Welcome to CMC Markets Institutional

CMC Markets is a leading global provider of online trading, technology and execution for institutional clients.

About CMC Markets Institutional

We offer leading-edge technology and execution along with the support and expertise which will enable your business to expand into new markets, offer new products and increase revenue potential.

Formed in 1989 and listed on London Stock Exchange, we have accumulated over 20 years' institutional experience, with existing partnerships in more than 25 countries. Our well-capitalised position further highlights our stability and attractiveness as a financial counterparty.

We facilitate bespoke, top-tier liquidity solutions for banks, brokers, funds and trading desks. We also provide access to over 10,000 CFD trading instruments through our award-winning Next Generation trading platform*, with over 60,000 clients and 15 offices globally.

Contact us and find out how we can work with you to find a suitable trading solution for your business.

Grey label solution

Our grey label solution is designed for regulated entities looking to introduce or trade on behalf of their client base.

Whether you’re a licensed investment firm operating a trading strategy for managed accounts, or a broker providing other added-value services, introduce your clients to our cost-effective, award-winning derivative trading solution so you can concentrate on accelerating your business growth and market potential.

- Neutrally branded, contemporary trading platform and native mobile apps

- Streamlined online client application process

- Ability to trade on your clients' behalf

- Professional trading tools including trade splitting (block allocation)

- Automated execution with no dealer intervention

- Customisable revenue reports including commission, spread and funding breakdowns

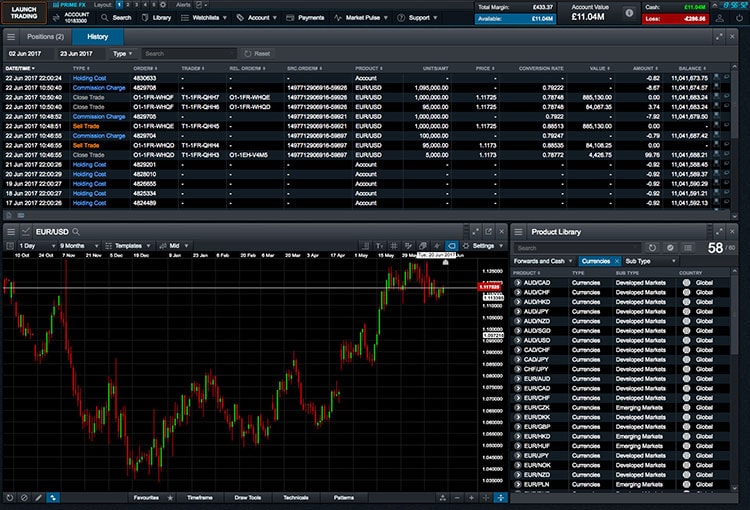

White label solution

Our market counterparty/white label environment, devised for regulated institutions, is a front to back brokerage solution enabling you to grow your business and increase revenue without putting a strain on resources.

It's designed to enable a bank or broker to leverage off its existing client network while operating and marketing using its own name and retaining full client ownership, employing advanced trading technology, risk-management tools, back-office systems, liquidity provision and market data solutions.

Your client base benefits from an optimal trading experience while we cost-effectively host and manage your IT infrastructure, allowing you to focus on growing your business.

- Sales conversion tools, plus autonomous client account creation and administration

- Customisable commissions and spreads enabling you to accommodate your client charging structure

- Bespoke platform layouts that conform to the needs and language of your local market

- Rapid time to market – operational integration can be achieved in just a few weeks

API Direct

Achieve comprehensive multi-asset coverage from a single provider with our API Direct feed, including access to our market-leading CFD liquidity and FX product suite. Consistent pricing and market depth across more than 400 instruments – from a single source – gives our institutional clients the confidence to know they are providing a market-leading, multi-asset class solution to their clients.

- Over 80 index, commodity and treasury CFDs, plus more than 300 FX pairs (including many synthetics)

- Stable liquidity and market depth across all asset classes, augmented by our own internal flow

- Rapid, flexible integration directly through an industry-standard FIX API, or by routing through your existing third-party fintech solution providers

Combine API Direct and Prime FX

Are you looking for institutional-quality liquidity across both CFD and FX? Why not take API Direct alongside our Prime FX feed? Learn more about Prime FX below.Prime FX

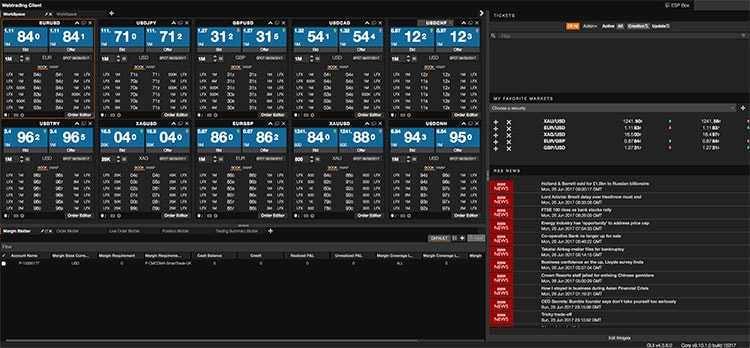

With decades of trading experience and leading technology, we can help brokers, banks and trading desks access institutional grade FX pricing. We offer direct access to liquidity using FIX API, providing the ability to link into pricing from genuine tier one liquidity providers. Clients also have access to an institutional trading GUI alongside our proprietary reporting and analysis tools, to manage their positions.

- Get comprehensive market access by leveraging CMC Markets’ strong balance sheet

- Over 60 FX pairs and bullion types available with competitive margin rates

- Deep liquidity using FIX API via the industry-recognised London data centre

- Institutional trading GUI and advanced suite of reporting and analysis tools

Combine Prime FX and API Direct

We offer the capability to connect to top tier, institutional-quality liquidity across both CFD and FX asset classes, enabling access to a wide range of instruments and tight FX pricing. Integrating our API and Prime FX feeds simultaneously ensures end-users realise the optimal combination of liquidity and pricing, with the ability to take both APIs either directly or via popular fintech solution providers.Institutional account

Our multi-asset trading accounts can be used by most financial firms, including banks and brokers, small and emerging fund companies and other proprietary trading vehicles.

- Advanced, award-winning trading platform

- Smooth online corporate application process

- Professional order types and powerful trading tools

- Access to tier-one liquidity provision

- Automated reporting processes, including concise, efficient delivery of raw end-of-day data

Contact us

We are dedicated to ensuring you have everything you need to partner with us.

Contact us to discuss how we can create a bespoke programme for you.

Thank you for your message

Your enquiry is important to us, a member of our Institutional team will contact you within the next two business days.

If you need assistance sooner, please call our team on +44 (0)20 7170 8300.

*Awarded 'Best CFDs Broker', Finance Magnates London Summit Awards 2016; and 'Best Platform Features', based on highest user satisfaction among spread betters, CFD and FX traders, Investment Trends 2017 UK Leverage Trading Report.