US equity indices consolidated for a second day as the dollar rallied strongly. Traders unwound expectations for more rate cuts on improving macro data.

The US non-manufacturing PMIs beat market expectations with strong employment and new order prospects. The PMI reading of 54.7 is higher than the forecast of 53.5 and previous month’s reading of 52.6.

Alongside an upbeat non-farm payroll released last Friday, it suggests that the Fed’s current policy is likely to stay in place for an extended period. Meanwhile, more evidence is pointing to the prospect of a global cyclical slowdown to bottom out in early 2020 and to start to accelerate. Of course, this is largely dependent on trade factors such as the US consumers’ ability to spend more.

The expectation for a phase one deal to be struck between Washington and Beijing is high, which led to a temporary breakdown of 7.00 of USD/CNH. The offshore renminbi is widely regarded as a sensitive and accurate barometer of US-China trade talks over the past 18 months. A stronger CNH suggests that the trade talks are moving towards a resolution, but it depends on the Trump administration’s willingness to provide concessions on the tariffs.

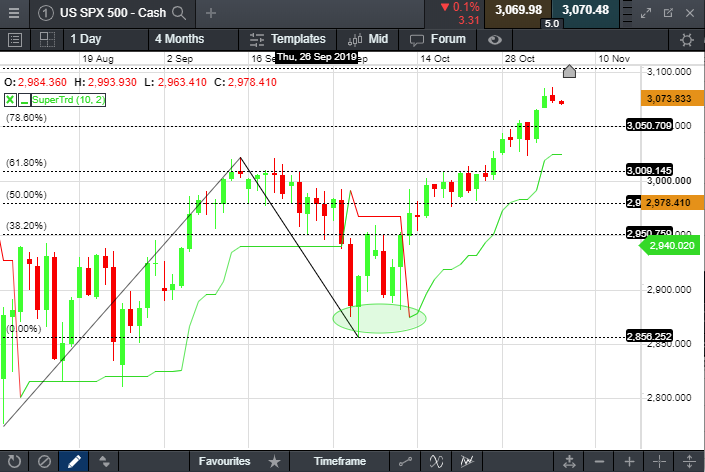

S&P 500 – recent rally is taking a pause as investors unwind rate cut expectations and stayed on the fence waiting for trade news. Technically, overall trend remains bullish with immediate resistance level found at 3,100 points. A potential pullback from the current level could point to a retracement to 3,050 points.

Gold – stronger dollar sent gold prices lower to US$ 1,486 area, which is a key support level for the past three months. Trade news, if turns sour, could catalyse a strong rally in precious metals so traders will be keeping a close eye on it.

AUD/USD – 0.690-0.692 proved an immediate resistance as RBA held rate unchanged yesterday. Immediate support level can be found at 0.688 area, and trade news will likely have high impact on Aussie dollar.

USD/CNH - a dipping toe below 7.00 yesterday suggests that markets remains cautiously optimistic on the trade deal, and ignored the fact that the People’s Bank of China (PBoC) lowered a key interest rate of 1-year MLF by 5bps.