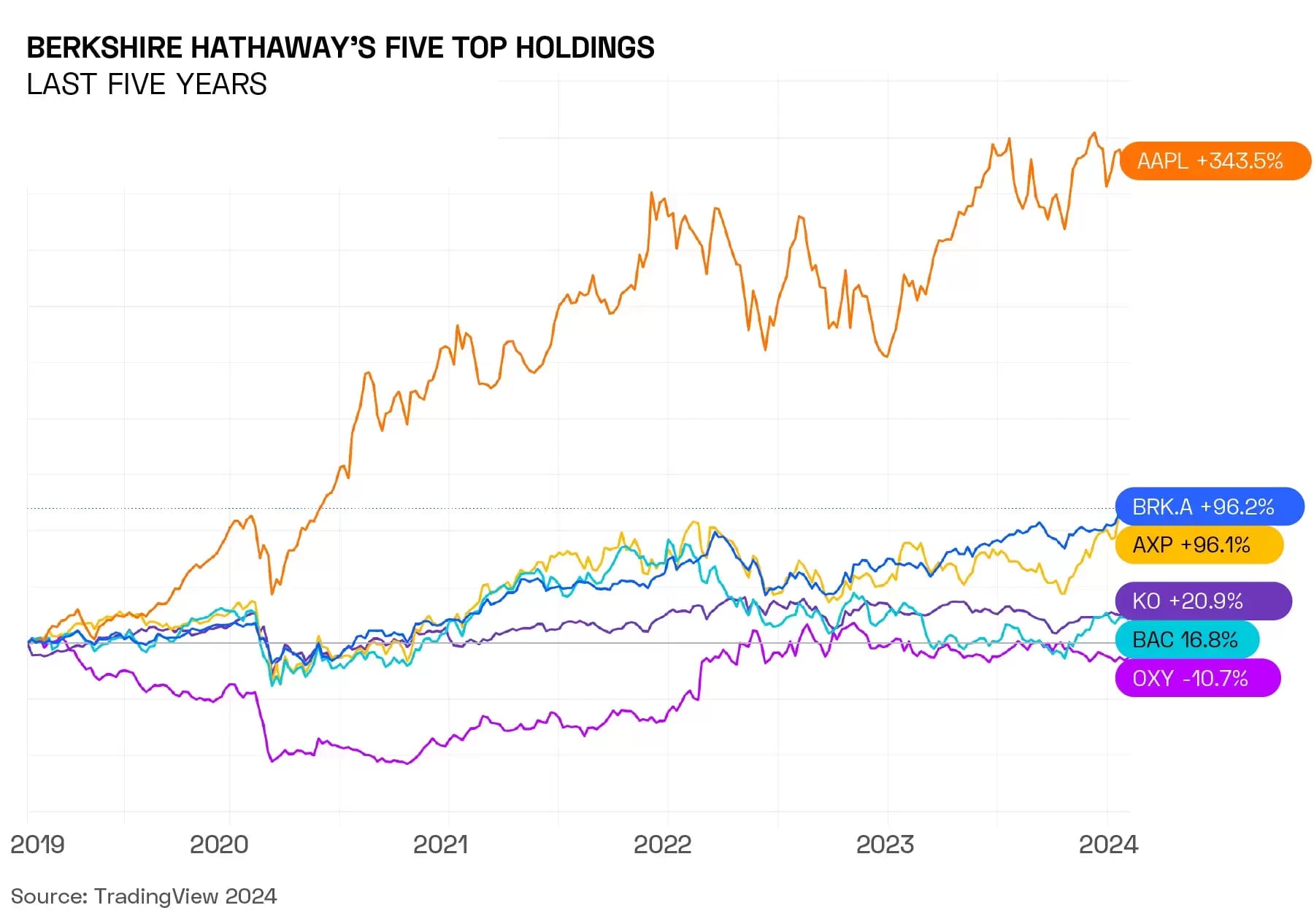

Underscoring the effectiveness of Buffett’s approach to long-term value investing, the five-year chart tells a clearer story. Over this time frame, Occidental is the only stock that has fallen, and all the others have posted gains of over 16%.

Investors seeking to replicate Warren Buffett’s returns could invest in the stocks in which Berkshire Hathaway itself invests.

According to the firm’s 13F filing, Berkshire Hathaway added and held Sirius XM Holdings [SIRI] and Atlanta Braves Holdings [BATRK] during the quarter ending 30 September. A more direct way of tapping into the Buffett strategy would be to own Berkshire Hathaway stock itself.

There would be something ironic about adopting either of these approaches, however.

Buffett’s philosophy and strategy are rooted in a thorough analysis of businesses that the market has overlooked. Buying stocks because someone else already has, in the hope they will appreciate in price, might well constitute the antithesis of value investing.

Put another way, were the Oracle of Omaha writing this, his advice might be for individual investors to perform their own research, based on the formulae above, into businesses operating within sectors they know well themselves, and decide independently what they want to own over the long term.

“The best investment by far is anything that develops yourself…Whatever abilities you have can’t be taken away from you.” — Warren Buffett

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy