The utopian future portrayed in The Jetsons is fast becoming a reality, from mechanical arms flipping burgers to robot butlers gliding down hotel hallways providing room service — including at Alibaba’s [BABA] FlyZoo hotel in Hangzhou, China.

But the robotics theme is about more than cute humanoids that provide entertainment and service our every whim. The industry is transforming how companies do business in a range of ways, and the coronavirus pandemic has only turbocharged this.

A combination of job losses, social-distancing measures and supply-chain disruptions has led companies in the food, logistics and manufacturing industries to adopt robotics in order to adapt and survive. Concerns over hygiene have also been a boon for cleaning robots, while the pressures placed on healthcare services as a result of COVID-19 have highlighted the important role surgical robots can play.

The recent interest in robotics helped the iShares Automation & Robotics ETF [RBOT] deliver a return of 38.76% in 2020. Since the beginning of January, the ETF has returned 5.8% (as of 5 February’s close) and has been consistently outperforming the S&P 500 since the broader market sell-off last March.

38.76%

Returns of the iShares Automation & Robotics ETF in 2020

The following companies all offer exposure to the ongoing robot revolution.

Robots that clean

2020 was the year robots shone by mopping floors and disinfecting surfaces. Sales of cleaning robots totalled $341m in 2019 and market advisory firm Mordor Intelligence has forecast that this valuation will balloon to $2.3bn by 2025.

For the three months to the end of September, market leader iRobot [IRBT] reported revenue of $413m, up 42.9% from Q3 2019 and up 47.5% on Q2 2020. It was the best-performing quarter for year-over-year growth since Q4 2017.

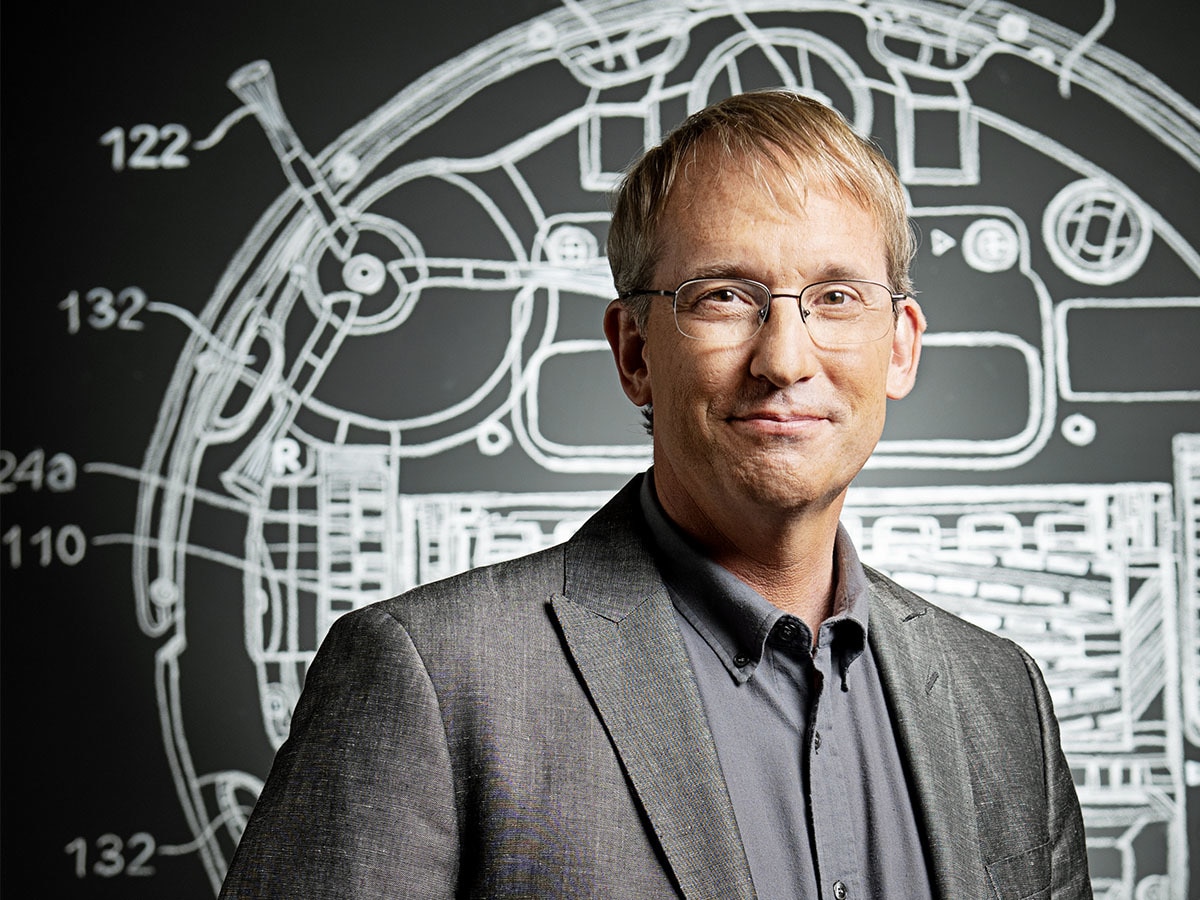

During its Q3 2020 earnings call, the company – co-founded by CEO Colin Angle, pictured, in 1990 — indicated that it expects to deliver revenue of between $480m and $490m for the fourth quarter (reporting on 10 February). This would represent a year-over-year growth of between 12% and 15%, falling in line with the analyst consensus estimate of $485.02m offered by Zacks Equity Research.

Many analysts want to see if a post-pandemic recovery will take the gloss off sales in the second half of 2021 and beyond. According to a research note by Tim Mulrooney, analyst at William Blair, seen by the Washington Post, there should be a continued demand for cleaning robots — largely thanks to their inclusion in commercial cleaning contracts.

“I do believe there has likely been a slight paradigm shift in how people think about hygiene, as well as how corporations and governments approach sanitation-related issues,” wrote Mulrooney.

“I do believe there has likely been a slight paradigm shift in how people think about hygiene, as well as how corporations and governments approach sanitation-related issues” - Tim Mulrooney, analyst at William Blair

Robots that pack

For the fulfilment centres of Amazon [AMZN] and Walmart [WMT], robots have been part of the story for a long time, but there’s a relatively new player in the game.

Last year, Ocado [OCDO.L] completed two robot-related acquisitions. In November, the food delivery company announced its $262m purchase of Kindred Systems, which develops robotic picking systems for warehouses. The second purchase was Haddington Dynamics, which researches and develops industrial robotic arms, for $287m. Ocado also has a partnership with Kroger [KR], helping the US retailer scale up its fulfilment capabilities.

In a research note seen by Barron’s, Luca Ramotti, an ETF analyst at Legal & General Investment Management, wrote: “In setting out the strategic rationale for acquisitions, Ocado highlighted the high costs associated with sorting and selecting goods in its giant warehouses — up to £7m annually per centre.”

“In setting out the strategic rationale for acquisitions, Ocado highlighted the high costs associated with sorting and selecting goods in its giant warehouses — up to £7m annually per centre” - Luca Ramotti, an ETF analyst at Legal & General Investment Management

“Anything that can make the process more efficient is therefore welcome for ecommerce providers,” Ramotti added.

Robots that operate

Sales of medical robots made up 47% of total turnover generated by professional service robots in 2019, according to the International Federation of Robotics. Sales in the US were up 28% year-over-year to $5.3bn — this figure is expected to hit $11.3bn in 2022.

With healthcare systems under enormous pressure at the moment, surgical robots have proven useful in aiding surgeons to perform operations at a safe distance.

$11.3billion

Expected US sales of medcial robots by 2022

Robotic surgery specialist Intuitive Surgical [ISRG] reported fourth-quarter 2020 revenue of $1.33bn, up 3.9% on Q4 2019 revenue of $1.28bn and up 23% on the previous quarter’s sales of $1.078bn. Earnings per share for Q4 were $3.58. These numbers beat analysts’ estimates of $1.23bn and $3.12 per share.

The positive earnings report resulted in a slew of upgrades for the stock. Lawrence Keusch, analyst with Raymond James, reiterated his outperform rating and raised the price target from $800 to $865, which would represent a 13.5% rise from its closing price of $762.25 on 5 February. The stock reached an all-time high of $826.81 on 23 December.

Keusch argued in a note to clients, seen by Seeking Alpha, that while Intuitive Surgical may experience pandemic-related headwinds in the first quarter, there should be “consistent improvements [in results] throughout the year”.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy