Introduction

Set up in four simple steps, OPTO’s Folio feature allows traders to harness a rich array of research and insights to level up their investments in over 55 high-growth themes — including artificial intelligence (AI).

Allocated according to a professional strategy and automatically rebalanced every quarter, Folios encapusulate a systematic approach that prioritizes long-term goals.

Read on to find out how to build a Folio with OPTO.

The AI Investment Landscape

AI has revolutionized almost every aspect of life over the last five years.

The primary effects on the investing industry have been AI-led sector booms, alongside changes in the ways both individuals and institutions are investing their money.

For the average investor, AI represents a big draw — and a potential risk. For those looking to invest in high-growth themes, a professional strategy and thorough research are essential for mitigating losses and maximizing gains.

That’s where OPTO’s Folio feature comes in.

Why and How to Build a Folio

OPTO’s Folio feature enables you to harness OPTO’s resources in four easy steps.

How to Build Your Folio

Setting up your Folio on the OPTO app is easy — in just four steps, you can optimize your trading and get back to the important stuff.

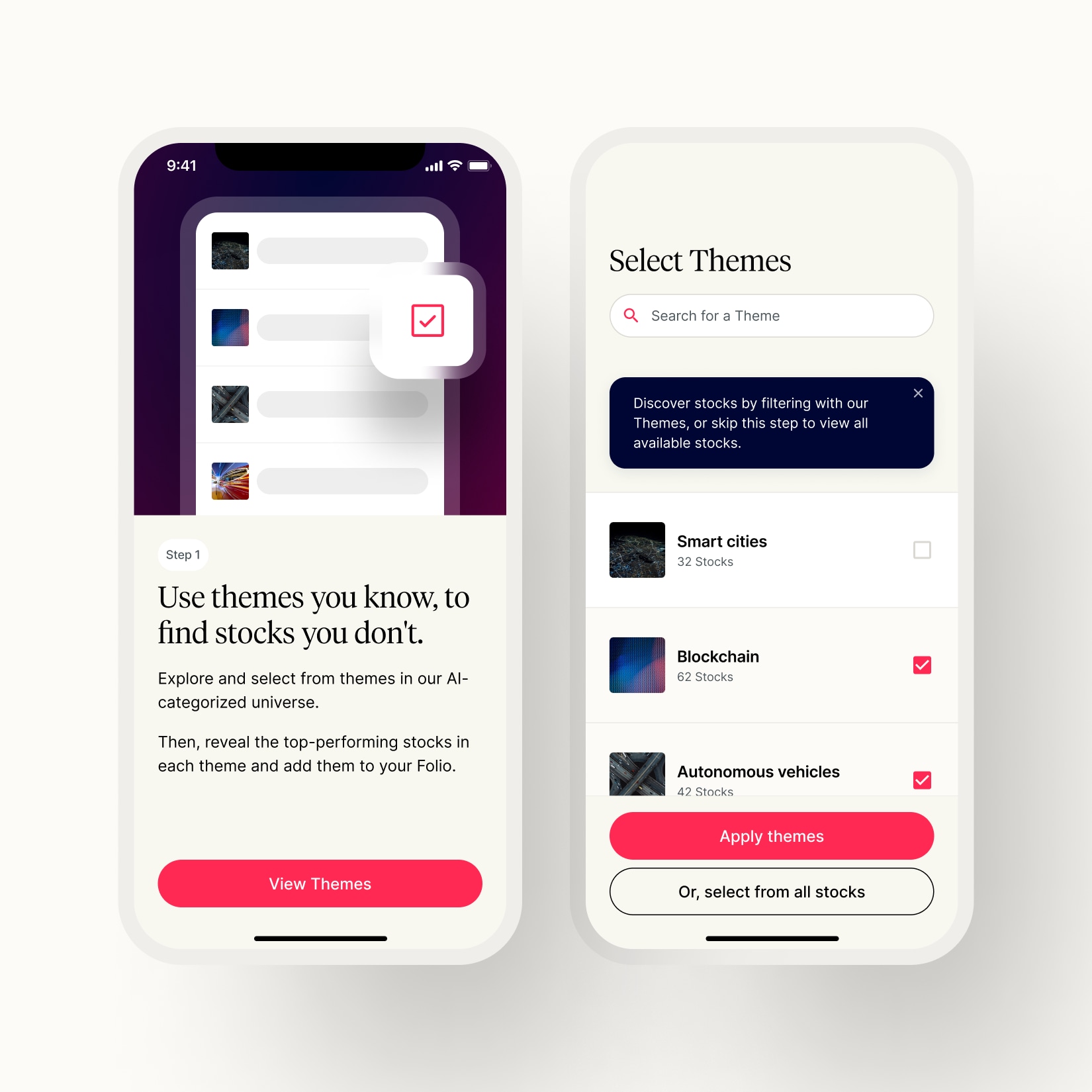

Step 1: Select Your Themes

To get started, you will be asked to pick themes you are interested in. You can pick multiple themes, or opt to see all available stocks instead.

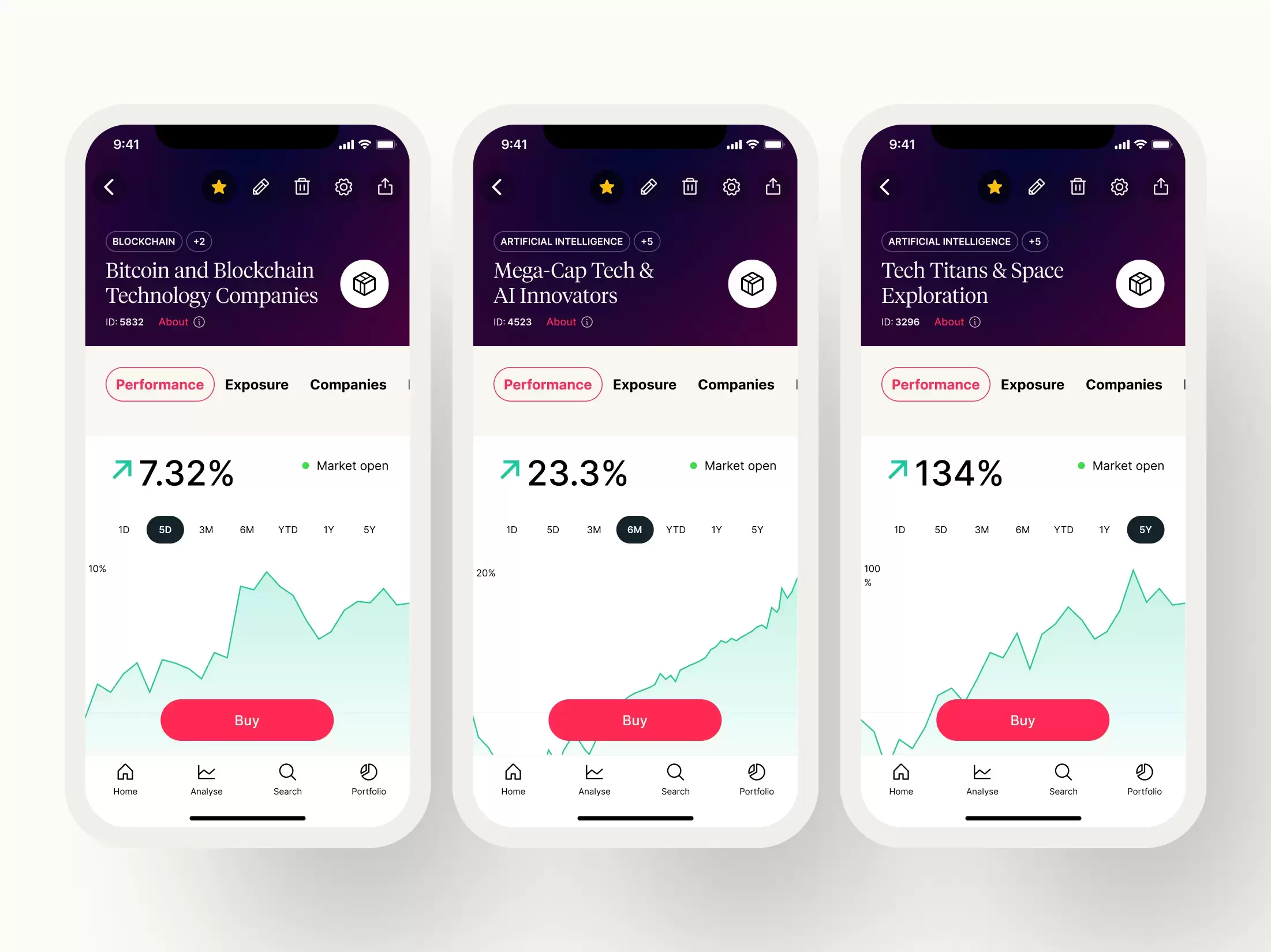

Within your chosen themes, you will be asked to pick a minimum of three stocks that you would like to invest in. In the selection screen, you will see each asset’s performance over a given timeframe: you can select between multiple periods, from one day to five years.

You will then have a chance to review your chosen stocks, and confirm that you are happy with the selection.

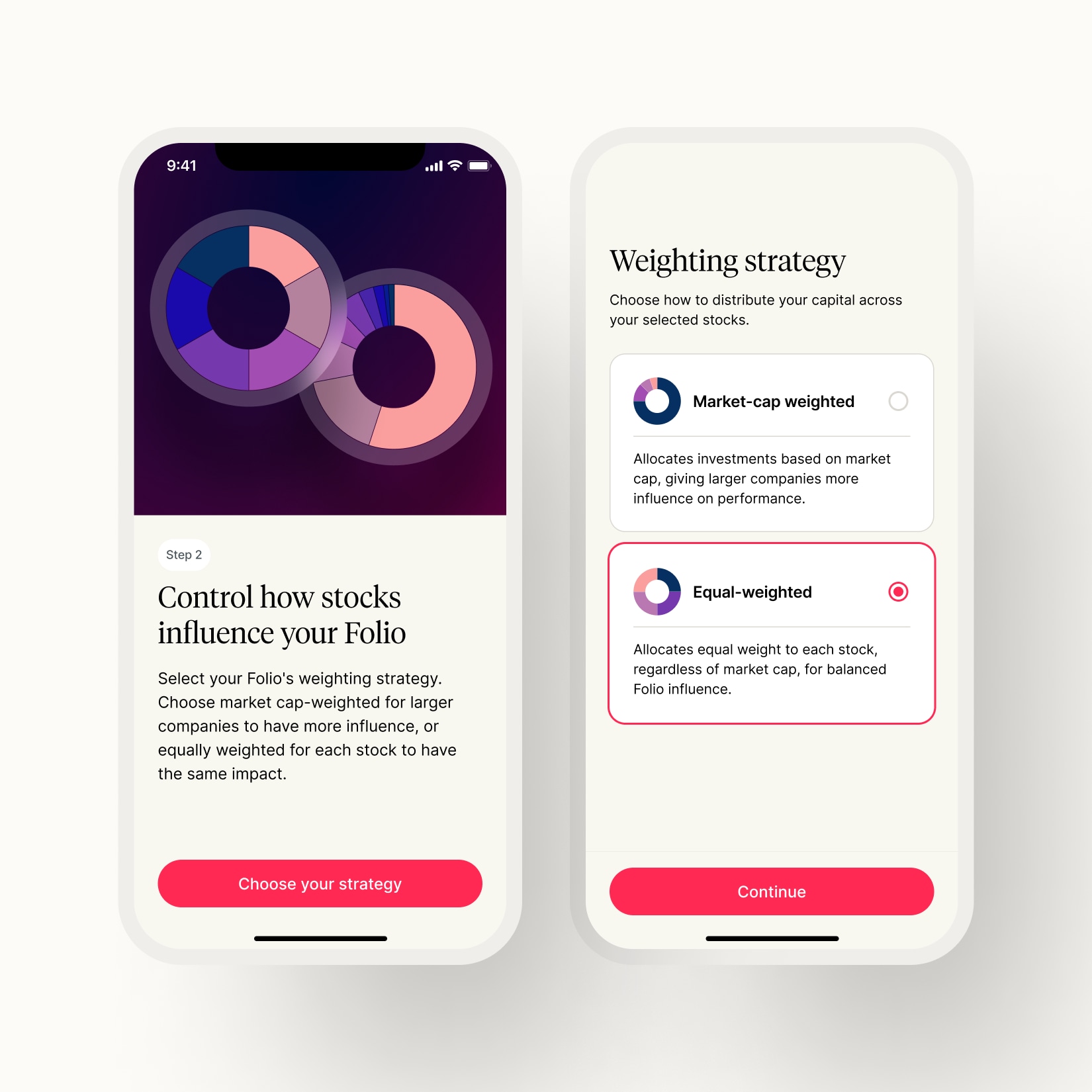

Step 2: Apply a Portfolio Strategy

Next up, you will define your weighting strategy for the Folio. You can opt for market cap weighting, which gives larger companies more influence, or equal weighting, in which each of your selected stocks will have equal impact.

Your choice will likely be informed by your risk tolerance, the current landscape of the sector you are interested in, and any growth plays you have in mind.

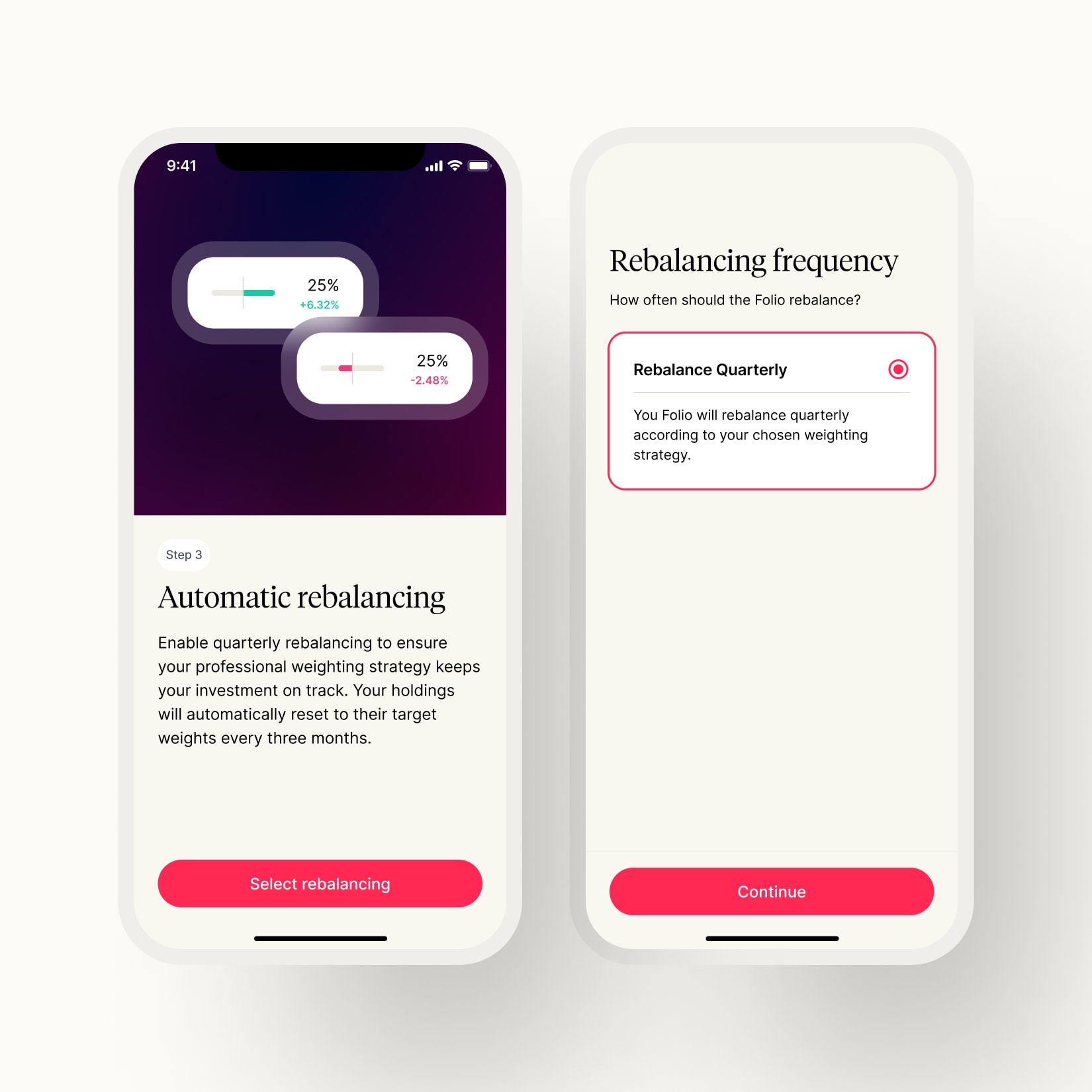

Step 3: Automate Investing with Quarterly Rebalancing

Enabling quarterly rebalancing means automating the rest of the investing process.

Every three months, your Folio holdings will rebalance to their target weights, ensuring that your strategy remains on track.

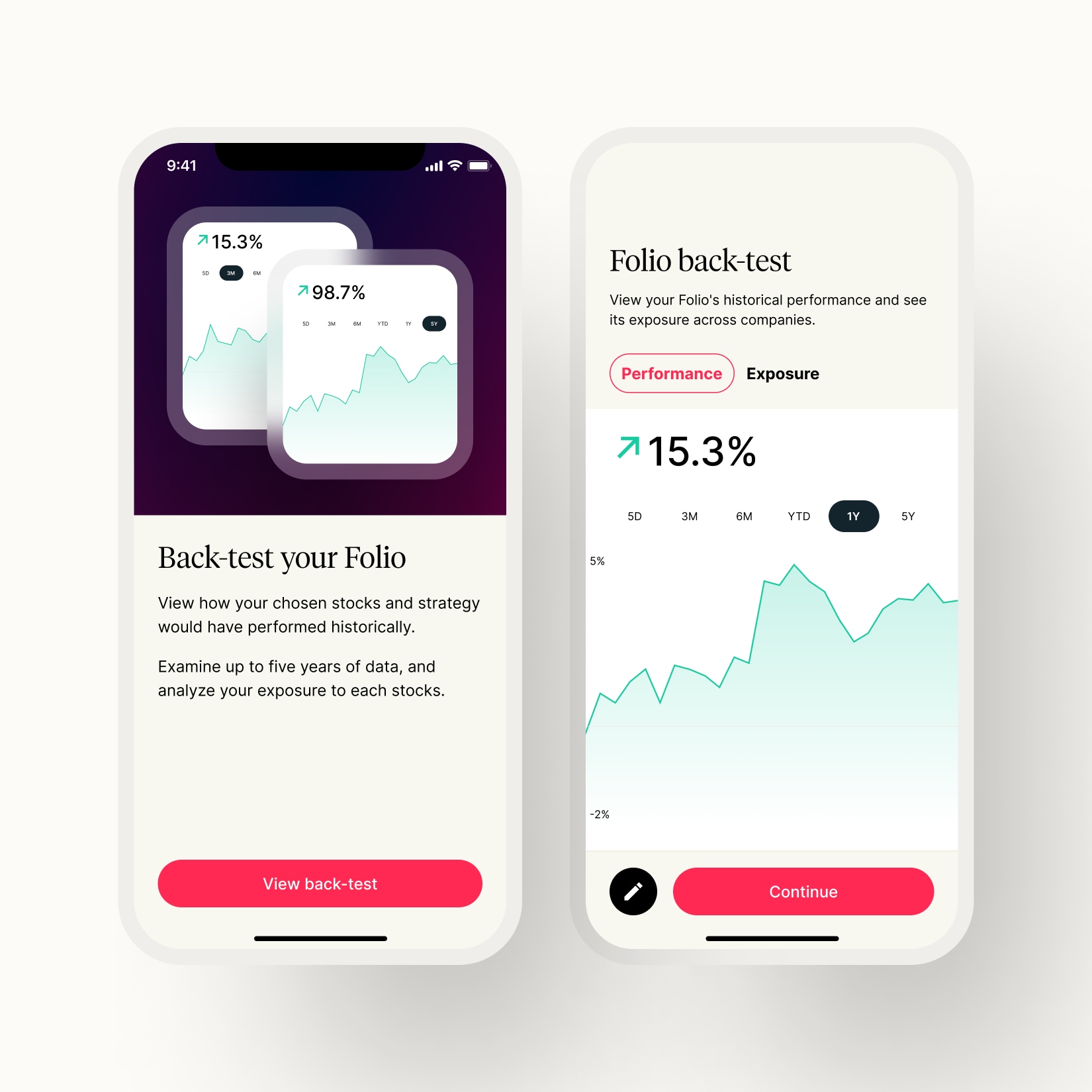

Step 4: Preview and Optimize Performance

Before you start investing, you can use OPTO’s powerful backtest feature to see how your portfolio would have fared over the past five years, offering you a glimpse of potential future gains.

Test, reorganize and hone your strategy to make the most of your Folio.

When you are happy with your Folio, confirm your decisions and let OPTO take care of the rest.

Why Should I Use Folios?

OPTO Folios bridge the gap between risk and reward, enabling you to diversify your exposure and thus maintain strong forward returns, without the volatility that active trading brings.

Folios also reduce the risk of emotional decisions disrupting your strategy — with markets increasingly volatile in the current political climate, it can be difficult to hold your nerve and prioritize the long-term picture. Using a Folio takes the stress out, making it easier to stick to your plan and reap the rewards.

Finally, the thematic element of Folios means you can discover top stocks across 55 themes, from robotics to agtech and food innovation: cut the time it takes you to find interesting stocks and get straight to investing.

What to Include in Your AI-Themed Folio

If you are looking to build a Folio with an AI focus, here are some standout stocks you might like to consider.

ServiceNow [NOW]

Investors looking to gain exposure to corporate AI solutions could do well to consider ServiceNow, a business management software company servicing 85% of the Fortune 500.

Building AI products into the heart of departments from customer success to sales, ServiceNow is an excellent example of an established company innovating to unlock further growth.

Broadcom [AVGO]

For those interested in the manufacture that supports AI’s development, Broadcom could be one to watch.

Up 84.12% for the 12 months to February 4’s close, Broadcom continues to benefit from semiconductor chip demand. With tech titans like Apple [AAPL] and Hewlett Packard Enterprise [HPE] using the firm’s products, the outlook could be good this year.

Constellation Energy [CEG]

Increasingly, energy providers are being touted as AI plays, as power supply for the data centers that support AI development becomes a global priority.

In the US, Constellation Energy is the foremost provider of nuclear energy, a source that has been tapped as potentially essential to data centers. Up 137.80% for the 12 months to February 4’s close, CEG could well be a stock to watch as the AI market continues to develop.

Conclusion

Setting up your OPTO Folio to take advantage of the AI boom simply could not be easier. Following the four steps outlined above, you will gain exposure to emerging themes while reducing the risk of human error disrupting your portfolio.

Ready to get started? Download the app today.

The content in this article is for informational purposes only. Opto Markets LLC does not recommend any specific securities or investment strategies. Investing involves risk & investments may lose value, including the loss of principal. Past performance does not guarantee future results. Investors should consider their investment objectives and risks carefully before investing.