The 3D printing industry is evolving. Specialists in the space like 3D Systems are establishing subsidiaries to focus on applications for sub-sectors like healthcare, while outsiders like Michelin are creating their own divisions to get in on the act. Both stocks are held in the ARK 3D Printing ETF.

3D printing stocks have taken a hammering so far this year, but the industry is set for prodigious growth over the coming decade according to recent reports. ARK Invest’s 3D Printing ETF [PRNT] has fallen 38% in the year-to-date (through 28 October), signalling vulnerability in the space amid the market downturn.

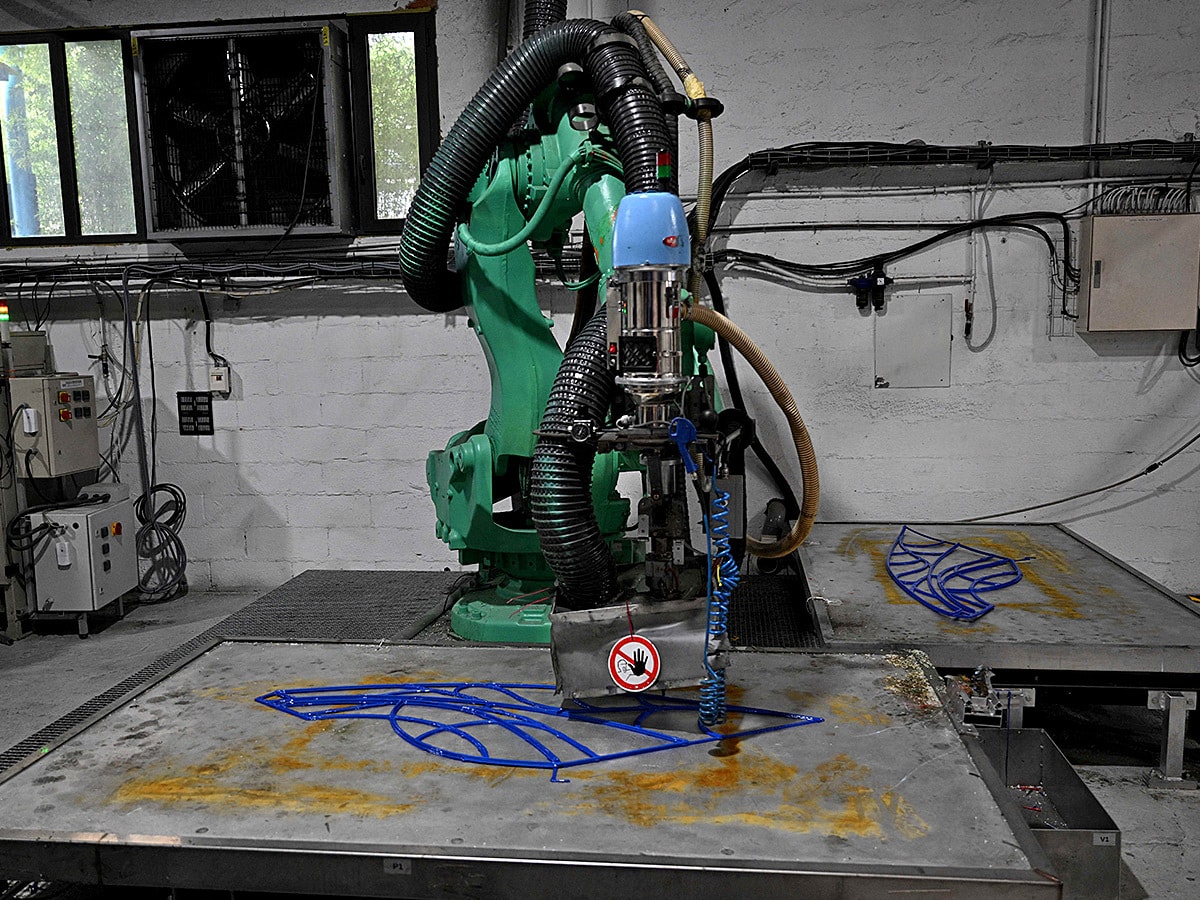

High inflation has contributed to a rise in costs and a fall in demand for many industrial services, and 3D printing is no exception. However, the technology remains a central component of modern manufacturing processes, in products from tyres and engine parts to human organs, and is expected to grow over the next decade.

The fund’s top holdings include 3D specialist Faro Technologies [FARO], which tops the list with a 4% weighting as of 31 October, and manufacturing giant Trimble [TRMB], which comes second with a 3.8% weighting. Faro’s share price has fallen 58.2% in the year-to-date October, while Trimble’s has dropped 30.9%.

Automotive stocks lead 3D printing market

A recent report by Strategic Market Research recently forecast a 21% compound annual growth rate (CAGR) over the next eight years for the 3D printing market, which would see the industry reach $77.8bn by 2030. Rising demand for applications in sectors such as healthcare, automotive and aerospace will be the primary drivers of growth in the sector. Automotive is the largest sector using additive manufacturing, with more than 20% of its market share exposed to the vertical.

A separate report by ResearchandMarkets.com valued automotive 3D printing at $1.7bn for 2020, and estimated that it will grow slightly faster than the 3D printing market as a whole with a CAGR of 23.7% from 2021 to 2030, reaching $13bn within that period.

With that in mind, tyremaker Michelin [ML.PA] could feature higher on the ARK 3D Printing ETF list of holdings from where it currently sits at 29th on the list. Michelin has been using metal printing technology to design and produce moulds for its tyre products since 2006. Michelin’s share price fell 25.1% in the year-to-date, though has rallied 13.9% over the previous fortnight.

3D Systems drags down PRNT’s performance

Some of the more revolutionary applications of 3D printing technology will be seen in the world of healthcare and medicine. Earlier this year, 3DBio Therapeutics made headlines when a human ear it had created using 3D printing technology was successfully transplanted onto a 20-year-old woman who had provided the cells from which the ear was created, according to The New York Times.

3D Systems [DDD], which has a 3.13% weighting in the 3D Printing ETF, recently announced the formation of a 3D bioprinting subsidiary named Systemic Bio. Using 3D Systems’ Print to Perfusion program as well as technology from Allevi, another subsidiary, Systemic Bio intends to use 3D bioprinting to produce vascularized organ models using human tissue.

3D Systems’s President and CEO Dr. Jeffrey Graves said that the company’s potential to “manufacture hundreds or even thousands of custom-designed, proprietary human tissue models” could allow healthcare companies to test the efficiency of drugs, saving time in their development processes.

3D Systems’ share price has dragged on the 3D Printing ETF throughout the year, however, falling 58.5% to date.

The next frontier in manufacturing

ARK’s own investment case for the fund cites end-use parts as “the next frontier” for the 3D printing industry. The firm believes that this segment has a market potential of $490bn, and that penetration will grow from 1% in 2022 to 20% in 2026.

The rise of electric vehicles over the next five years is also cited as another driver for the industry, with an anticipated eightfold increase in sales forcing manufacturers “to adapt by retooling and reinventing manufacturing lines.” The fund expects 3D printing to facilitate prototyping and eliminate redundancies, easing this transition for auto manufacturers.

ARK expects 3D printing to radically change the face of industrial production over the coming years. In the near-term, that means helping companies overcome supply chain and labour disruptions. The asset manager forecasts the value of 3D printing in manufacturing to increase from $16bn in 2020 to $1.1trn in 2030.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy