In 2022, renewables continued to consolidate the gains that we saw during the big surge from 2020 lows. As a whole, the sector has managed to outperform the wider market, although there have been some exceptions, with underperformance from onshore and offshore wind companies in Europe acting as a wider drag on the sector.

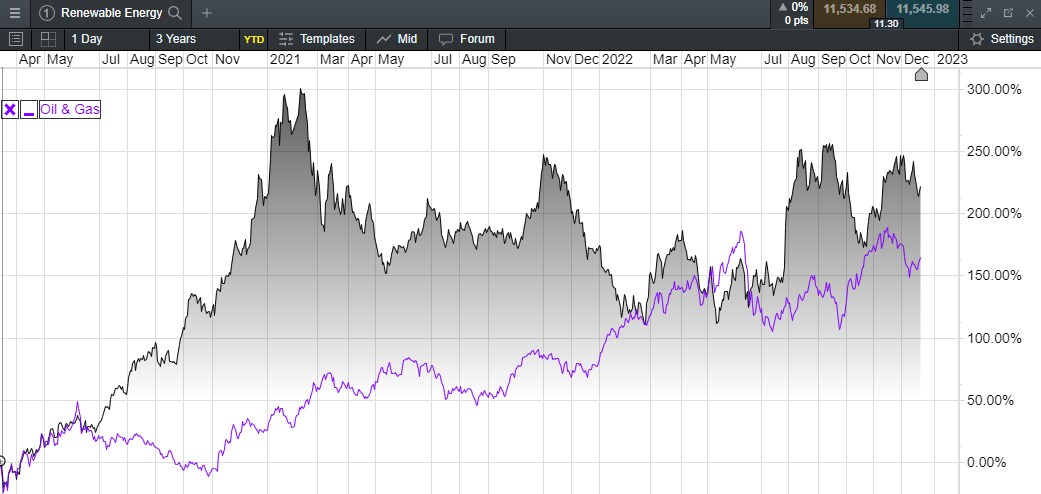

It’s also interesting to see how renewable energy has performed relative to the oil and gas sector, after the big sell-off in response to the first Covid-19 lockdowns back in 2020.

CMC Oil & Gas, Renewable Energy baskets' relative performance post-lockdown lows

While the Renewable Energy basket enjoyed a big surge during 2020, it has spent the next two years trying to consolidate those gains, and has spent most of this year outperforming the wider S&P 500 and Nasdaq 100, but has lagged behind oil & gas, which has benefited from the continued resilience in energy prices, and the fact that these are likely to remain high in the absence of significant new capacity.

If anything, the resilience in fossil fuel prices can be squarely laid at the door, along with the lack of realistic alternatives, of 25 years of political failure on both sides of the Atlantic to plan for a renewables transition. Consequently, we’re still seeing that failure of policy even now, as politicians get captured by political ideology instead of embracing unpopular pragmatism.

As climate activists adopt unrealistic policy positions which offer little in the way of solutions to record high energy prices right now, politicians prefer to pander to that zeitgeist rather than focus on the world as it is now, instead choosing to focus on how they would like it to be, which while noble doesn’t help with the immediate problem.

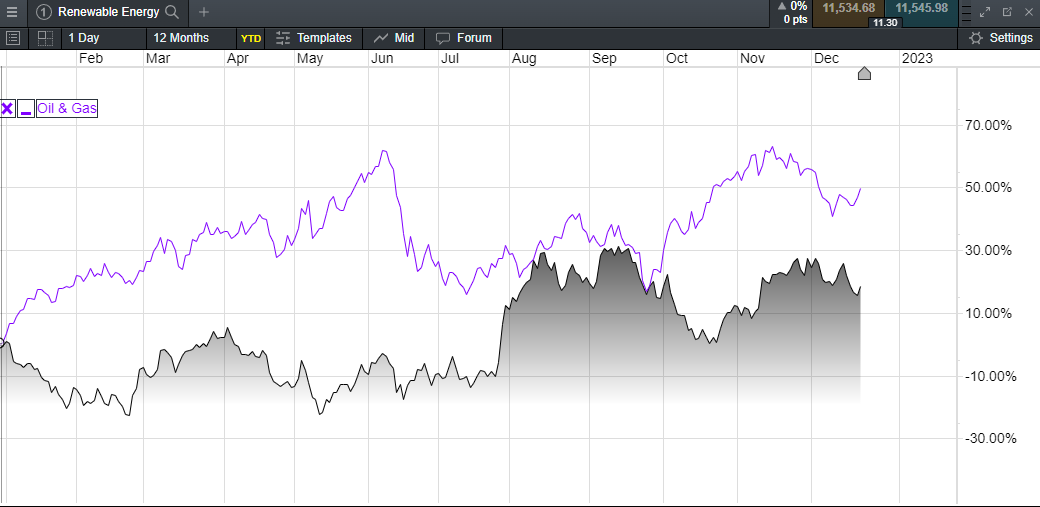

Oil & Gas vs Renewable Energy performance (year-to-date)

This lag behind oil and gas has been no more apparent in the performance this year as shown above between the CMC Renewable Energy basket, relative to the CMC Oil & Gas basket which has seen gains of over 40%.

Having seen gains in excess of 250% by the start of this year, we have started to see a bit of a correction, and a pause, which when you look at the fundamentals of a lot of the companies in the Renewable Energy basket, isn’t altogether surprising. Even the more established companies in the renewable energy space have struggled this year, although they have performed well over a longer period.

Denmark for example, has two well established companies that specialise in offshore and onshore wind, in Orsted and Vestas Wind Systems.

Orsted, Vestas Wind Systems comparison chart since 2020

These two companies have a much better and durable pedigree in this space, and did very well in the aftermath of the pandemic lockdowns, as shown by the graph above, however its notable that in the last two years they have struggled to move higher, with Orsted struggling to make any gains at all.

Investment in wind power, and renewables in general remains a capital-intensive process, and margins aren’t anywhere near as large as they are for fossil fuels, although the recent spike in electricity prices has helped matters in this regard, and which saw the company raise its full-year profit guidance for 2022 to between DKK21bn to 23bn, with most of that coming from its coal units.

Nonetheless, unlike the oil majors who can also create and sell by-products of their core product, renewables providers don’t have that same luxury, so can’t always rely on that when the wind doesn’t blow. This difficulty is reflected in the capex numbers for Orsted, which has seen annual capex rise from DKK17.6bn in 2017, with the intention to spend up to another DKK350bn, or about $54bn by 2030, to increase its currently installed capacity from 15GW to 50GW.

This is a significant increase in spend for a company that has seen its revenues average around DKK65bn since 2017, although its life has been made a little easier due to the energy windfall on the back of the sharp rise in electricity prices, which has seen annual revenues surge from DKK77.67bn last year to well over DKK100bn so far year to date.

As a more mature business in this space, Orsted also has the luxury of being profitable, recording a €3.6bn operating profit in the first nine months of this year, with €1.5bn of that related to the farm downs of Hornsea 2 and Borkum Riffgrund 3. This will always be an issue with respect to wind power generation, as with most renewables’ revenue. You are at the mercy of the elements, and lower wind speeds mean lower revenues, all the while investment in new capacity require significant upfront costs.

This year the business has spent €2.2bn on new projects in Greater Changhua in Taiwan, Hornsea in the UK, as well as developments in the US and Poland. With the cost of raw materials like copper becoming more expensive, the transition not only to wind but also solar is only likely to become more challenging as margins become thinner.

Looking at some of the companies within the Renewable Energy basket, we can see how some of the market leaders in this space are adapting to higher demand for their products, and how that is being reflected in share price performance, at a time when calls for a transition to renewables has become louder, along with calls that governments actively discourage funding for new sources of fossil fuels. Moving to renewables won’t be a light switch transition, much as many people would like it to be. It will need to be done on a slow burn basis, so that energy price rises don’t drive millions of people into fuel poverty, in a mirror of what is currently happening now.

The Renewable Energy basket contains companies that specialise in the renewable technologies of wind power, solar, hydroelectric, along with the development of battery technology. Of the 18 companies in the share basket, the biggest five make up almost 47% of the total weighting. They are:

1. First Solar 13.09% - American renewable energy company First Solar is a leading global provider of solar solutions, whose share price has seen gains of over 80% year to date giving it a market cap of over $17bn. Annual revenues are expected to be $2.6bn, which is below the levels seen in 2019 when the company turned over $3bn. The company was founded in 1999 and is based in Tempe, Arizona. It manufactures solar panels and is a provider of photovoltaic (PV) power plants and other supporting services. According to its website, First Solar has the lowest carbon footprint, lowest water usage and fastest energy payback of any PV technology firm, and delivers cost-competitive alternatives to fossil fuels. It currently operates many of the world’s largest grid-connected PV power plants.

2. Enphase Energy 13% - Enphase Energy is a US energy management technology company that designs and manufactures residential and commercial solar solutions, and which has seen its share price rise by over 70% year to date. Solar solutions include solar generation, home energy storage and web-based monitoring and control. The company was founded in 2006 and has headquarters in California. Enphase aims to turn sunlight into a safe, reliable and resilient source of energy to power society, using one of the industry’s best-performing clean energy systems. In particular, the company is a market leader in solar microinverters, having shipped around 30 million products across the world for use in residential and commercial markets. It vows to create a carbon-free future for everyone and replace the need for fossil fuels altogether. With a market cap of over $40bn the company has a turnover of over $2bn. Enphase Energy is listed on the Nasdaq and is a constituent of the S&P 500.

3. Maxeon Solar Technologies 11.68% - created in Q2 of 2020 when SunPower Corp split into two separate companies. Headquartered out of Singapore, Maxeon will make use of low-cost manufacturing process to bring the cost of making solar panel overseas with factories in Mexico, Malaysia and the Philippines, and then resell these through the SunPower brand into the US. Maxeon will use its own brand to expand into global markets. It’s still early days for Maxeon with revenues of $783m in 2021, however it is expected to grow this to over $1bn this fiscal year as the kinks come out of its new relationship with SunPower. It is still operating at a hefty loss, although these are expected to come down. The shares are up over 30% year to date.

4. MKS Instruments 4.48% - headquartered in Andover, Massachusetts, the company develops and manufactures advanced pulsed lasers for precision applications, manufactures semiconductors and other advanced electronics which power a variety of new technologies. These include 5G, AI augmented reality, autonomous vehicles, as well as power solutions and plasma generation. Their solutions support green energy development in the creation of products that increase the efficiency of solar, wind and hydro energy solutions. With a market cap of over $5bn, the shares are down around 50% year to date, despite an expectation of revenue growth of 17.2% to $3.46bn, and annual profits of $9 a share.

5. Hawaiian Electric Industries 4.39% - as the largest supplier of electricity in Hawaii, it is perhaps surprising that so little of it is supplied by geothermal energy or solar. The company is currently rolling out a project to boost solar adoption faster or face yearly fines of $900k, as part of the US administrations new climate plan. The company’s share price has traded sideways this year, with annual revenues of $2.8bn and a market cap of $4.5bn the company generates steady profits of around $2 a share.

As can be seen from the examples above, there is a huge amount of interest in the renewable energy sector, with a lot of innovation; however when looking at the fundamentals, while profits have been improving, costs have also risen largely due to chip shortages, which aren’t expected to improve without extra capacity, as well as some supply chain disruption.

Despite this, the long-term prognosis suggests there is a lot of scope for growth. At the end of 2020 it was estimated that only 3% of US households had solar panels. President Biden’s climate agenda has a target of 40% by 2035. That’s a lot of solar panels, as well as semiconductors, and all the other related parts.

The next few years are likely to be interesting times for renewables, with winners and losers alike. In times like this, spreading your risk is safer than adopting a pick and mix approach to investing, and baskets can be helpful in spreading that risk.

CMC Markets erbjuder sin tjänst som ”execution only”. Detta material (antingen uttryckt eller inte) är endast för allmän information och tar inte hänsyn till dina personliga omständigheter eller mål. Ingenting i detta material är (eller bör anses vara) finansiella, investeringar eller andra råd som beroende bör läggas på. Inget yttrande i materialet utgör en rekommendation från CMC Markets eller författaren om en viss investering, säkerhet, transaktion eller investeringsstrategi. Detta innehåll har inte skapats i enlighet med de regler som finns för oberoende investeringsrådgivning. Även om vi inte uttryckligen hindras från att handla innan vi har tillhandhållit detta innehåll försöker vi inte dra nytta av det innan det sprids.