Founded in 2012, Upstart [UPST] has made a name for itself in the consumer credit space by increasing approval rates and offering cheaper loans.

The secret? Artificial intelligence (AI), says Paul Gu, Co-founder and Chief Technology Officer at Upstart.

“Upstart is an AI lending company at heart,” he explains. The company uses machine learning to assess an individual’s creditworthiness, looking at a range of factors beyond traditional credit scores, including education and employment history. Indeed, Gu imagines a future where more credit issuers employ automated tools to improve the lending process, and boost overall access to credit.

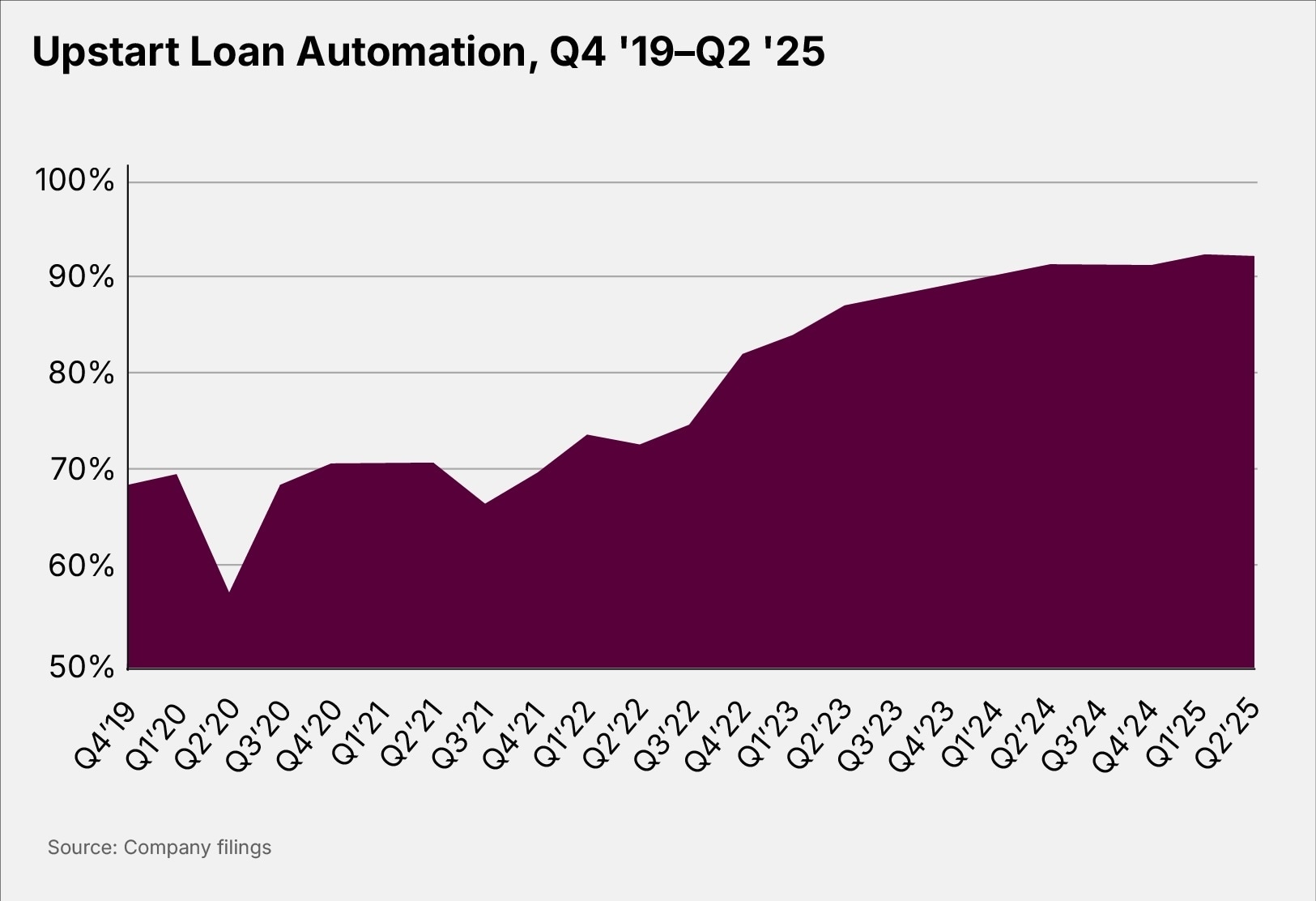

“Today, about 92% of all our loans are what we call fully automated,” he says. “That means that no manual work had to be done on the borrower’s side or on Upstart’s side.” That rate has improved from 69% at the end of 2019, as shown in the graph below.

In the latest episode of OPTO Sessions, Gu joins us to discuss the abilities and limitations of AI systems, how to combat fraud, and what AI lending with look like five to ten years from now.

Neural Networks

As a player in the competitive fintech ecosystem, how is Upstart looking to stay ahead? “The number one thing is we continue investing in the AI to make it better every day.” Given the breakneck pace of technological development, full commitment is key. “With the pace of AI, if you’re not going to be both feet in, going at 100%, you’re basically just not going to get anywhere.”

Understanding how AI works can be quite a challenge, but Gu explains how Upstart improves its models in simple language: “it gets deeper, and it gets wider.”

By deeper, Gu means improving the core capabilities of the AI models that Upstart works with. For the loan approval process, for example, the consumer sets the performance expectation — “they are expecting to get a loan in real time,” Gu says — and the company works to meet it by addressing latency and accuracy issues.

The process of widening, meanwhile, means “applying AI to virtually everything that we do.” Beyond office-level efficiency gains, that means employing AI tools to facilitate all parts of the lending process. And it’s paying off, Gu adds. “We’ve started applying it to the servicing of loans, which can help people structure their payments and timing. The second order effect of that is you get much higher repayment rates.”

As many other companies have discovered, AI has also proved invaluable for Upstart’s targeted marketing efforts, helping to “reach the right people who actually need the product at the right time.” That said, the company has noticed their cost of acquiring customers has been trending down — the opposite of the trend usually seen among businesses. Better AI processes have had a hand in this by demonstrating the creditworthiness of a larger part of the population. “The rate at which we’re growing the population of people for whom we can be the best rate and best process is actually faster than the rate at which we’re depleting the low-hanging fruit from a targeting and marketing perspective,” Gu explains.

Combatting Fraud

In the latest quarter, 92% of Upstart’s loans were automatically processed, from start to finish. Why not 100%?

“The fundamental limiting constraint is that you have a non-zero number of fraudsters that are coming to attack your system,” Gu admits. While fully automating the entire process is possible, once the machine learning models have identified an individual as a potential fraudster, “you want to send them through really as cumbersome a review process as you possibly could.”

Lenders deal with two distinct kinds of fraud, Gu relates. The first, known as third-party fraud, involves stolen identities used by professional fraudsters, either individually or in groups. “These are easier to detect because they have common patterns to their behavior that you can detect,” he says. “And of course, that is what AI is very good at doing.”

The second kind of fraud, first-party fraud, involves “a person [who] has decided that they want to strategically trash their credit score in exchange for more money.” There, you have to look for signs such as how fast the individual is going through the application — non-traditional signals that Upstart’s AI models also excel at identifying. However, it remains “very hard to completely eliminate.”

By working with banks, Upstart is enabling more traditional lenders to deploy its AI screening systems, which helps boost banks’ security and also gives them access to a larger consumer base. “New customers today are so much more likely to want to come via the internet instead of walking in a branch,” he notes.

And while the models are already improving lending outcomes, there’s still a way to go. The key to further gains, Gu says, is data. “The more sophisticated your model architecture, the exponentially more training data that you need in order to make it work.”

Lastly, while AI may ultimately conduct much of the lending process, there’s still room for a human touch, Gu says, pointing to the importance of financial counseling. Even with easy access to cheap credit, “at the end of the day, you still need to decide how you want to live your life and what kind of lifestyle you want to support. I think ultimately those are human questions.”

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy