Meta Platforms medium-term technical analysis chart

The recent rally of 18% seen in the share price of Meta Platforms (META), the parent company of Facebook, from its 28 July 2022 low post-Q2 earnings announcement has reached a potential roadblock at a 186.20 key medium-term resistance.

(18 August 2022, 2:40pm SGT)

Source: CMC Markets & TradingView

Integrated technical analysis (graphical, momentum, Elliot Wave/fractals) suggests that META now faces the risk of a drop to retest its 23 June 2022 low and even the possibility of shaping a lower low after that.

Key levels (1-3 months/META)

Pivot (key resistance): 186.20

Supports: 153.10 & 137.10/132.55

Next resistance: 236.80/248.00

Directional bas (1-3 months/META)

Bearish bias below 186.20 key medium-term pivotal resistance for a potential drop to retest the 23 June 2022 swing low areaof 153.10, and a break below it may see a further slide towards a key major support area of 137.10/132.55.

On the flip side, a clearance with a daily close above 186.20 invalidates the bearish tone for a significant corrective rebound towards the next resistance zone of 236.80/248.00 (also the 200-day moving average & the 38.2% Fibonacci retracement of the major downtrend from 1 September 2021 all-time high to 23 June 2022 low).

Key elements (META)

- Since 5 April 2022, the price actions of META have started to oscillate within a three-month plus bullish reversal “Descending Wedge” configuration. Elliot Wave/fractal analysis suggests that META has potential room to shape a residual down move sequence towards 137.10/132.55 (also the lower boundary of the “Descending Wedge”) before a more significant corrective rebound takes shape in terms of magnitude and duration.

- The daily RSI oscillator has again staged a retreat from a corresponding key resistance at the 59% level, suggesting that medium-term downside momentum has resurfaced.

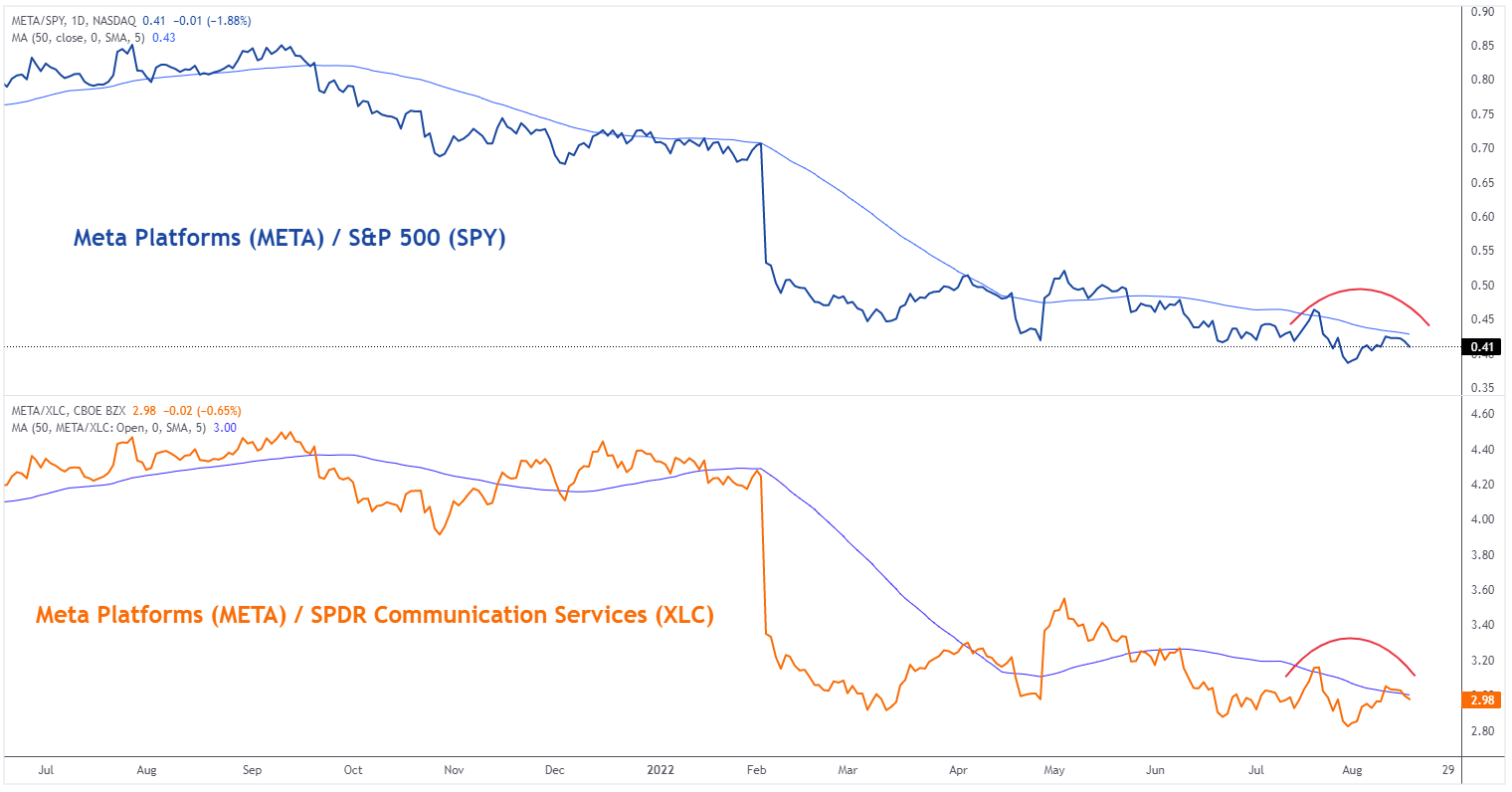

- Relative strength analysis of META against the benchmark S&P 500 and its Communication Services sector shows potential underperformance of META.