The broad selloff resumed on Wall Street one day after the Fed’s outsized rate hike as recession fears intensified by more central banks’ aggressive tightening measures. The Swiss National Bank unexpectedly rose its interest rate by 50 basis points overnight, which is the first time since 2007. Slowing economic growth and rampant inflation tell that stagflation becomes reality. The US 5-year and 30-year bond yields stayed inverted, while the 2-year and 10-year yields spread narrowed to nearly zero, repeatedly flashing a recession alert.

Risk-off prevails across the broad markets, with haven assets up, typically in gold futures and government bonds, while risk assets, including equities, cryptos slumped further.

With more central banks approaching rate hikes, the Bank of Japan’s policy meeting sheds spotlight in today’s Asian session, when the central bank is expected to give up the dovish guidance on controlling the JGB’s yield curve, which may worsen the already fragile sentiment. The US dollar might suffer further from reversing moves in the US bond markets if this is what happens.

AU and NZ day ahead

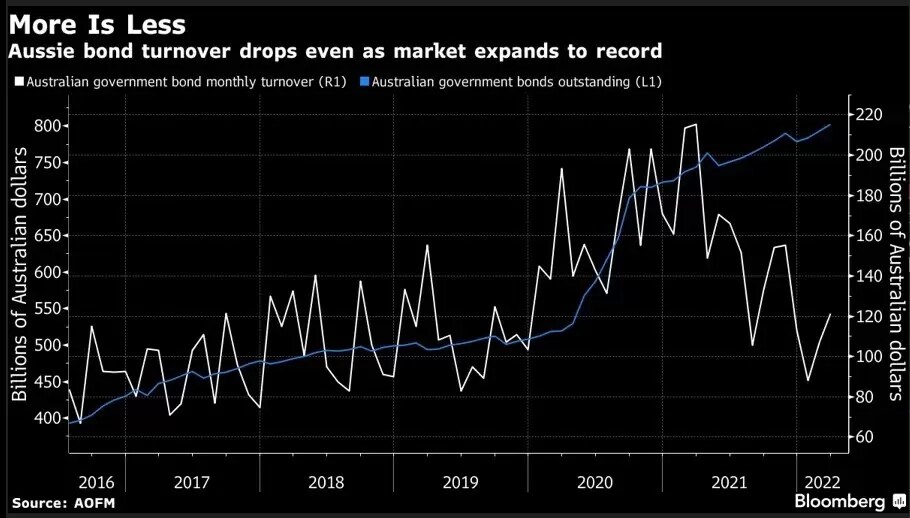

The ASX 200 is set to plunge further, and the SPI futures slid 2%. The index may deepen losses in today’s session as the energy sector was the biggest laggard in the overnight US session, which could spill the selloff over the regional markets. Recession fears start restraining the commodity prices and capping exporters’ gains. In addition, the Australian bond market's liquidity shrinks to the lowest since 2019, with the short-dated bond yields hitting the highest since 2012.

The S&P/NZX 50 slumped 1.91% in the first hour of trading. The benchmark index plunged 23%, to 10646 on Thursday, the lowest level since May 2020. The broad selloff may take the local equity markets lower.

US

The Dow Jones Industry Average fell 2.41%, to 29,927, finishing under 30,00 for the first time since January 2021. The S&P 500 slid 3.24%, to 3,666, pointing to the worse week of performance since March 2020. And Nasdaq slumped 4.08%, to 10,646, or 35% down year to date.

All the 11 sectors in the S&P 500 finished lower. The energy sector was the worst performer, down 5.6%, despite a rise in the oil price, as investors may cut positions to cover losses in the other sectors. The growth stocks all fell, with big techs down between 2-3%.

The cosmetics giant Revlon filed for Chapter 11 bankruptcy protection due to supply chain issues, citing it could not supply one-third of customer demand for its products. And this may be just the start of a collapse in the vulnerable retailers.

Europe

European stocks were all down on recession fears after both BOE and SNB rose interest rates. The Stoxx 50 (-2.96%), FTSE 100 (-3.14%), DAX (-3.31%), CAC 40 (-2.39%). Read more

Commodities

Crude oil prices rose marginally after an initial fall of 3.6% at the lowest. The central banks’ rate hikes are pressuring the oil prices, despite ongoing tight supplies. Recession fears mount in the resources markets, with copper, Aluminium, Nickel, and iron Ore all falling between 1-3%. However, precious metals were up on the rising haven demands. Agricultural products also rose due to a drop in the US dollar and supply concerns.

WTI: US$117.71 (+1.63%), Brent: US$119.03 (+0.44%), Natural Gas: US$7.43(-0.51%)

COMEX Gold futures: US$1, 855.2 (+2%), COMEX Silver futures: US$21. 95 (+1.4%), Copper futures: US$4.05 (-1.54%)

Wheat: US$1, 090.50 (+2.54%), Soybean: US$1,543.25 (+1.30%), Corn: US$735.00 (+1.94%).

Currencies

US dollar fell sharply as US bond yields slid, while SNB rose interest rate by 50 bps, sparking a surge in the Swiss Franc. The Japanese Yen spiked ahead of the BOJ meeting today, when the bank may capitulate to the hawkish stance. And the British pound jumped against the USD on the BOE’s 25 bps rate hike, which is the fifth time in a row by the central bank.

(See the below FX rates at EAST 8:27 am, Bloomberg)

US dollar index: 103.64 (-1.23%)

EUR/USD: 1.0546

GBP/USD: 1.2341

USD/JPY: 132.58

USD/CHF: 0.9670

USD/CAD: 1.2946

AUD/USD: 0.7047

NZD/USD: 0.6360

Treasuries

The US bond yields fell slightly, while the other regional bond yields stayed high.

US 10-year: 3.195%, US 2-year: 3.21%.

Germany bund 10-year: 1.70%, UK gilt 10-year: 2.51%.

Australia 10-year: 3.98%, NZ 10-year: 4.21%.

Cryptocurrencies

The crypto markets chaos might be worse going forward, with both bitcoin and Ethereum continuing to be under pressure, heading to the pivotal supports at US$20,000, and US$1,000 respectively, amid the broad selloff in the risk assets.

(See below prices at AEST 8:57 am according to Coinmarketcap.com)

Bitcoin: US$20,430 (-9.10%)

Ethereum: US$1,076 (-11.77%)

Cardano: US$0.4754(-9.90%)