1. Introduction

Electric vehicles (EVs) play an essential role in decarbonising the transportation sector, which relies more heavily on fossil fuels than any other and accounted for 37% of global CO2 emissions in 2021, according to the International Energy Agency (IEA). Global EV sales have experienced exponential growth in recent years, in 2022 increasing by nearly 60% and surpassing 10 million for the first time. One in every seven passenger cars bought worldwide in 2022 was electric, according to the IEA, a ten-fold increase since 2017, when only one in every 70 vehicles sold was electric. However, there is still some way to go before EVs can realise their full potential in the fight against climate change. Reaching a path aligned with the IEA Sustainable Development Scenario will require there to be 230 million electric vehicles on the road worldwide by 2030.

The global EV market consisted of an estimated 8.2 million units in 2022 and is expected to grow at a CAGR of 21.7% through 2030, to eventually reach 39.2 million units, according to an April 2022 report published by Markets and Markets.

In 2022, China held the largest EV market share, with one in every four cars purchased being electric; in Europe, this figure was one in five, while in the US, it was almost one in ten. By contrast, EV sales are still low in emerging and developing economies, such as Brazil, India and Indonesia, where fewer than 0.5% of car sales are electric, according to research by the IEA.

39.2million

Expected EV units by 2030

2. Key players

Tesla [TSLA]

- With a market cap of $598.6bn as of 29 March, the US company is a leading EV manufacturer. Its mission is “accelerating the advent of sustainable transport.”

- Tesla’s Model Y was the most popular plug-in EV in the world in 2022, with global sales of over 770,000.

- Its year-on-year revenue growth was 51.4% in 2022, and although its share price fell by 65% in the same year—due to supply chain issues and uncertainties related to the future role of its CEO Elon Musk—Tesla is still leading the EV race.

BYD [BYDDY]

- Chinese carmaker Build Your Dreams (BYD) has a market cap of $97.5bn, and switched to producing only electric and hybrid vehicles in March 2022.

- The company beat Tesla in terms of EV sales in 2022, with 1.9 million vehicles sold, compared to 1.3 million for Tesla.

- BYD is the leading EV brand in China, and in January, it began selling in Japan. It has also announced plans to both sell and produce its vehicles in Europe.

NIO [NIO]

- The Chinese EV manufacturer has a market cap of $15.4bn. It managed to increase production by 51% year-over-year in December 2022.

- Its vehicle deliveries reached 122,486 in 2022, a 34% increase from 2021; however, it reported a loss of 3.07 Chinese renminbi (¥) per share on revenue of ¥16.1bn in Q4, wider than Refinitiv analyst estimates of a ¥1.77 loss per share on ¥17.3bn in revenue.

- The company is set to bring a new mainstream line of EVs to Europe after it launches in China in 2024.

3. Background

The environmental benefits of EVs as sustainable alternatives to internal combustion engine (ICE) cars have been a key driver of the market’s performance over the past decade. Both new and legacy carmakers are gearing up to embrace electrification and are investing heavily in its development. Traditional auto brands such as Volkswagen [VOW3.DE], Ford [F], Toyota [7203.T], Nissan [7201.T], and General Motors [GM] are ramping up their spending to catch up in the EV race, with many converting favourite consumer models into electric versions. Tesla [TSLA] has been dominating EV sales, covering 65.4% of the global EV market in 2022.

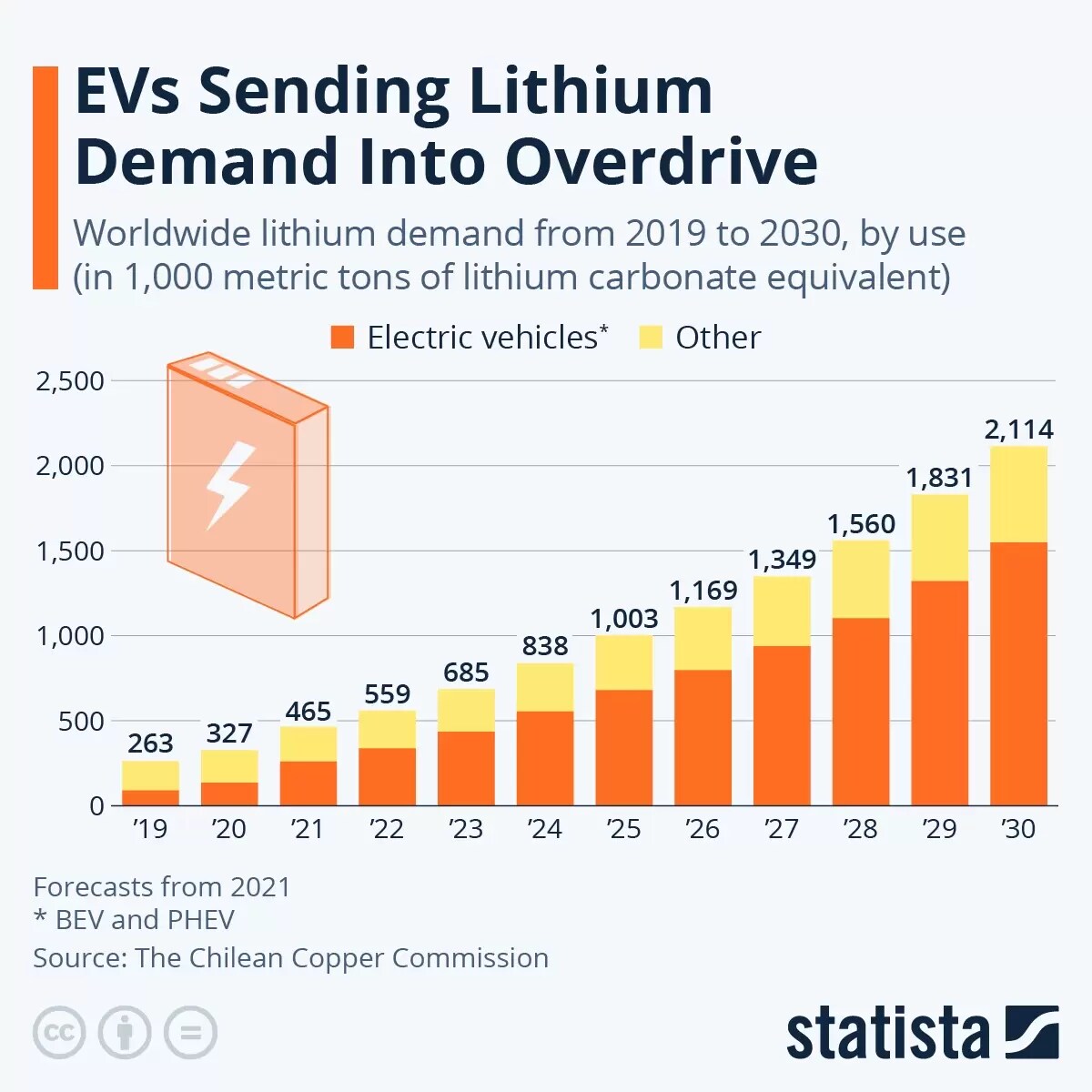

While BloombergNEF research suggests that consumer demand for EVs is showing signs of slowing this year, Morgan Stanley has forecast that EV’s share of global vehicle sales will likely increase from 7% in 2022 to almost 90% in 2050. This growing demand is catalysing demand for lithium, the key component of EVs’ lithium-ion batteries. As shown in the Statistainfographic below, demand for lithium is expected to increase from 263,000 metric tons in 2019 to over 2.1 million metric tons by 2030.

According to the IEA, China was the global leader in battery manufacturing in 2021, with a monopoly of 75% of the world total, followed by the US, Hungary, and Germany. In August 2022, US President Joe Biden enacted the CHIPS and Science Act to boost domestic chip research, development and production; it will also serve to challenge China’s semiconductor industry. The move was followed by export controls, announced in October, that limit the sale of US-made semiconductor equipment to companies with branches in China. Taiwan Semiconductor Manufacturing Company (TSMC) [TSM] is building a second plant in the US state of Arizona, where it will likely make chips for Apple [APPL], as Opto has detailed.

4. Growth Drivers

Multiple factors are driving the success of EVs.

Sustained government policy —

Global public spending on EV-related subsidies and incentives almost doubled in 2021, to nearly $30bn, according to an IEA report. Many countries continue to pledge to phase out ICEs with ambitious electrification targets for the coming decades. Five times more new EV models were available in 2021 compared to 2015, reaching around 450 models in the market, increasing attractiveness for consumers.

In the US, the Infrastructure Investment and Jobs Act (IIJA), signed into law in November 2021, includes over $1trn in public investment, which is intended to accelerate the clean-energy transition, improve the reliability of the electric power infrastructure, and ultimately reduce range anxiety. In August 2022, the US government signed the Inflation Reduction Act (IRA), directing $500bn in new federal spending toward carbon emissions reduction and tax breaks to boost clean energy, reduce healthcare costs and increase tax revenues.

Race to net zero —

As these incentives take effect and consumers grow more concerned about their carbon footprints, demand for EVs is expected to keep increasing. With a wholesale move to electric vehicles seen as key to reaching net-zero emissions by 2050, the EU announced that the sale of petrol and diesel vehicles will end by 2035. The UK has gone further, with a ban on new ICE vehicle sales beginning in 2030, and new hybrid car sales to be banned from 2035, as well as other policies such as the Ultra-Low Emission Zone in London. However, governments might have to speed up their efforts. In a March 2023 report, the Intergovernmental Panel on Climate Change highlighted that there is very little chance of keeping the planet from warming by over 1.5C above pre-industrial levels, as it has already warmed by 1.1C. The report suggests that the only way to avoid the worst-case climate scenarios is by shifting towards clean energy faster than previously planned.

Falling costs in a competitive landscape —

The EV market is becoming increasingly competitive, with legacy car manufacturers and new companies alike moving into the space. According to the IEA, the cost of battery EVs (BEVs) has been steadily decreasing over the past few years, from a global average of $36,000 in 2021, down 7% from 2020. The factors driving the drop in prices include improvements in battery technology, increased production and competition among automakers, and government incentives to encourage broader EV adoption. In March, Benchmark Minerals reported that lithium prices had dropped almost 20% since January 2023, even as EV sales continued to rise. Other key battery materials have fallen in price, including cobalt and copper. The drop in commodity prices has made it easier for manufacturers to slash prices for EVs. In March, Tesla lowered the prices of its two most expensive models by thousands of dollars, a move that followed previous cuts by Tesla in January to its Model 3 and Model Y, and by Ford to its Mustang Mach-E. A BloombergNEF report forecast that EV prices will continue to fall, with the average price of a BEV expected to be less than that of an ICE vehicle by 2027.

5. Investment Case

Investing in EVs and related technologies is an important part of the transition to a low-carbon economy. Besides offering a viable solution to reducing the environmental impact of transportation, EVs also present significant economic opportunities for investors.

First of all, EVs have lower operating costs than gasoline-powered vehicles due to their greater energy efficiency and lower maintenance requirements. As battery technology continues to improve, the cost of EVs is also expected to decline, making them more affordable and accessible to a broader range of consumers.

“We’re at an inflection point for electric vehicles,” said Jay Jacobs, the US head of thematics and active equity ETFs at BlackRock, on the 9 March episode of Opto Sessions.

EVs have “moved from a niche innovator or early adopter product to achieving much more mass-market appeal”, Jacobs added, with government policies such as the IRA and the IIJA fuelling this trend in the United States.

6. Electric Vehicles ETFs Spotlight

Electric Vehicles ETFs that provide exposure to stocks in the sector include:

KraneShares Electric Vehicles & Future Mobility ETF [KARS]

This ETF focuses on companies directly involved in EV and EV component production. Its net assets amount to $178.4m as of 28 March.

Click here to see the fund’s top 10 holdings.

iShares Self-Driving EV and Tech ETF [IDRV]

This broadly focused ETF seeks to track the performance of “emerging market companies that may benefit from growth and innovation in and around EVs, battery technologies and autonomous driving technologies”. As of 28 March, its total net assets amount to $403.9m.

Click here to see its top 10 holdings.

Global X Autonomous & Electric Vehicles ETF [DRIV]

This ETF invests in makers of electric and self-driving cars, including developers of the necessary software and hardware, legacy automakers, and tech companies making their way into the space, such as Toyota, Apple and Alphabet [GOOGL]. As of 28 March, its total net assets amount to $829.8m.

Click here to see its top 10 holdings.

7. Innovation and development

Although this relatively new industry is growing, it could face speedbumps in the short to medium term. Some potential challenges for EV mass adoption include:

Supply Chain Bottlenecks and Geopolitics —

EVs rely on lithium-ion batteries, and there are concerns about the availability of raw materials needed for their production, including cobalt. Currently, 80% of cobalt is processed in China, which could lead to supply chain disruptions in the event of geopolitical tensions or other disruptions.

Lack of Necessary Infrastructure and Manufacturing Capacity —

One of the biggest challenges for EV adoption is the lack of charging infrastructure. While many countries and companies are investing in charging stations, there are concerns that the pace of development may not keep up with demand for vehicles. EVs also require a significant amount of electricity, which could strain the power grid if too many of them are charging at the same time. This could lead to power outages or other disruptions. In addition, as the demand for EVs grows, there are concerns that there may not be enough manufacturing capacity to meet this demand, leading to longer wait times for customers or higher prices.

Disposal Worries —

As the number of EVs on the road increases, the need for recycling and disposal of batteries and other components is expected to grow. Currently, experts are concerned about the environmental impact of battery disposal, and more research is needed to develop effective recycling methods.

Governments and companies across the globe continue to invest heavily in research and development, charging infrastructure, and manufacturing capacity expansion to address these challenges in efforts to ensure a smooth transition to clean energy.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy