Virgin Galactic’s [SPCE] share price has nearly doubled in value so far this year, from $11.79 on 2 January to $22.45 on 31 July, giving it a market cap of over $4.7bn.

However, there’s been a bit of turbulence. Positive test flight headlines in February briefly pushed Virgin Galactic’s share price to a high of $37.35, before the COVID-19 crisis crash-landed the stock back to $10.56 in mid-March.

Since then, Virgin Galactic’s share price has enjoyed a smooth, steady take-off, with a 28% lift to $14.78 in the second quarter and a further 40% rise in July alone.

There’s also been a lot of hype and excitement around Virgin Galactic’s share price recently, especially after it unveiled the cabin design for its SpaceShipTwo space planes last week, showing the 8,000 people on its waiting list what they’ll get for their $250,000.

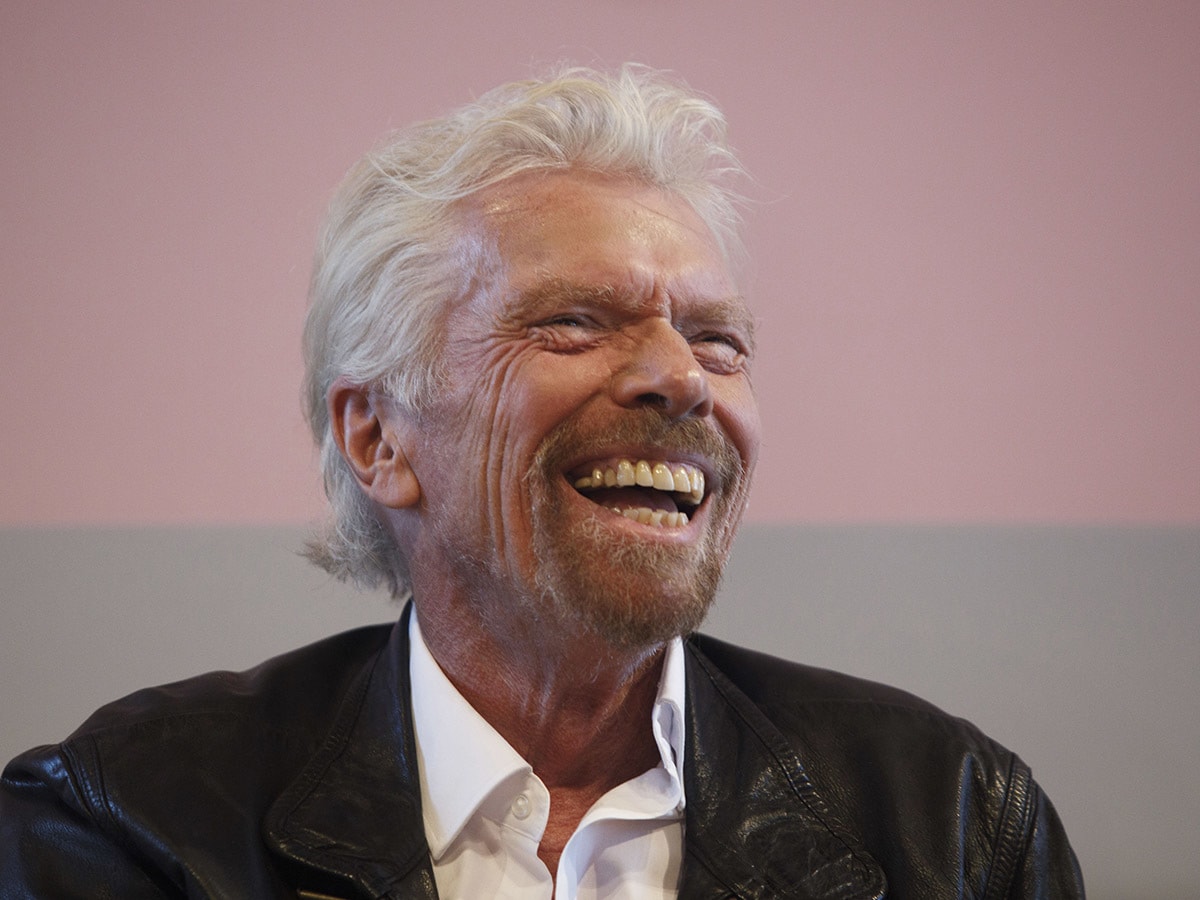

Richard Branson said in a statement that the cabin “has been designed specifically to allow thousands of people like you and me to achieve the dream of spaceflight safely” .

Anticipation of the announcement gave Virgin Galactic’s share price a 2.5% thrust on 27 July. However, the stock has since fallen 9.9% since then to $22.45 on 31 July.

Can Virgin Galactic’s upcoming earnings report, due on Monday (3 August), help lift the company’s share price? This is, after all, a still-unprofitable space company with no guaranteed revenue until it actually launches its extraterrestrial shuttle service.

Not just a “story stock”

There is the possibility that the share price could go higher after Virgin Galactic announced it was just one spaceflight away from getting its commercial operator's license.

Following a string of successful suborbital flights from the company’s carrier aircraft Unity, it’s thought the company needs to complete just one or two more missions to satisfy the Federal Aviation Administration's licensing requirements.

If successful, this will bring Virgin Galactic one giant step closer to its ambition to take passengers into space by the end of this year.

Some analysts have dismissed Virgin Galactic’s trajectory as “story stock”, especially as the company is yet to schedule flights. But investors are likely to have confidence in this month’s appointment of a new CEO.

Michael Colglazier, who as Disney Parks’ former president and managing director knows a thing or two about sprinkling stardust, has been drafted in to guide Virgin Galactic’s next phase as a public-facing company.

“He will create an amazing customer experience for our future astronauts as we ramp up for spaceflight operations,” Chamath Palihapitiya, company chairman, said. Its previous CEO George Whitesides, a former NASA chief of staff, ensures continuity by moving across to become chief space officer.

Undervalued?

The forecast for second-quarter earnings among CNN Business analysts is a loss of $0.26, yet Virgin Galactic has a consensus rating of buy among four analysts polled, with a majority of three, and one hold rating. The median share price target for the stock is $23.50, a 4.7% increase on 31 July’s closing price.

There are also questions as to whether the share price is actually undervalued, given Elon Musk’s rival SpaceX was valued at $36bn following its February funding round, despite not yet being publicly listed and having only run its first manned mission in May.

As a result, Virgin Galactic could see a boost following its recent agreement to work with NASA on developing technologies for advanced passenger flight at supersonic and hypersonic speeds. In the longer term, UBS estimates space tourism will be a $3bn market by 2030.

$3billion

Estimated value of space tourism by 2030

Virgin Galactic looks surprisingly solid with listed assets at $548m, against liabilities of $136m, according to its first-quarter results. It had taken 400 refundable deposits during the quarter, giving it over $100mn in potential future revenue.

Once it starts scheduling flights, and getting hold of that money, Virgin Galactic could boldly go into a brand new trading space. But until Unity and its passengers land safely, everything’s still up in the air.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy