Asian markets are set to open broadly higher following an upbeat US session overnight. China’s reserve requirement ratio was cut as trade optimism further boosted sentiment, while a string of improving manufacturing PMI readings across the Asean region led to beliefs that a cyclical recovery is around the corner.

Some further improvement in Singapore’s manufacturing PMI is expected in December, as factory output, exports and new orders have grown modestly across the Asean and India region. There is a concern is that the pace of expansion is insufficient to make a solid turnaround in falling backlogs, employment and inflation; which suggest the road towards a full recovery will remain challenging.

The Singapore market registered a strong performance on Thursday, and is likely to continue the upward trajectory today following a strong lead in US markets overnight. In 2019, the local market has been over-punished by trade uncertainty and an economic slowdown, causing it to underperform compared to its global peers.

Hong Kong’s retail sales is forecasted to contract by 25.5% year-on-year, a further deterioration from October’s reading of -24.3%. A recession is underwayg in Hong Kong and is likely to deepen further. Retailers have suffered a poor Christmas period due to a sharp decline in tourism arrivals this year. Since the government protests first started in April, visitor numbers have collapsed. October’s arrival numbers tumbled by 43.7% from a year ago.

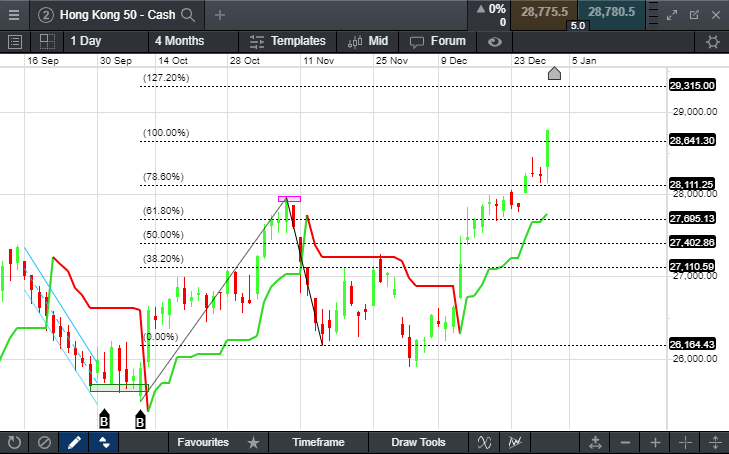

The Hong Kong stockmarket, however, is defying gravity. PBoC’s RRR cut has boosted Hong-Kong-listed Chinese financial firms; namely banks, brokerages and insurance. The Hang Seng Index has broken out a key resistance level at 28,6050 and moved decisively higher overnight (see our Hong Kong 50 chart below).

Hong Kong 50 - Cash chart