US stocks extended losses for the fourth consecutive trading day as recession fear continued to weigh. The Cleveland Federal Reserve President Loretta Mester sees the Fed fund rate rising above 4% in the coming months.

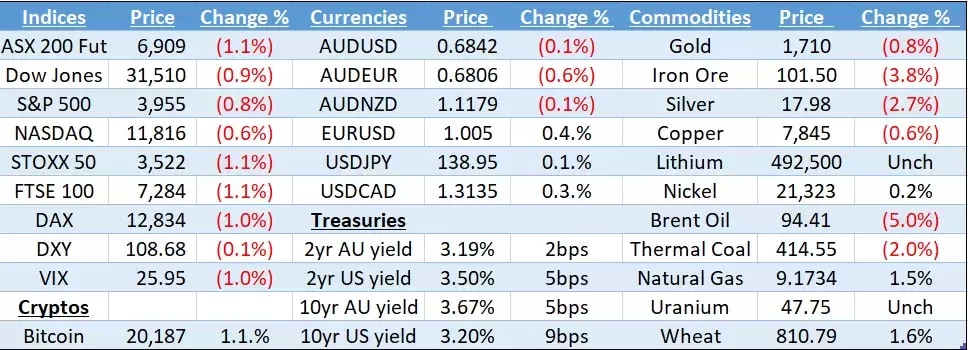

- Dow fell 0.88%, S&P 500 down 0.78%, and Nasdaq declined 0.56%. The three averages ended August with a more than 4% loss. 10 out of the 11 sectors in the S&P 500 closed in red, with material and consumer discretionary stocks leading losses. The Communication services sector is the only sector that finished slightly higher, up 0.01% as Snap’s shares popped 8% after the company announced to cut 20% of employees, which lifted other social media’s shares, with Meta Platforms up 3.67%, and Pinterest jumping 5%.

- Asian markets are set to open lower, dragged by the global risk-off sentiment. S&P/ASX futures fell 1.04%, Nikkei 225 futures slid 0.92% Hang Seng Index futures were down 0.42%. The S&P NZ 50 index slid 0.1% at the open.

- BYD (HK: 01211) shares slumped 7% on the news that Warren Buffett’s Berkshire Hathaway is to sell 1.33 million shares worth $47 million, cutting its holdings from 20.04% to 19.92%.

- China’s manufacturing PMI contracted for the second straight month in August. In fact, the data contracted for 4 months in the last 5 months since March.

- Crude oil futures fell further despite a larger-than-expected draw in the inventory data as OPEC +’s output cut expectations faded on a demand upgrade for 2022. The organisation will meet on 5 September to discuss future production plans. On the other hand, President Biden is engaging in the Iran nuclear negotiation, which could return Iran’s supply by 1 million barrels per day. Both base metal and precious metals also slid for the second trading day due to a strong US dollar, rising bond yields, and recession worries.

- The Eurodollar strengthened further on the ECB’s hint for a 75-bps rate hike in September. The Eurozone CPI rose to 9.1%, while Core CPI was up to 4.3% in August vs. 8.9% and 4.0% in July. The EUR/USD rose for the third trading day, to 1.0050 this morning, heading to a key resistance level of 1.01.

- Commodity currencies continued to weaken against the US dollar due to weak China’s manufacturing PMI and a downbeat in the commodity prices.