A new year, a new beginning. Time to revisit the investment strategy and reset the portfolio. For many investors this will mean further moves towards growth exposures (materials, consumer discretionary, IT) and away from defensive themes. In my opinion there is one stock that should be on everyone’s sell list – Telstra (TLS).

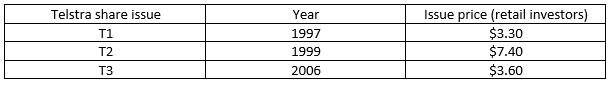

Telstra has served many investors and the broader Australian share market very well. It introduced a generation to direct share investment, and it remains the most popular Australian stock with more than a million shareholders. Investors who bought into the first or third issue of shares (T1 and T3) have received above average dividend streams for many years and bought their shares at less than the current stock price. T2 investors may be less impressed:

Poor recent share price action adds to this negative outlook – at least in the short term. Note well the two gaps on the chart (above) – the fall from $4.40 when the stock went ex-dividend in mid-August and the plummet in late August after TLS told the market it couldn’t monetise the NBN income as previously announced.

These gaps are highly significant to chartists.

They act as important support and resistance levels. A closing of the gap is considered a strong signal for further moves in that direction. Unfortunately for TLS shareholders a failure at a gap is also highly significant.

That’s what occurred last week. TLS shares traded up into the gap. A closing price at or above $3.83 would have closed the gap and likely sparked trader buying. However when the share price peaked at $3.78, then dropped below $3.75, the signal became decidedly negative.

Despite investors natural affection the combination of fundamental and technical negatives could see TLS tests the low at $3.34. A breach of that level brings long term targets below $3.00 into play. Committed long investors may consider selling now to buy back at their leisure.