MP Materials [MP] is the leading rare earth minerals producer in the Western Hemisphere. The company operates the only rare earth mining and processing facility in the US.

Lynas Rare Earths [LYSCF], based in Australia, is the largest rare earths producer outside China and a key supplier to Western markets through its Mount Weld mine and Malaysian processing facility.

USA Rare Earth [USAR] is developing a sintered neodymium magnet manufacturing plant in Oklahoma. The company went public in March and has yet to earn revenue.

Years of strategic planning and relaxed environmental standards have allowed Beijing to dominate rare earth refining. In 2024, China accounted for 91% of global refined output and 60% of total mine production, according to the International Energy Agency (IEA).

Against this backdrop, we examine these three key players in the non-Chinese rare earth mining industry. We’ll discuss the sector’s dynamics, review each stock’s recent performance, and explore the bull and bear cases for MP, LYSCF and USAR stocks.

Sector Talk: Escalating Sino-US Tensions

“We’re in one now,” declared US President Donald Trump on October 15, when asked by a reporter if the country would enter a “sustained trade war” with China.

The statement came after China imposed new export controls on rare earths. The updated rules require foreign companies to secure government approval before exporting products made with Chinese rare earths, and to disclose their intended use.

Beijing’s move highlights the Asian nation’s continued dominance over the minerals, vital to everything from consumer electronics to fighter jets. In response, the Trump administration has made boosting domestic rare earth production a national priority.

With the temporary trade deal signed between the world’s top two economies set to end in November, authorities are scrambling to agree on new terms, while manufacturers turn to non-Chinese rare earths producers to shield their businesses from the trade war.

The escalating trade tensions have already begun reshaping supply chains and prompting a wave of strategic investments across the rare earths sector.

In July, the United States Department of Defense (DoD) signed a deal with Las Vegas-based MP Materials to become its largest shareholder, with a 15% stake. The agreement also saw MP Materials sign a price floor commitment of $110 per kilogram for neodymium and praseodymium (NdPr) oxide products with the DoD — well above the long-term average price of $60 per kilogram — and secure $1bn in financing from JPMorgan Chase [JPM] and Goldman Sachs [GS].

Overseas, Australia’s Lynas Rare Earths continues to scale new record highs, benefiting from its position as “one of the only major players outside China,” according to the IEA.

The global push to build independent supplies of these critical minerals has even lifted pre-revenue companies such as USA Rare Earth.

In early October, USAR stock jumped over 8% amid expectations of a similar deal with the US government, after CEO Barbara Humpton said the company was in “close communication” with the White House.

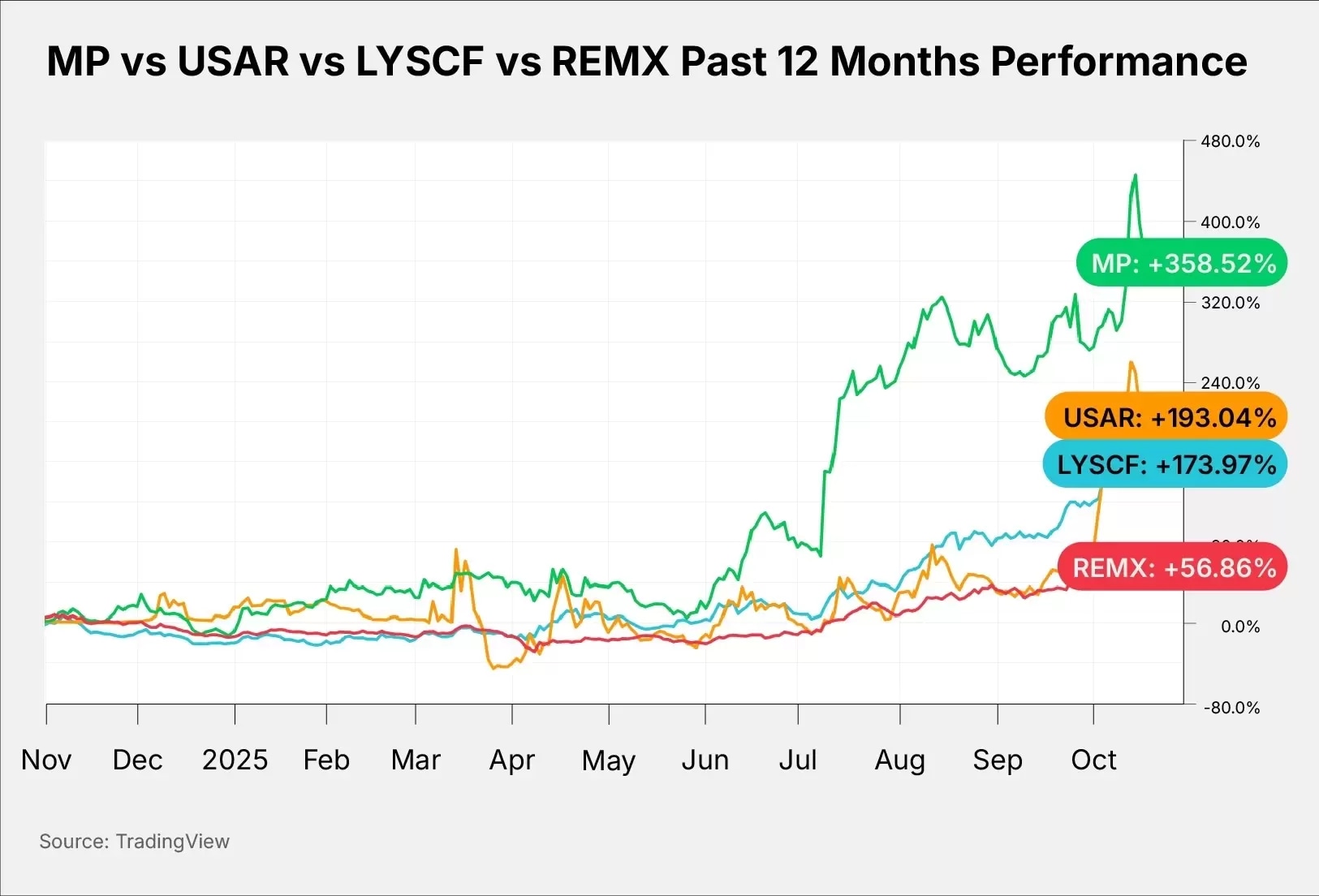

Market performance of MP Materials, Lynas Rare Earths and USA Rare Earth

MP Materials’ share price is up over 431.41% year-to-date. On October 14, MP Materials hit an all-time high of $100.25.

As of October 20, USA Rare Earth was trading at $31.59, up 215.9% since its IPO in March 2025.

Meanwhile, OTC shares of Lynas Rare Earths were trading at $14.00, as of October 20, up 249.13% in year-to-date terms. The company’s primary listing is on the Australian Stock Exchange.

In comparison, the VanEck Rare Earth and Strategic Metals ETF [REMX] — which includes Chinese and global rare earth companies such as Australia’s Iluka Resources [ILKAY] and China Northern Rare Earth Group [600111:SS] — is up 85.85% year-to-date.

Here is how the three stocks currently compare to each other.

MP | USAR | LYSCF | |

Market Cap | $12.57bn | $2.59bn | $11.66bn |

P/S Ratio | 48 | N/A | 29.69 |

Estimated Sales Growth (Current Fiscal Year) | 41.26% | N/A | 111.61% |

Estimated Sales Growth (Next Fiscal Year) | 147.21% | N/A | 38.51% |

Source: Yahoo Finance

MP, USAR and LYSCF: The Investment Case

The Bull Case for MP Materials: US Government Support

MP Materials is North America’s leading producer of rare earth minerals. It operates the world’s second-largest rare earth mine at Mountain Pass, California.

The company is also building an advanced facility in Fort Worth, Texas, to manufacture rare earth metals, alloys and magnets. The facility is expected to increase the company’s US rare earth magnet manufacturing capacity to an estimated 10,000 metric tons once operational in 2028.

Given its strategic role in the US supply chain, the company has attracted significant federal backing from the DoD.

Further strengthening its position, in July 2025 MP Materials signed a long-term supply agreement with Apple [AAPL] to provide rare earth magnets.

The Bear Case for MP Materials: Lofty Valuations

A growing concern for investors is MP Materials’ elevated valuation. Despite its strong strategic position and government backing, the company’s market cap has ballooned to over $12.5bn, with a forward P/E ratio exceeding 80 and a P/S multiple near 48 as of October 20.

These figures are far higher than industry peers such as Lynas Rare Earths — with a forward P/E ratio of 52.03 — and Iluka Resources — with a forward P/E ratio of 40.46 — indicating that much of the optimism surrounding US rare earth independence may already be priced in.

Investors should also note MP Materials derived 80% of revenue in 2024 and 90% of revenue in 2023 and 2022 from sales to Chinese company Shenghe Resources. However, in April 2025, Sino-US tensions saw MP Materials cease shipments to China.

The Bull Case for Lynas Rare Earths: Biggest Producer Outside China

Lynas Rare Earths is the biggest rare earths producer outside China and contributed 4% of global refined rare earths production in 2024, according to the IEA. In comparison, MP Materials only accounted for 1% of global refined rare earths production in 2024.

In November 2024, the company opened Australia’s first rare earth processing facility and announced plans to build refineries in the US supported by $258m in funding from the DoD.

In May 2025, Lynas became the first commercial heavy rare earths producer outside of China following upgrades to its processing plant in Malaysia.

Furthermore, government support for the US rare earths industry, which included a price floor commitment of $110 for NdPr, has helped shore up higher selling prices from Lynas too.

The Bear Case for Lynas Rare Earths: Political Risks

The company remains exposed to political and regulatory risks in Malaysia.

Lynas Rare Earths’ flagship processing facility in the country has repeatedly come under scrutiny from government agencies and local communities over environmental concerns. In 2018, Malaysia’s newly elected administration launched an investigation into the company’s handling of radioactive waste generated during rare earth refining.

Additionally, Lynas’ expansion plans in Australia and the US require substantial capital, exposing it to cost overruns and execution risks. Falling rare earth prices or easing global supply chain tensions could also erode the premium currently attached to non-Chinese suppliers.

The Bull Case for USA Rare Earth: Magnet Supply Chain

USA Rare Earth aims to establish itself as a key player in the US rare earth magnet supply chain. The company is currently developing a neodymium magnet manufacturing plant in Stillwater, Oklahoma.

In March 2025, USA Rare Earth announced plans to begin prototyping permanent neodymium magnets for customers in the second quarter of 2025. The company aims to commission the plant’s first production line in early 2026.

In August, USA Rare Earth disclosed that the company had signed 12 memoranda of understanding and joint development agreements representing the potential for approximately 300 tons of annual production with customers across the aerospace, defense, data center and automotive sectors.

The Bear Case for USA Rare Earth: No Revenue

USA Rare Earth has yet to generate any revenue since its founding and continues to post operating losses, resulting in a growing accumulated deficit.

The company faces significant execution risk as it works to establish its neodymium magnet production business. Its ability to sustain operations depends largely on successfully implementing its business plan, securing additional funding and maintaining strict control over expenses.

As of June 30, USA Rare Earth had cash of about $121.79m. The company reported a loss from operations of $8.80m in Q2 2025.

Conclusion

MP Materials stands out for its strong US government backing and the only operational rare earth mine in the US, while Lynas benefits from its early-mover advantage and global scale. USA Rare Earth remains speculative but provides early exposure to the US magnet manufacturing supply chain.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy